Abstract:Plus500 said on Monday that it has obtained a license from the Dubai Financial Services Authority (DFSA) to join the lucrative Middle Eastern markets.

Plus500 Receives DFSA License

The London-listed firm said that the new license will provide substantial development potential by enabling the broker to extend its capabilities to consumers in the UAE.

“We are delighted to have received license authorization from the DFSA in the UAE, and we are excited to bring our market-leading technology capabilities to customers in the region. This is the latest realization of our strategy to enter new markets, develop new products, and deepen engagement with our customers,” stated David Zruia, CEO of Plus500.

The DFSA license is extensively used by brokers who want to enter the Middle Eastern markets. In recent years, several brokers, such as Zenfinex, XTB, and MutiBank Group, have received DFSA accreditation.

Plus500's Global Expansion Goal

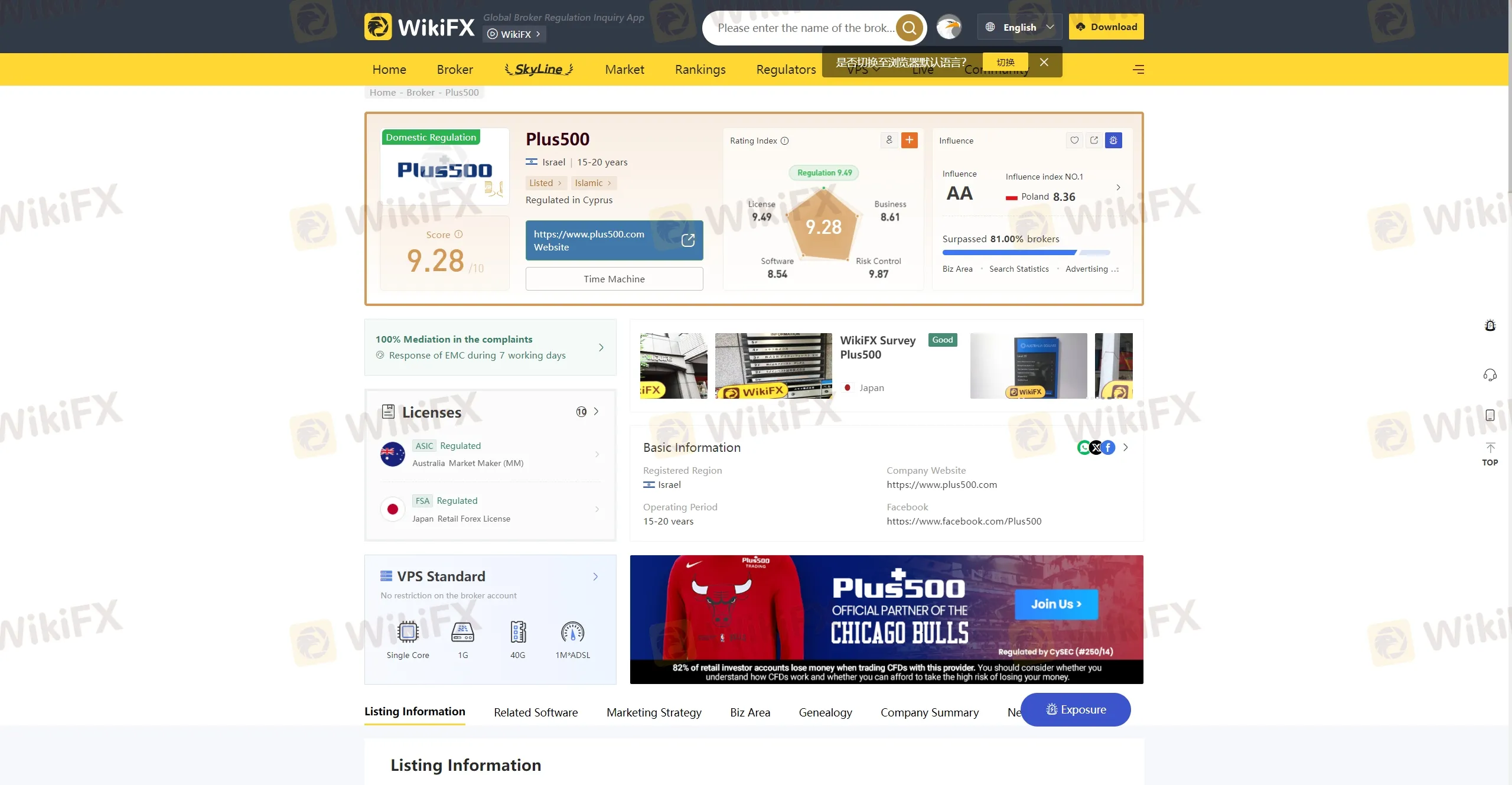

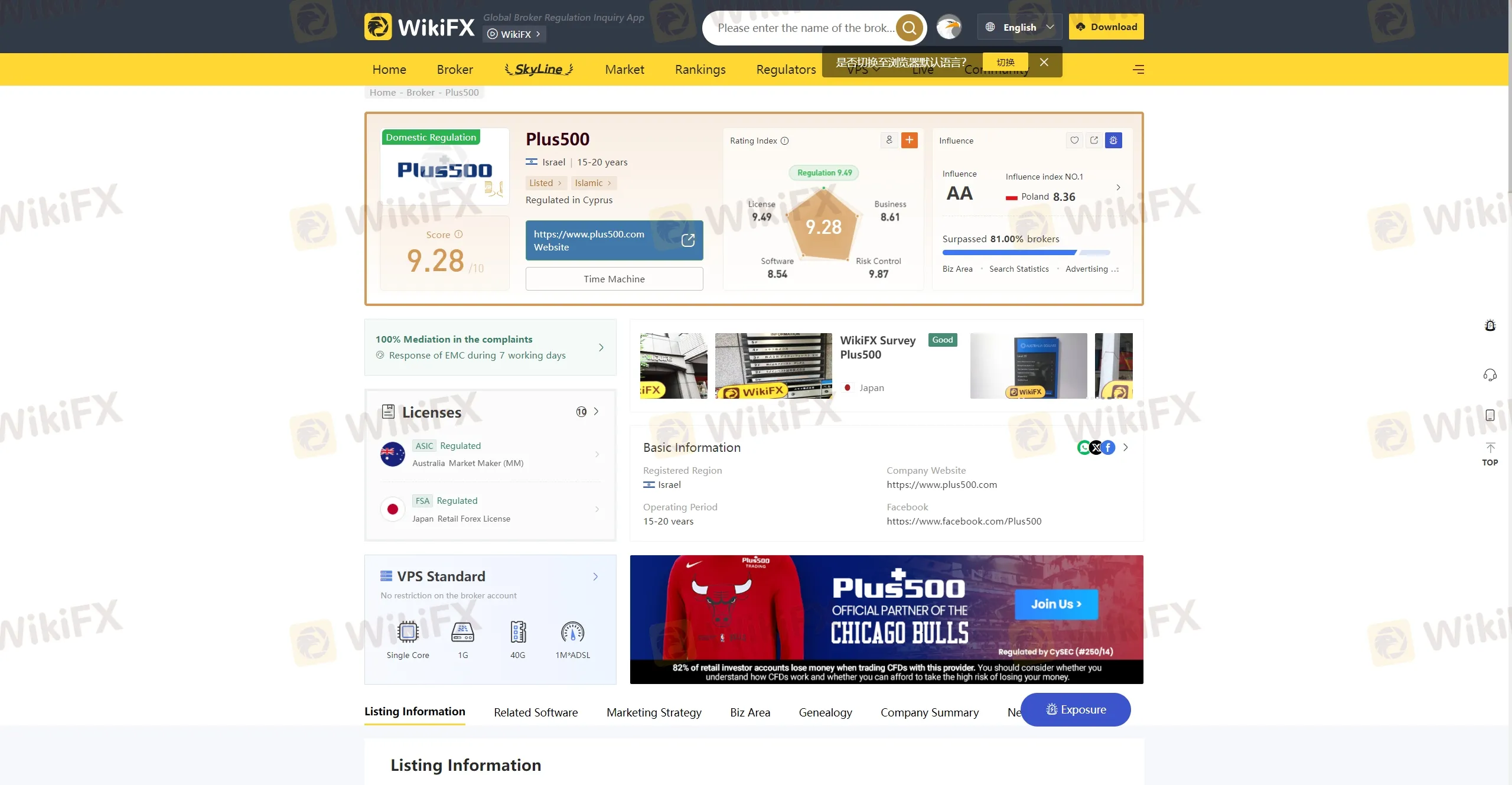

Plus500, headquartered in Israel, was launched in 2008 and provides forex trading services as well as CFDs on various asset classes such as stocks, indices, cryptocurrencies, ETFs, and options. It is one of the few retail FX/CFD brokers that is publicly traded.

Furthermore, it is one of the brokers that has substantially invested in technology and solely provides trading services via its own trading platform.

Plus500 has greatly tightened its regulatory standards over the years and currently possesses twelve licenses internationally. Over the last three years, the firm has secured licenses in the United States, Japan, Estonia, and Seychelles. It entered the US and Japan via the acquisition of two domestically controlled enterprises in those countries.

The broker received the new DFSA license after finishing the fiscal year 2022 with $832 million in revenue and $454 million in EBITDA. Both statistics were up from the previous year and met the company's expectations.

It is currently focusing on expansion in the United States, and in Q3 2022, it will develop a US-specific proprietary futures trading platform. It discontinued a seven-year partnership with the Spanish football club Atletico Madrid in October to establish a four-year sponsorship agreement with the Chicago Bulls, a professional basketball team headquartered in the United States.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3