Abstract:Gold Price Forecast: XAU/USD balances around $1,920, establishes below 200-EMA, fresh sanctions on Russia

Fresh sanctions imposed on Russia by the US will escalate the financial shock on Moscow.

FOMC minutes advocate one or more 50 bps interest rate hikes this year.

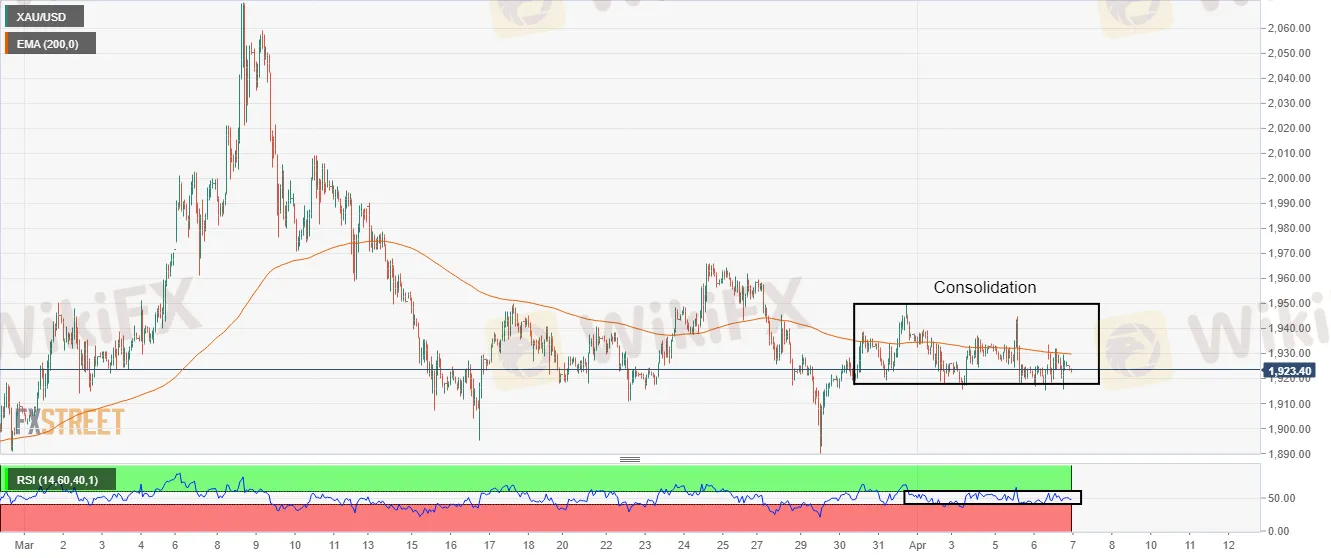

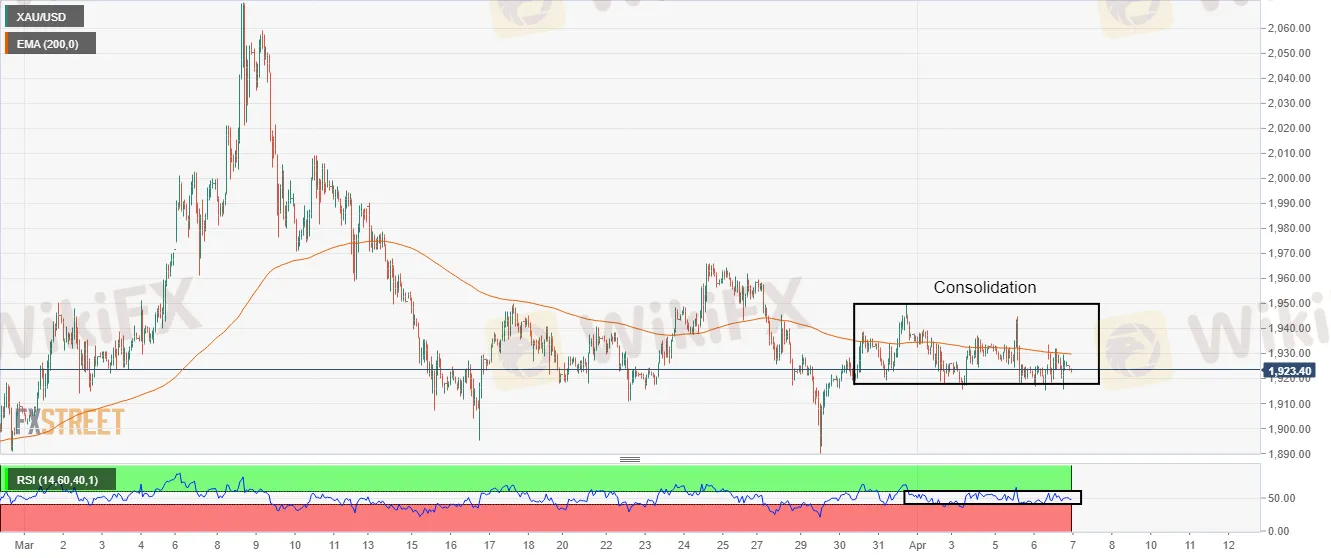

Gold (XAU/USD) has been witnessing a lackluster performance over the last six trading sessions. The precious metal is displaying back and forth moves in a range of $1,915.22-1,949.86. It is worth noting that the release of the Federal Open Market Committee (FOMC) minutes and speeches from various Federal Reserve (Fed) policymakers this week have failed to put any substantial impact on gold prices.

The minutes that have received much attention from the FOMC in March is the expectation of one more interest rate hike by 50 basis points (bps) this year. Apart from that, the rapid pace at which the Fed will augment the balance sheet reduction is one of the major highlights. Fed policymakers are majorly agreed on monthly caps of about $60B for Treasury securities, and $35B for mortgage-backed securities (MBs).

Meanwhile, Philadelphia Fed President and FOMC member Patrick Harker in his speech on Wednesday has indicated that restoration in the interest rates is likely that will bring the lending rate back to neutral at 2.5%.

The mighty US dollar index (DXY) is aiming to tap the psychological resistance of 100.00 amid fresh sanctions on Russia by the US administration, which has triggered the negative market sentiment. The US has imposed full blocking sanctions on Russia's Sberbank and Alfa Bank, which will dramatically escalate the financial shock on Moscow as these giants of the latter holds more than one-third assets of Russia

Gold Technical Analysis

On an hourly scale, XAU/USD is juggling in a range of $1,915.22-1,949.86 over the past few trading sessions. The precious metal has established below 200-period Exponential Moving Average (EMA) at $1,930.00, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) is oscillating in a 40.00-60.00 range, which advocates a consolidation ahead.