Abstract:In the world of online trading and investing, one of the biggest threats to new and experienced traders alike is falling into the trap of clone brokers. These are fake or scam brokers who impersonate legitimate companies to trick investors. Understanding the difference between a clone broker and a real broker is essential for protecting your money and making smart financial decisions.

In the world of online trading and investing, one of the biggest threats to new and experienced traders alike is falling into the trap of clone brokers. These are fake or scam brokers who impersonate legitimate companies to trick investors. Understanding the difference between a clone broker and a real broker is essential for protecting your money and making smart financial decisions.

1. Regulation and Licensing

• Real Brokers: Genuine brokers are Licensed and supervised by recognized financial regulators such as the FCA (Financial Conduct Authority – UK), SEC (Securities and Exchange Commission – USA), ASIC (Australian Securities and Investments Commission), or SEBI (Securities and Exchange Board of India). These authorities require brokers to meet strict standards regarding capital requirements, client fund protection, transparency, and ethical conduct. As a result, real brokers must follow detailed rules and procedures that are designed to safeguard investors interests, prevent fraud, and ensure fair trading practices.

• Clone Brokers: Clone brokers, on the other hand, often pretend to be regulated when they are not. They may copy the name, license number, or registration details of a genuine broker in an attempt to fool investors. Some even design websites that closely resemble the real ones, using stolen logos and legal text to appear legitimate. However, these brokers operate without any oversight, and their claims of being regulated are entirely false. They are set up solely to deceive and exploit unsuspecting traders.

2. Website and Contact Details

• Real Brokers: Legitimate brokers maintain secure and professional websites, often with domains that begin with “https\://” to indicate encryption and security. Their contact information, such as phone numbers, emails, and physical office addresses, is clearly displayed and verifiable. They usually have a responsive and knowledgeable customer support team that offers assistance through multiple channels (live chat, phone, email).

• Clone Brokers: Clone brokers often use fake or copycat websites that look almost identical to those of real brokers. The domain name may be slightly different, such as using “.net” instead of “.com”, or adding a hyphen or extra character. They may also list fake contact numbers or unresponsive email addresses, and customer support, if it exists at all, is usually vague, unprofessional, or completely automated. Their goal is not to serve but to scam.

3. Fund Safety and Withdrawals

• Real Brokers: Trusted brokers are required to keep client funds in segregated bank accounts, which means your money is kept separate from the companys own funds. This protects your investment in case the broker faces financial difficulties. When it comes to deposits and withdrawals, real brokers have Clear, documented procedures and transactions are processed in a timely and secure manner. Most importantly, withdrawal requests are not delayed or denied without valid reasons, giving you confidence in your ability to access your funds whenever needed.

• Clone Brokers: Clone brokers are notorious for withholding client funds. After you deposit money, they may create obstacles or make false excuses to delay or block withdrawals entirely. Some victims report that after an initial small withdrawal is approved (to build trust), larger withdrawals are denied or ignored. Once you realize the issue, customer service usually becomes unreachable or unhelpful. In many cases, the broker disappears with the investors' money.

4. Trading Conditions

• Real Brokers: A genuine broker will offer Transparent and fair-trading conditions, including reasonable spreads, clear margin requirements, appropriate leverage levels, and risk warnings that comply with regulations. They typically use reliable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader, which are secure, stable, and widely trusted in the industry. They also provide access to real market data, economic calendars, and risk disclosure statements so that you can trade responsibly.

• Clone Brokers: Clone brokers often attract new users by promising unrealistic benefits such as guaranteed profits, zero risk, or very high leverage that far exceeds what‘s legally allowed in most countries. Their trading platforms may be fake, poorly built, or manipulated, showing fake prices or account balances to make you believe you’re earning profits until you try to withdraw. This is a common scam technique designed to trick users into depositing more money.

5. Reputation and Reviews

• Real Brokers: Authentic brokers usually have an established reputation in the financial industry. You can find genuine customer reviews, ratings from independent sources, and even media coverage or industry awards highlighting their reliability. Many also have active communities on forums or social media, where real traders share their experiences. This public track record helps new investors feel confident about the brokers credibility and service quality.

