WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. Throughout July and August, WikiFX has collected nearly 2,000 complaints. A question has been raised in our mind: what type of exposure appears most frequently? In this article, WikiFX will rank the exposure categories according to their severity.

In order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. Throughout July and August, WikiFX has collected nearly 2,000 complaints. A question has been raised in our mind: what type of exposure appears most frequently? In this article, WikiFX will rank the exposure categories according to their severity.

About WikiFX

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX can evaluate the safety and reliability of more than 38,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

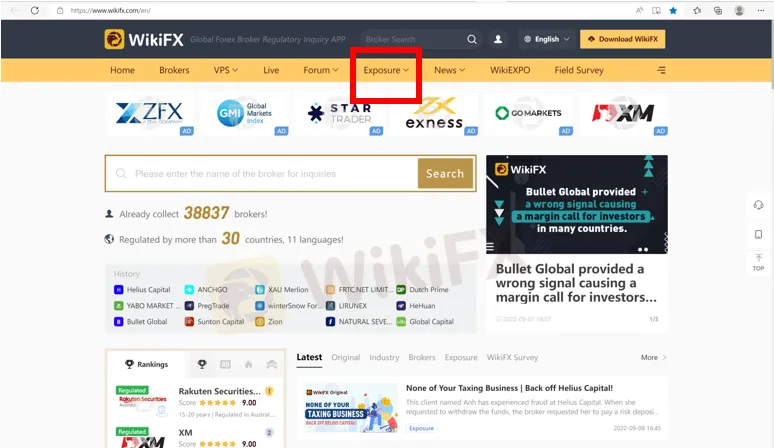

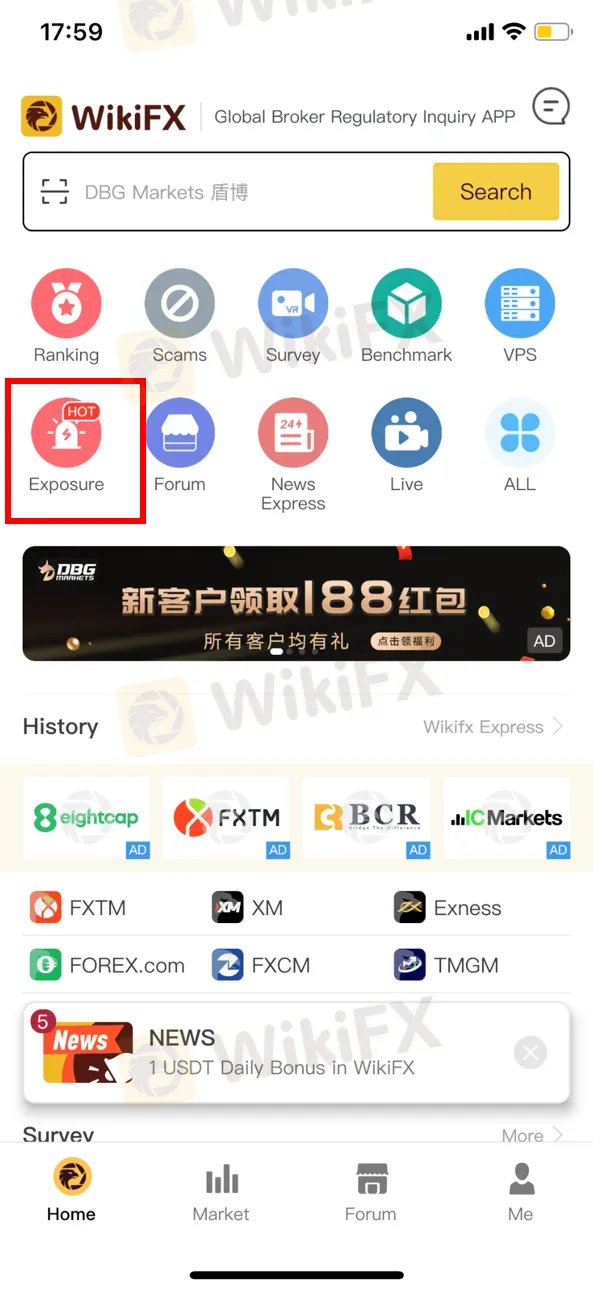

Exposure on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

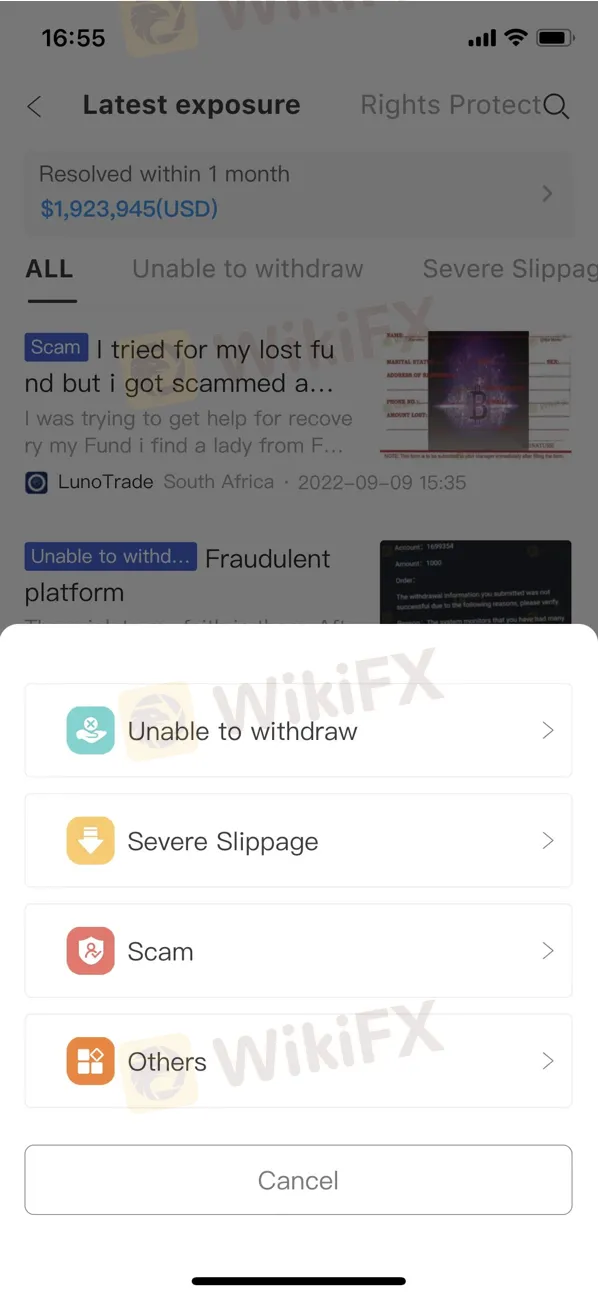

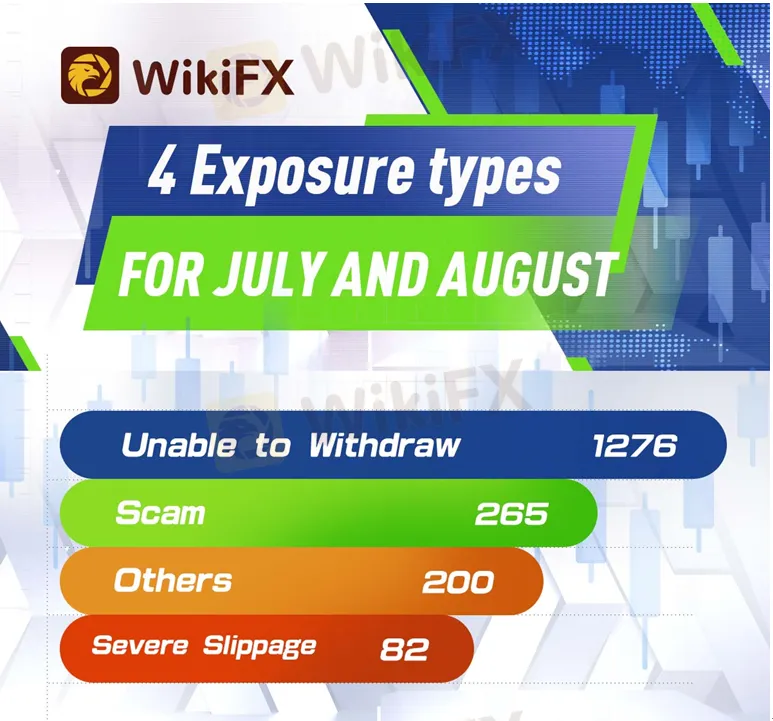

Ranking of 4 exposure types for July and August

1. Unable to Withdraw (1276)

As of September 8, 2022, WikiFX has received 1276 exposures related to “Unable to Withdraw” from July to August.

