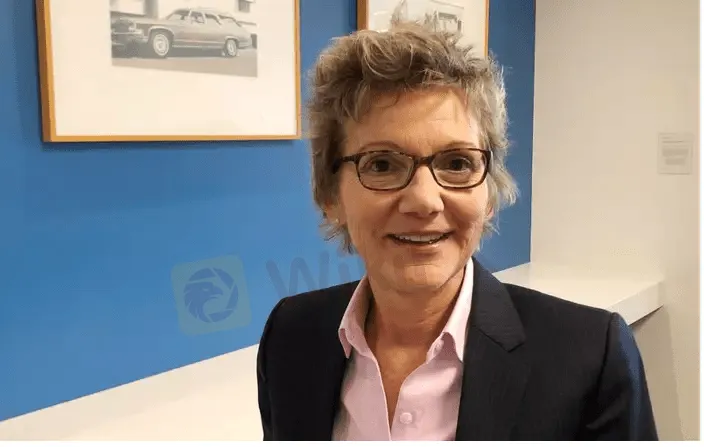

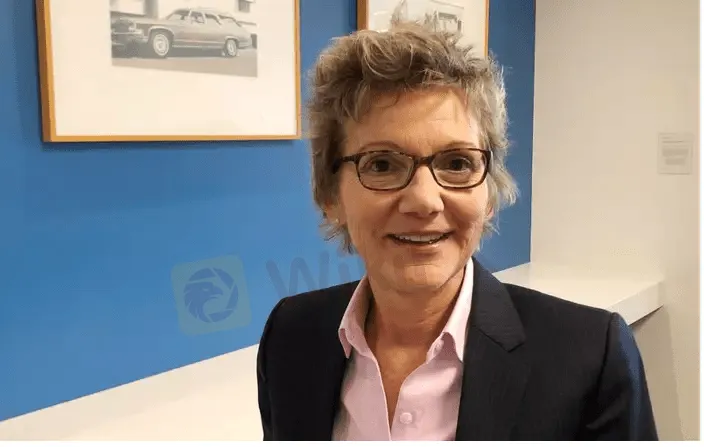

Abstract:San Francisco Fed President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation after new data showed a reprieve in consumer price pressures, the Financial Times reported on Wednesday.

San Francisco Federal Reserve Bank President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation, the Financial Times reported on Thursday.

Dalys remarks comes as U.S. consumer prices remained unchanged in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for weary Americans who have watched inflation climb over the past two years.

In an interview with the Financial Times, Daly did not rule out a third consecutive 0.75% point interest rate rise at the central banks next policy meeting in September, however, she said that a half-percentage point rate rise was her “baseline”. (https://on.ft.com/3SEkQ7E)

“Theres good news on the month-to-month data that consumers and business are getting some relief, but inflation remains far too high and not near our price stability goal,” the newspaper quoted Daly as saying during the interview conducted on Wednesday.

She also maintained that interest rates should rise to just under 3.5 per cent by the end of the year, according to the report. The fed funds rate, the rate that banks charge each other to borrow or lend excess reserves overnight, is currently in the 2.25%-2.5% range.

Slowing U.S. inflation may have opened the door for the Federal Reserve to temper the pace of coming interest rate hikes, but policymakers left no doubt they will continue to tighten monetary policy until price pressures are fully broken.

The Fed is “far, far away from declaring victory” on inflation, Minneapolis Federal Reserve Bank President Neel Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the CPI report.

Kashkari, the Fed‘s most hawkish member, said he hasn’t “seen anything that changes” the need to raise the Feds policy rate to 3.9% by year-end and to 4.4% by the end of 2023.