Abstract:CNMV puts out a list of entities that have been warned or are not allowed to do business in order to keep people from investing. The release of this list is an important step in protecting investors from scams and fraudulent activities in the Spanish securities market.

The Comisión Nacional del Mercado de Valores (CNMV), the Spanish securities market regulator, recently released a warning list to the public. The list contains the names of companies that the CNMV has identified as potentially fraudulent or operating without authorization. The release of this list is an important step in protecting investors from scams and fraudulent activities in the Spanish securities market.

The warning list contains the names of companies that are not registered with the CNMV or authorized to offer securities in Spain. This means that these companies are not subject to the regulations and oversight that the CNMV provides to ensure the transparency and fairness of the securities market. The companies on the list are typically operating outside of the law, using aggressive sales tactics and misleading information to convince investors to buy their securities.

The new list of unauthorized entities according to the data dated February 13, 2023

ZOOMEX

www.zoomex.com

ACTION MARKETS LTD

www.actionmarkets.com

CRYPTO NATION PRO

www.crypto-nationapp.com

BAMBOOZLE GROUP LTD

www.enerixinvest.pro, www.enerixinvest.co

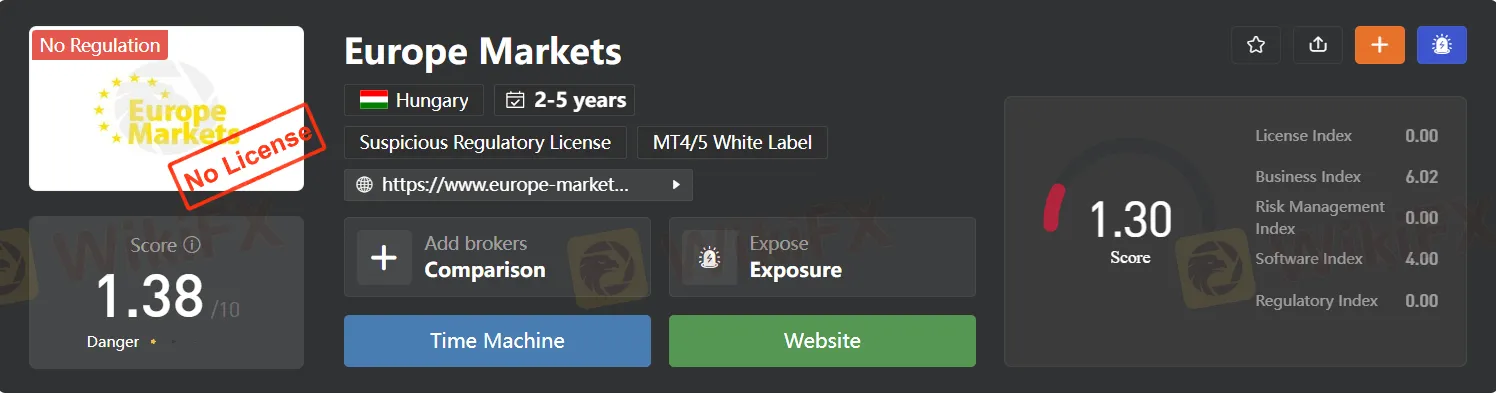

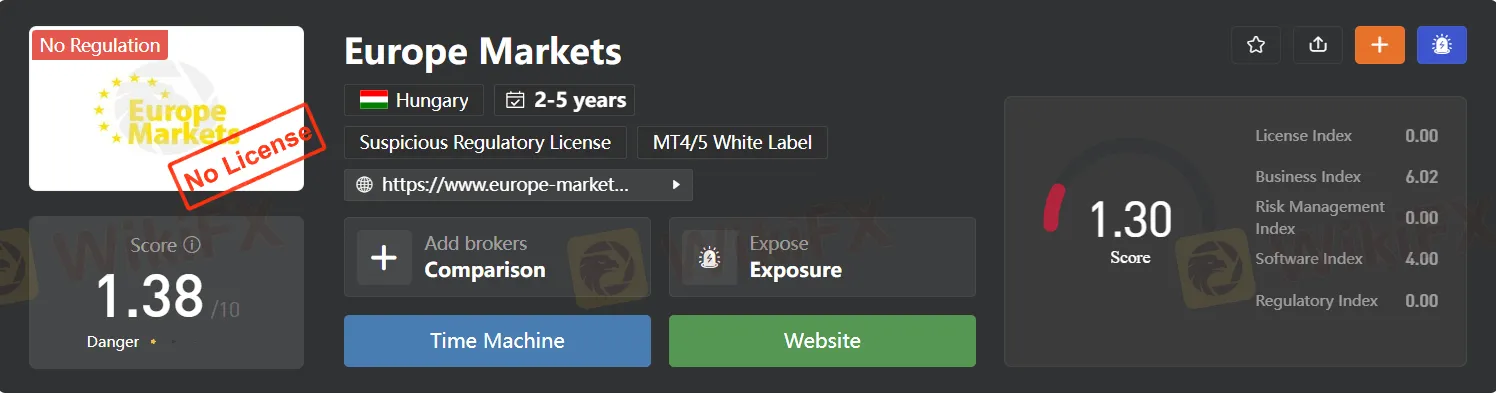

EUROPE MARKETS

www.europe-markets.com

EVER RISE BROKERS

www.everrisebrokers.com

FXWINNING LIMITED

www.fxwinning.pro

MFTTRADE

www.mfttrade.com

REVERRA LLC

www.swizz-pro.com

AKBUKE CAPITAL LLC

www.akbuke.capital

WikiFX as a medium platform to Major Financial Regulators

WikiFX is an online platform that provides information and reviews on forex brokers and financial institutions. The platform offers a database of registered forex brokers and enables traders to share their experiences and rate the brokers. This information can be useful for major regulators, as it helps them identify unauthorized entities and take action against them.

Traders can also benefit from WikiFX's database, as it helps them avoid unregulated or fraudulent brokers. By providing transparent and reliable information, WikiFX empowers traders to make informed decisions and avoid potential scams or losses. Additionally, the platform's rating system can help traders identify the most reputable and trustworthy brokers, providing them with peace of mind and confidence in their investment decisions.