It is no doubt that withdrawal rejection is the most serious and common problem that many investors met when they invest in an unreliable broker. Refusing to allow clients to withdraw is the typical trick that scam brokers do. Scammers take clients‘ funds away fraudulently. And make unacceptable excuses to delay and reject clients’ withdrawal requests.

Some scam brokers ask investors to pay extra tax or risky fees if the investors insisted on withdrawal. Tax scams are one of the common tactics used by unreliable forex brokers. WikiFX has witnessed many cases wherein a fraudulent forex broker scared their trading clients about having tax payments in arrears and urged them to pay quickly before being punished by the authorities. However, it is rare to see a forex broker that uses this as an ultimatum, or rather “threat” towards its client. These brokers threatened to freeze traders' accounts by demanding that they pay their taxes by a specified date.

WikiFX currently has made an article about the scam brokers rejecting victims withdrawal requests and even putting forward unacceptable demands. Please feel free to read this article via the link. https://www.wikifx.com/en/newsdetail/202209079914856356.html

2. Scam (265)

As of September 8, 2022, WikiFX has received 265 exposures related to “Scam” from July to August.

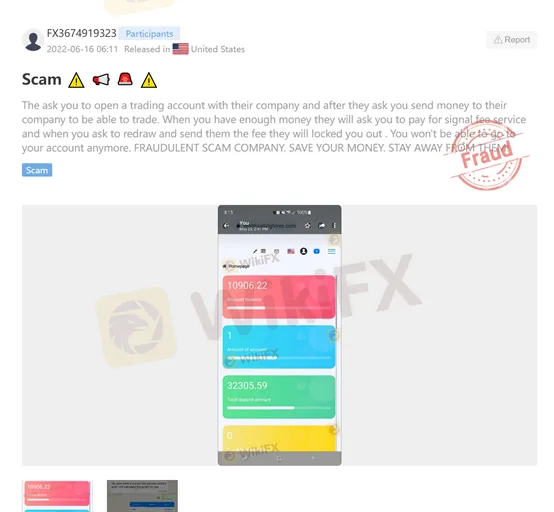

Usually, the investors accused brokers of scams because they have terrible customer service. The agents do not help efficiently or they do not respond at all.

Those brokers may use tempting offers to persuade you to open an account, and eventually make you deposit more money by giving some rewards at the beginning. Once the scam becomes so obvious, they will take your money away without giving you any response.

Sometimes, the withdrawal problem also can be listed as a “scam”

3. Others (200)

As of September 8, 2022, WikiFX has received 200 exposures related to “other issues” from July to August, which makes traders upset. For example, some victim claimed that the website of some brokers is fake; The regulatory license of some brokers is a suspicious clone, etc.

4. Severe Slippage (82)

As of September 8, 2022, WikiFX has received 82 exposures related to “Slippage” from July to August. These brokers usually have the poor ability in risk management. Or they are just scammers manipulating the trading process causing huge losses to the traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Share Your Expertise on What’s Moving the Market.

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.