Abstract:Asian shares were left in limbo on Friday while the U.S. dollar made all the running as recession clouds gathered over Europe and highlighted the relative outperformance of the U.S. economy.

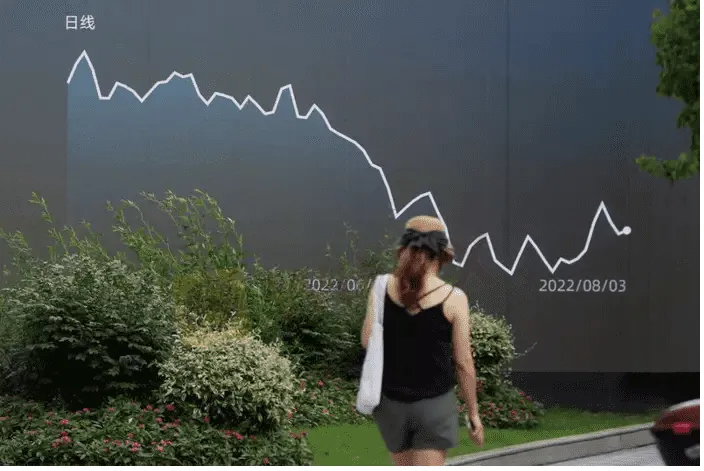

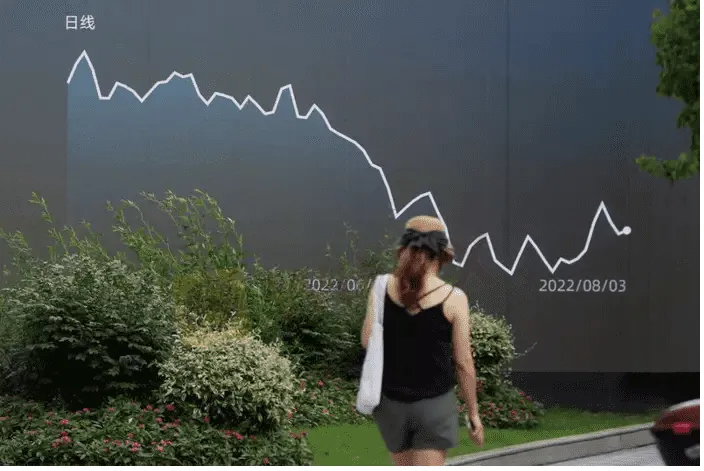

Added concerns about the health of China‘s economy saw MSCI’s broadest index of Asia-Pacific shares outside Japan ease 0.3%, to be down 1.1% on the week.

Chinese blue chips were flat, while South Korea lost 0.5%. Japans Nikkei fared better with a 0.3% gain due in part to a renewed slide in the yen.

S&P 500 futures eased 0.1% and were little changed on the week having repeatedly failed to clear the 200-day moving average, while Nasdaq futures slipped 0.2%.

EUROSTOXX 50 futures dipped 0.1%, while FTSE futures edged up 0.2%.

The threat of higher borrowing costs hung over markets as no less than four U.S. Federal Reserve officials signalled there was more work to do on interest rates, with the only difference being on how fast and high to go.

Markets are leaning toward a half-point hike in September and a one-in-three chance of 75 basis points (bp). Rates are seen peaking at least 3.5%, though some Fed members are arguing for 4% or more.

“There are no signs that the labour market or inflation data are slowing sufficiently for the Fed to declare victory on inflation,” said Brian Martin, head of G3 economics at ANZ.

“We see upside risks to the Feds inflation projections, and we expect these and the dot plot to be revised up in September,” he added. “We have revised up our year-end fed funds rate forecast by 25bp to 4.0% and now expect three 50bp hikes over the remainder of 2022.”

All of which underlines the importance of Fed Chair Jerome Powells Aug. 26 speech at Jackson Hole, usually a seminal event on the central bank calendar.

The bond market is clearly on the hawkish side with two-year yields 34 basis points below the 10-year yield and flashing recession warnings.

Dollar in demand

The “R” alarm is also ringing across Europe where natural gas prices hit record highs on Thursday adding to an inflation pulse that is sure to drive more painful policy tightening, exacerbating the risk of recession.

With European Union core inflation three percentage points above the European Central Banks 2% target, markets are wagering on another half-point rate hike in September.

The gloomy economic outlook has seen the euro drop almost 1.7% so far this week to $1.0078 and back toward its July nadir at $0.9950.

The dollar has also gained 2.0% on the yen this week to reach 136.28, the highest since late July. Against a basket of currencies it was up 1.8% for the week 107.60.

Sterling was another casualty, losing 1.8% for the week to $1.1917. Investors fear inflation in Britain at a stratospheric 10.1% will lead the Bank of England (BoE) to keep hiking and actually force a recession.

The cost-of-living crisis saw British consumer sentiment plunge to its lowest on record in August showed a monthly survey from data provider Gfk.

“Strength in the wage and price data have raised the bar for inaction and we now think the BoE will need to see clearer signs of a hard landing in order to pause,” said analysts at JPMorgan who raised their rate forecasts by 75 basis points to 3%.

“We look for a two quarter recession starting in 4Q that results in a cumulative 0.8% drop in GDP.”

The rise in the dollar has been a headwind for gold which has shed 2.4% on the week so far to $1,758 an ounce. [GOL/]

Oil prices were a little steadier on Friday, but still down on the week with Brent having touched its lowest since February at one point on concerns about demand. [O/R]

Brent was up a slim 2 cents at $96.61, while U.S. crude rose 5 cents to $90.55 per barrel.