Abstract:Going into the US midterm elections analysts were mostly split between three different positions:

Going into the US midterm elections analysts were mostly split between three different positions:

• Those analysts who pointed to the strong seasonal pattern in US stocks post the US midterm elections,

• Those who recognised the strong seasonals but said that it is different this time and stocks wont rally,

• Those who wanted to wait and see.

This article will look at some of the main points to consider when trying to track a way through by looking at the strengths and weaknesses of each position.

The seasonal strength

It can‘t be denied that the seasonals are very strong. Every US midterm election since 1950 has resulted in a higher S&P500 6 months later. That is a key statistic that can’t be ignored.

According to other analysts, this time is different and high inflation and the risk of the Fed giving a hard landing should mean that stocks dont perform so well. However, if you take a longer view we have to ask when will the Fed signal a pause in rates? It is likely to when/if the US economy shows signs of slowing.

Jobs and inflation

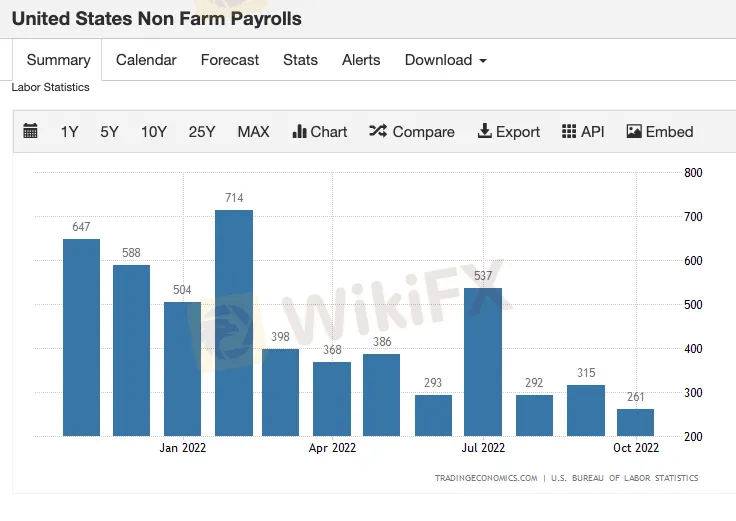

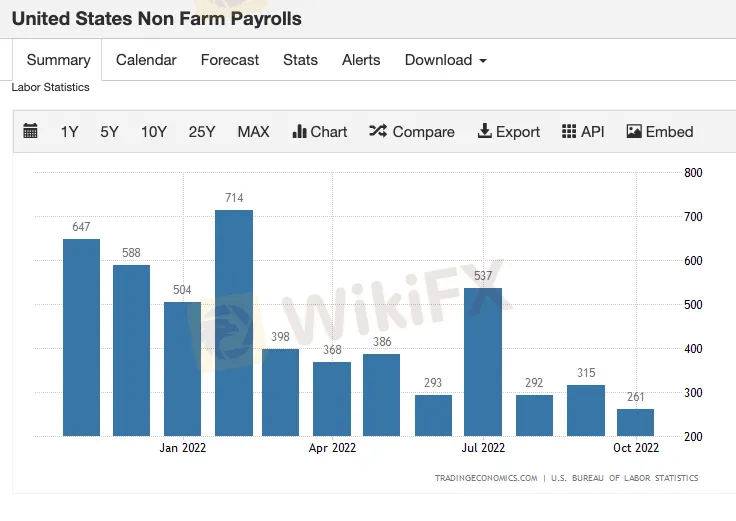

US jobs are still ok although the trend is tracking lower. The Fed will likely press the pause if/when the jobs market starts to slow down significantly.

Core inflation is moving higher and that will be a key metric going forward. If core inflation can show signs of slowing then that will give the Fed space to pause rates. Remember the Feds preferred measure of inflation is PCE.

So, one key thing to remember is that the Fed will try to pre-empt a downturn in the economy and signal a pause before the effects really impact. The Fed has already said that there is a lag effect and that it will be mindful of that. The lag effect is due to the time for interest rate hikes to cool demand. There is usually a 6 month+ lag effect which means the Fed will not want to wait until the economy is struggling in order to signal a pause. This has been born out in history with many stock rallies occurring while the economy is still slowing. See the graphs below to see this effect in play.

So, yesterday‘s CPI miss is good news for US stock bulls. Both groups of analysts may prove to be correct. This time it is different, but if the Fed signals a pause in December’s rate meeting that could still send stocks higher into year-end as potentially part of a US midterm rally after all. Whatever happened we need to be aware that volatility is ahead as each fresh economic data point is assessed in light of what it will mean regarding Fed policy.