Abstract:Britannia Financial Group has announced that the Prime Brokerage product of Britannia Global Markets Limited has been expanded to include trading of FX, Index, and Commodity CFDs.

Britannia Financial Group has announced that Britannia Global Markets Limited's Prime Brokerage product has been expanded to cover the trading of FX, Index, and Commodity CFDs.

The new service will be backed up by cutting-edge technology platforms such as Lucera, PrimeXM, MetaQuotes, and MaxxTrader.

Britannia's collaborations with award-winning financial services technology vendors will enable the Group to deliver cutting-edge aggregation software, ultra-low-latency connection, institutional-grade hosting solutions, and high-end MT4/MT5 Bridging and White Labels to its customers.

Britannia will also join the XCore community, confirming its dedication to the FX and CFD industries.

“We are thrilled to extend our Prime Brokerage offering to include CFDs and further enhance our technology infrastructure, which will enable us to successfully serve our customers' growing demand,” said Samuel Gunter, Head of Foreign Exchange Trading.

Britannia is dedicated to providing best-in-class service to our expanding professional and institutional customers by offering a diverse variety of trading and investing options. This new product and investment reflect the underlying goal of Britannia, which is to use technology to develop the Group's hallmark boutique, individualized services.

About Britannia Global Markets Inc.

Britannia Global Markets is a multi-asset brokerage that provides institutions, businesses, and UHNWs with execution, give-ins and give-ups, custody, and clearing services for a wide variety of financial instruments. Stock indices, interest rates, precious and base metals, agriculture, energies, financials, spot and forward foreign exchange, and equities are among the key global derivative markets accessible via the firm. Britannia is a stock exchange member in London as well as the Dubai Gold and Commodities Exchange. Britannia Global Markets is a subsidiary of the Britannia Financial Group, which is headed by Venezuelan/Italian banker Julio Herrera Velutini.

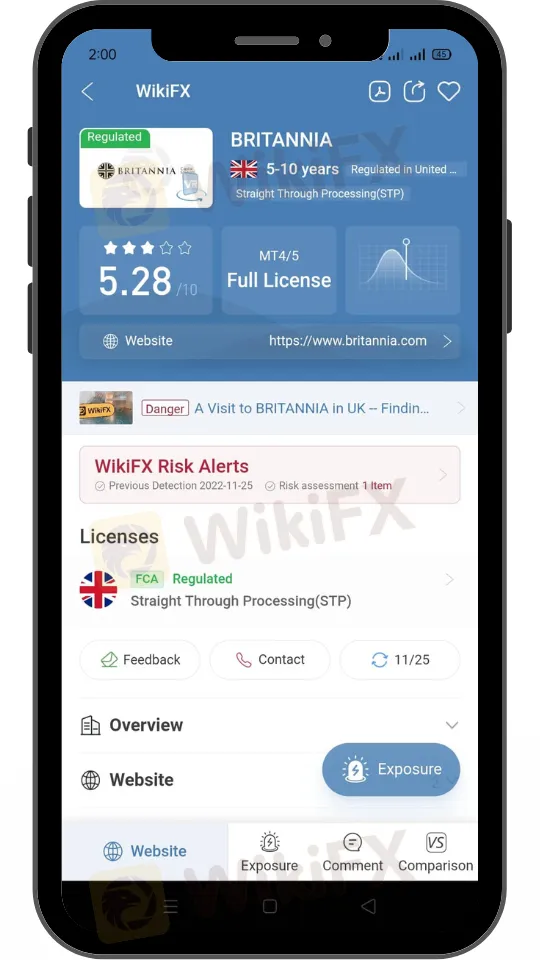

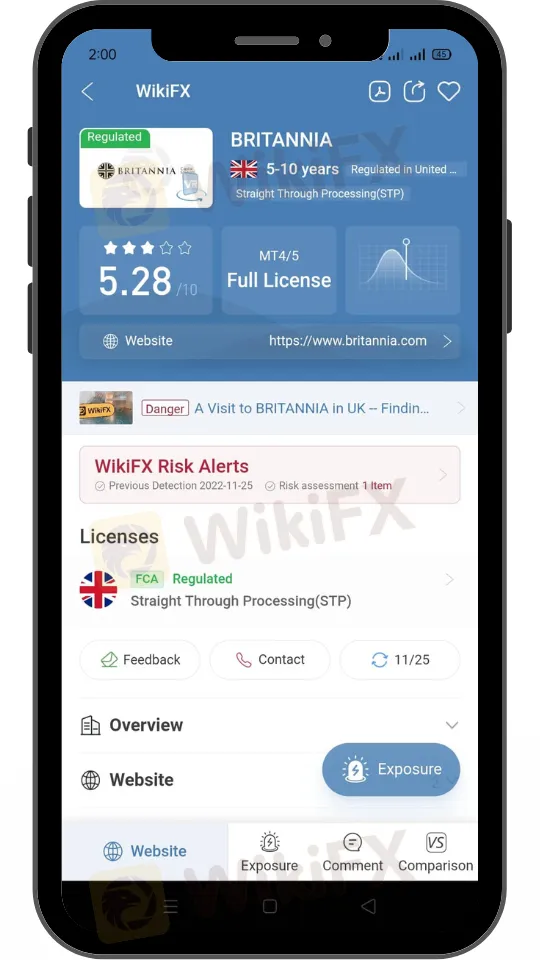

You can check out more of Britannia Capital Markets here: https://www.wikifx.com/en/dealer/8521258365.html

Stay tuned for more Forex Broker news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.