Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

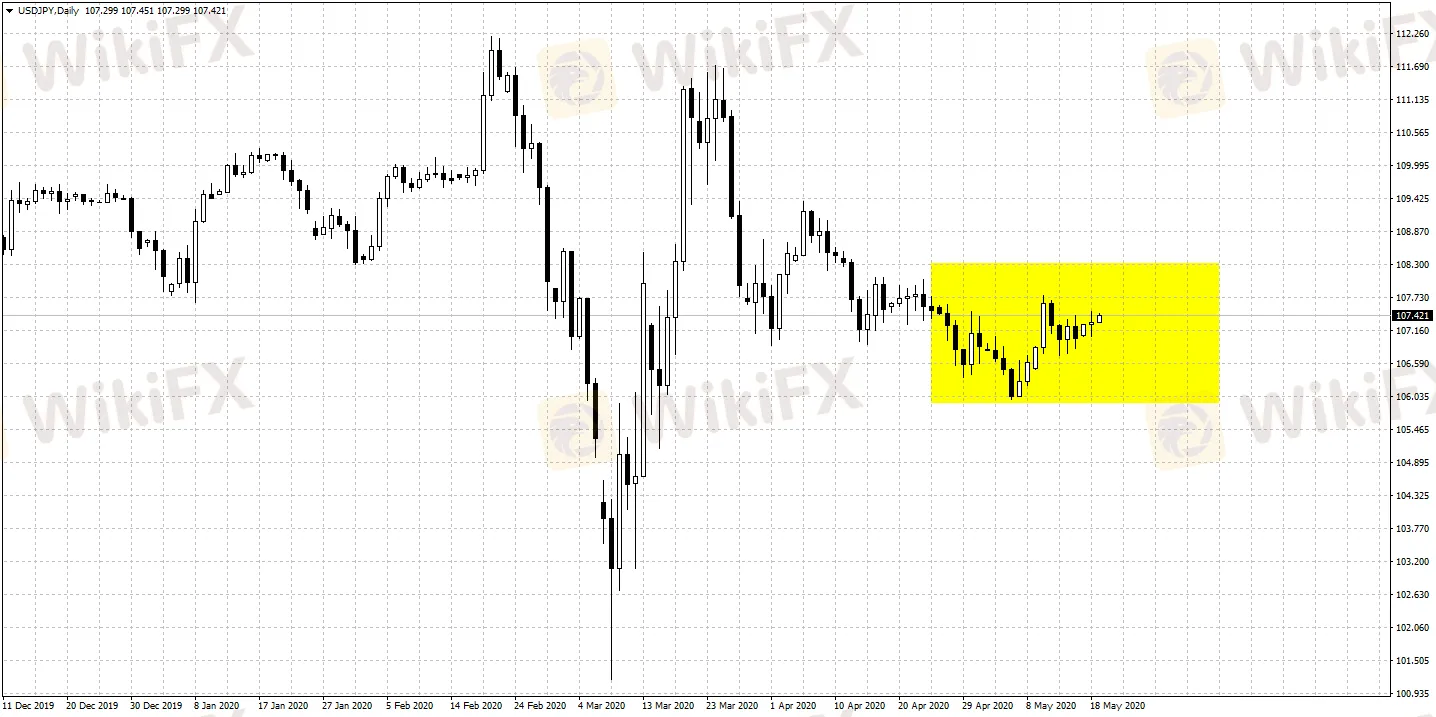

Abstract:Japan’s government data released on Monday shows that due to the pandemic and the consequent lockdown measures, Japan’s GDP in Q1, 2020 fell 3.4% year-on-year, shrinking for the second straight month and matches the technical definition of an economic recession.

May 19th, from WikiFX News. Japan’s government data released on Monday shows that due to the pandemic and the consequent lockdown measures, Japan’s GDP in Q1, 2020 fell 3.4% year-on-year, shrinking for the second straight month and matches the technical definition of an economic recession. This has been the first time after the second half of 2015 that the country faces a recession.

After the Fed’s aggressive monetary policies, USD/JPY still faces down-slope risks. The Fed’s active policy response helped reduce dollar’s risk of appreciating against traditional safe-haven currencies such as JPY and CHF, which made the Federal Reserve balance sheet rapidly growing to nearly US$7 trillion.

If the situation of the financial market again deteriorates, the yen will be the largest benefactor. The bank of Japan’s latest quantitative easing policy alone is not enough to change the yen’s strong momentum.

USD/JPY daily pivot points: 107.15-107.17

S1 106.56 R1 107.76

S2 105.98 R2 108.34

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

Currency markets opened the week with diverging narratives as the Japanese Yen (JPY) found footing on policy signals, while the Euro (EUR) struggles to price in the efficacy of German fiscal maneuvering amidst looming trade war threats.

The Bank of Japan (BOJ) has signaled a decisive shift away from its ultra-loose monetary past, with December meeting minutes revealing a policy board far more hawkish than market consensus anticipated. This development sets the stage for a high-stakes clash between monetary tightening and the government's massive fiscal expansion.

Despite the Bank of Japan’s (BOJ) attempts to normalize policy, the Japanese Yen faces a grim trajectory, with major institutions including JPMorgan and BNP Paribas forecasting a slide to 160 or lower against the Dollar by late 2026. The consensus is shifting from cyclical weakness to a narrative of "structural decline."