Abstract:Asia-Pacific bond yields followed U.S. Treasury yields higher on Wednesday and the dollar continued its climb after Federal Reserve officials signalled they are nowhere near done raising interest rates.

Stocks rose in volatile trading across Asia on Wednesday and the dollar pared early gains as investors weighed the potential fallout from U.S. House Speaker Nancy Pelosis visit to Taiwan, which has angered China.

Bond yields were also helped as demand for the safest assets eased despite heightened tensions between the United States and China, which views Taiwan as a breakaway province.

“In the longer term, there will be more frictions between the U.S. and China,” said Redmond Wong, Greater China market strategist at Saxo Markets in Hong Kong. “We have already been seeing selling from overseas investors in Chinese equities.”

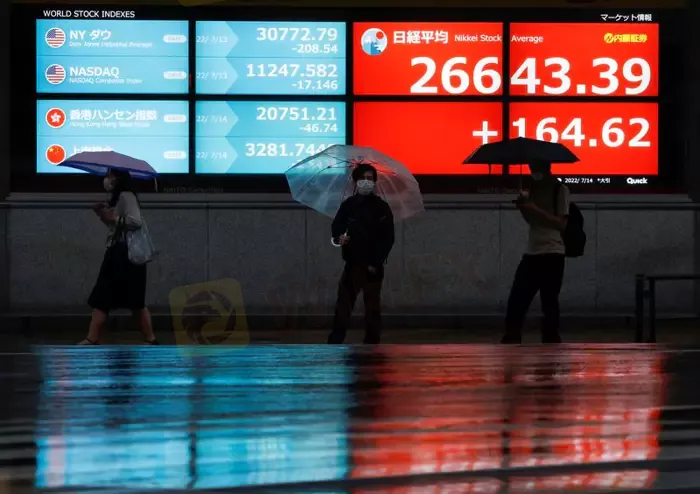

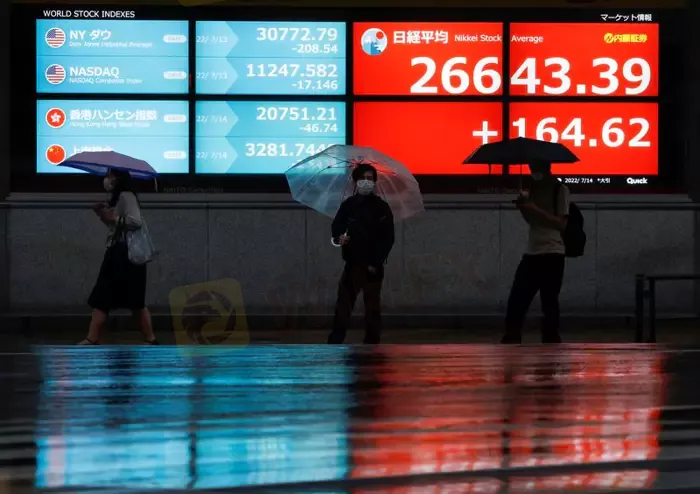

Japan‘s Nikkei closed up 0.53%, rebounding from Tuesday’s two-week closing low, while Hong Kong‘s Hang Seng gained 0.83% and Taiwan’s TAIEX index rebounded from earlier losses to gain 0.2% at the close.

MSCI‘s broadest index of Asia-Pacific shares rose 0.19%, helped by the rally in Japan as bargain hunters came in following Tuesday’s decline to a two-week closing low.

Australias AXJO fell 0.41% and Chinese blue chips lost 0.13%.

“Obviously, as investors in China, we would not like to see tensions escalate,” said Thomas Masi, vice president and co-portfolio manager of the GW&K Emerging Wealth Strategy.

“And we don‘t see the benefit necessarily of this trip, but there could be something that we don’t understand. On a risk-reward basis, should tensions ease, theres a lot more upside in these stocks.”

FTSE futures were down 0.20% and Euro STOXX 50 futures dropped 0.08% ahead of markets opening in Europe.

U.S. stock futures jumped 0.32%, following the S&P 500s 0.67% drop overnight.

A trio of Fed policymakers signalled on Tuesday that there would be no let up in the tightening campaign aimed at taming the highest inflation since the 1980s, even though it will take rates to a level that will more significantly curb economic activity.

Two of them, San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans, are widely regarded as doves.

Traders now see a chance of around 39.5% that the Fed will hike by another 75 basis points at its next meeting in September.

The benchmark U.S. 10-year Treasury yields were around 2.71% in Tokyo, not far from the overnight high of 2.774% following a 14 basis point surge.

The U.S. dollar index, which gauges the currency against the yen and five other major peers, was 0.188% lower at 106.25, having rebounded as much as 1.43% overnight following its slide to a nearly one-month low at 105.03.

Gold gained 0.57% higher to $1,769.73 per ounce, but following a 0.68% retreat the previous session.