Investors need to be aware of the risks associated with investing in companies that are not authorized by the CNMV. These companies may be engaged in illegal activities, such as money laundering or tax evasion, and their securities may be worthless or significantly overpriced. Investors may lose their entire investment if they are not careful and do not conduct thorough due diligence before investing.

CNMV's Essential tool

The CNMV's warning list is an essential tool for investors to protect themselves from these risks. The list is updated regularly, and investors can check it to see if a company they are considering investing in is on the list. If a company is on the list, investors should avoid investing in it and report it to the CNMV.

Investors should also be aware of the warning signs of potentially fraudulent activities. These include high-pressure sales tactics, promises of quick profits or guaranteed returns, and claims that the investment is low risk or has no risk at all. Investors should be wary of any company that makes these types of claims, and they should always conduct thorough due diligence before investing.

The CNMV's warning list is just one of the ways that the regulator is working to protect investors in the Spanish securities market. The CNMV also monitors the market for irregularities and suspicious activities, conducts investigations into potential fraud and market manipulation, and imposes fines and sanctions on companies that violate regulations.

The CNMV's work is essential to maintaining the integrity and stability of the Spanish securities market. Investors need to be able to trust that the market is fair and transparent and that they are protected from fraudulent activities. By releasing the warning list and taking other measures to regulate the market, the CNMV is fulfilling its mandate to promote the development and proper functioning of the securities market in Spain.

Conclusion

The release of the CNMV's warning list is a significant step in protecting investors from fraud and other illegal activities in the Spanish securities market. Investors need to be aware of the risks associated with investing in companies that are not authorized by the CNMV and should always conduct thorough due diligence before investing. By using the CNMV's warning list and staying vigilant for warning signs of fraudulent activities, investors can protect themselves and make informed investment decisions. The CNMV's work is critical to maintaining the integrity and stability of the Spanish securities market and promoting investor confidence.

Stay tuned for more unauthorized brokers.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3