مقدمة عن الشركة

| CEZ Hungary ملخص المراجعة | |

| تأسست | 2005 |

| البلد/المنطقة المسجلة | المجر |

| التنظيم | لا يوجد تنظيم |

| الخدمات | مبيعات الكهرباء، خدمات مجموعة التوازن، خدمات الطاقة المتجددة، إدارة المخاطر والتحوط |

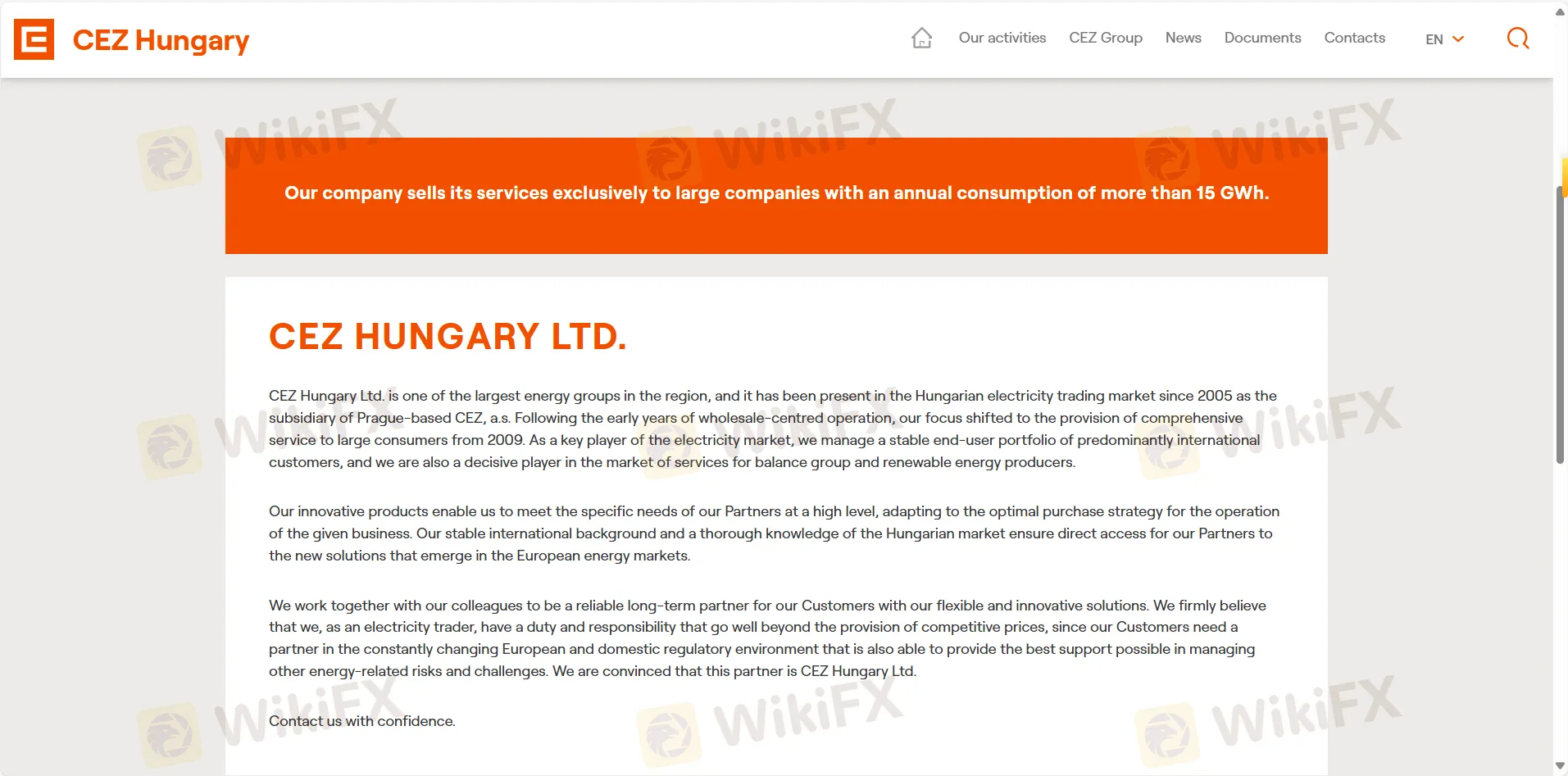

| حجم العقد الأدنى | >15 جيجاوات ساعة استهلاك سنوي (للعملاء الشركات فقط) |

| دعم العملاء | البريد الإلكتروني: sales@cez.hu |

معلومات CEZ Hungary

CEZ Hungary المحدودة هي الفرع المجري لمجموعة CEZ القائمة في براغ. كانت الشركة في سوق الكهرباء المجري منذ عام 2005. تعمل الشركة فقط مع الشركات الكبيرة التي تستخدم أكثر من 15 جيجاوات من الكهرباء سنويًا. تساعد هذه الشركات في شراء الكهرباء بطريقة تناسبها، والدخول في السوق، والتحوط ضد المخاطر. كما تساعد CEZ Hungary في مجموعات التوازن ودمج الطاقة المتجددة. تدعم معرفة CEZ Group الجغرافية وصحة تمويلها ما تقدمه.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| مدعومة من قبل مجموعة طاقة أوروبية كبيرة (CEZ، a.s.) | لا يوجد تنظيم |

| إدارة مخاطر مخصصة واستراتيجيات التوريد | لا يوجد وصول لمستخدمي التجزئة أو الشركات الصغيرة |

| خيارات خدمات الطاقة المتجددة والمجموعات المتوازنة |

هل CEZ Hungary شرعية؟

لا. CEZ Hungary المحدودة غير مُنظمة من قبل أي سلطة. يجب على التجار أن يكونوا على علم بهذا.

الخدمات

| الخدمات | التفاصيل |

| مبيعات الكهرباء | عقود مخصصة للشركات الكبيرة التي تستخدم أكثر من 15 جيجاوات من الطاقة سنويًا |

| خدمات مجموعة التوازن | إدارة النظام، توازن محفظة |

| خدمات الطاقة المتجددة | المساعدة في اتباع قواعد الطاقة الخضراء ودمجها |

| إدارة المخاطر والتحوط | أبحاث السوق، عقود التحوط، ونصائح حول كيفية شراء تلك بشكل استراتيجي |