• Clone Brokers: Clone brokers usually lack a real online presence or have many negative reviews and scam warnings. If they do appear in search results, its often on scam-reporting websites where users share their experiences of lost funds, blocked accounts, or disappearing brokers. These brokers rarely last long, often shutting down once exposed—only to resurface later under a different name.

How to Protect Yourself from Scam Brokers

1. Verify the Brokers License

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Dont Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Dont Rush

9. Report Suspicious Activity

10. Keep Records

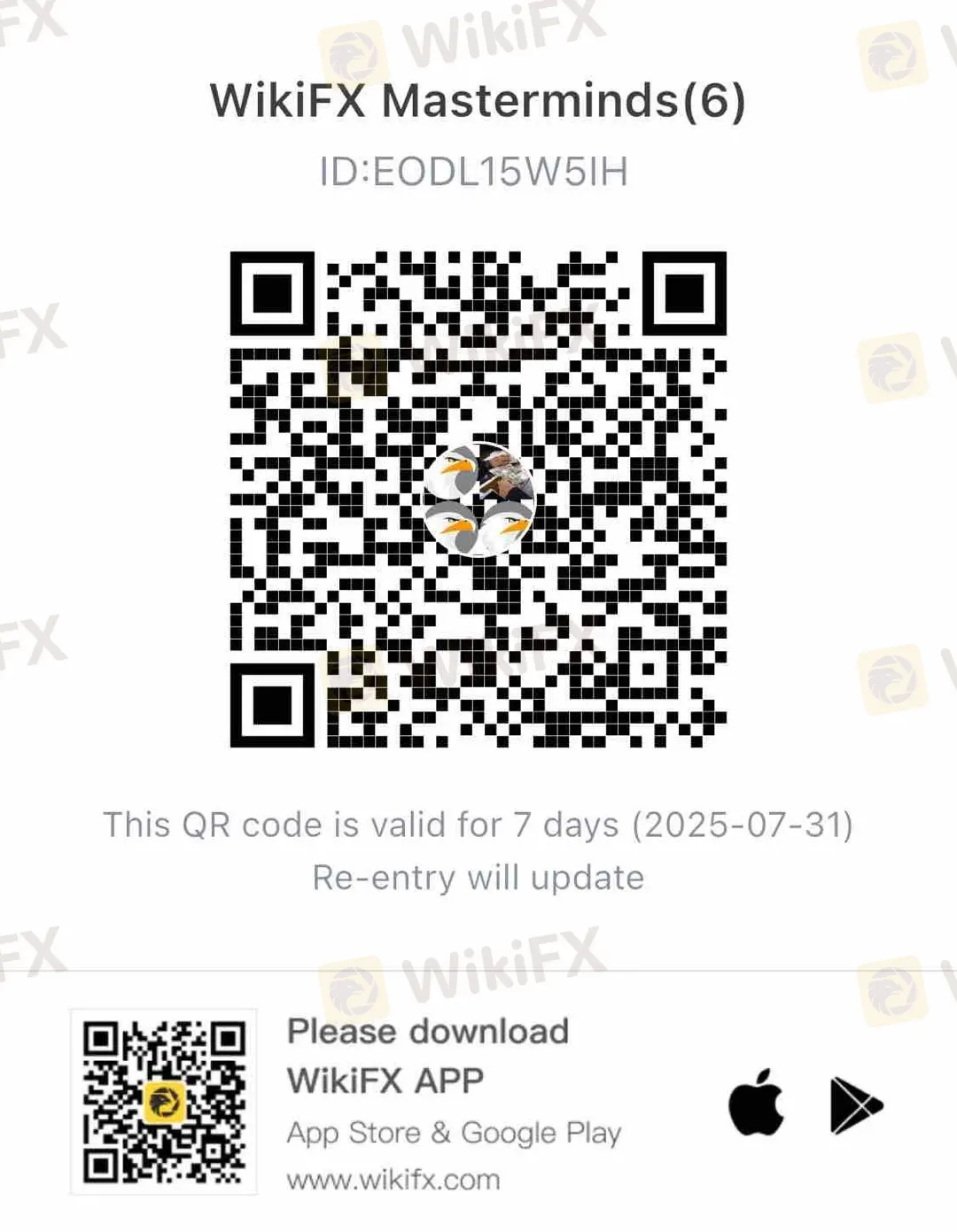

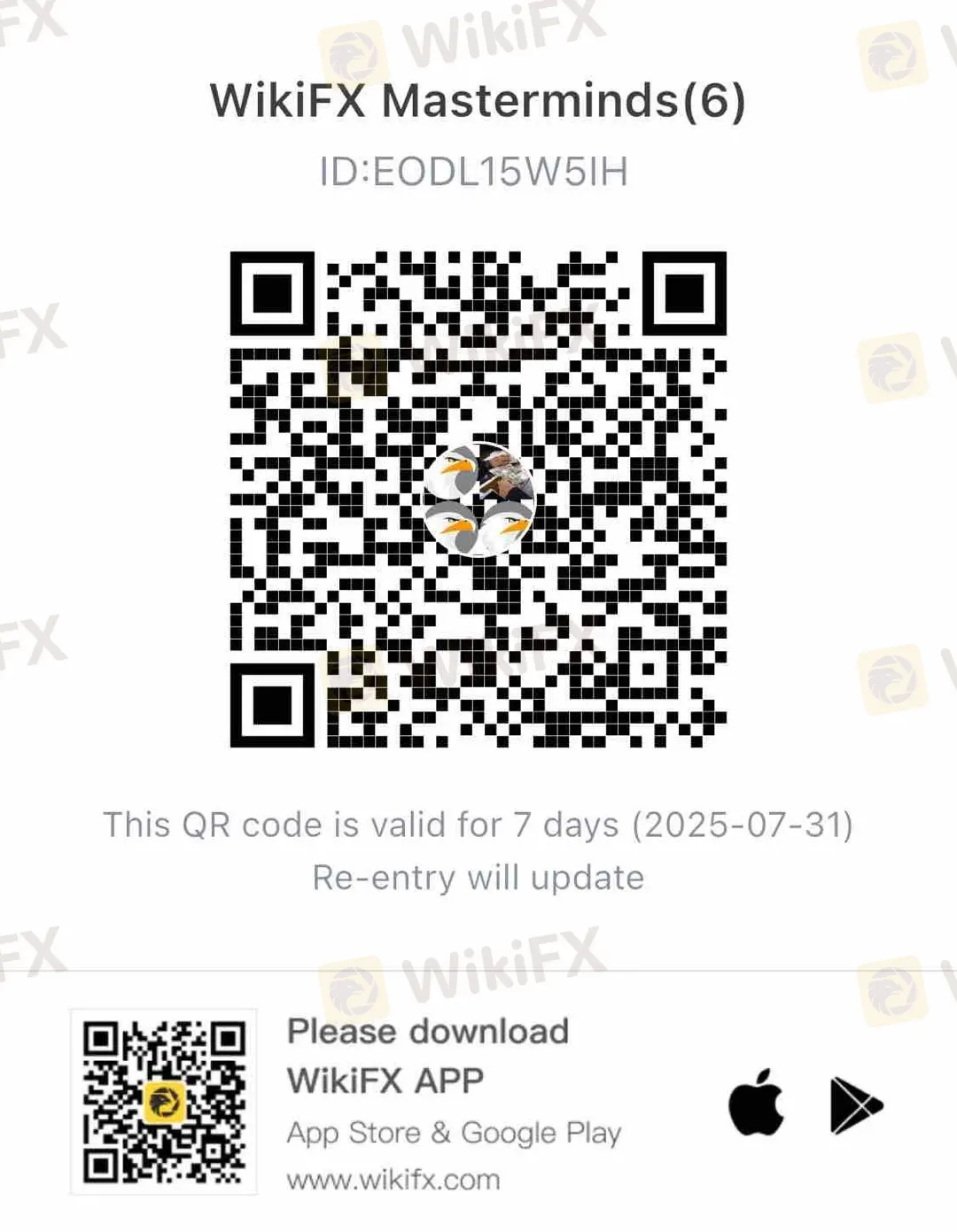

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!