Abstract:Multi-trading platform brokers offer traders access to diverse financial instruments and global markets, cost-effectiveness, and convenience. However, traders need to be cautious about the complexity, security risks, overtrading, and technical challenges. A careful evaluation of the broker's services and the trader's needs is crucial to avoid pitfalls and achieve successful trading.

Traders may access several trading platforms and a variety of financial instruments, including stocks, commodities, currencies, and derivatives, via a single trading account when using a multi-trading platform broker, also referred to as a multi-asset broker. Brokers with several trading platforms have been more popular in recent years as traders want to access international markets and diversify their portfolios. However, multi-trading platform brokers have benefits and drawbacks that we shall discuss in this post, just like any other trading platform or financial service.

Diversification: This is one of the main advantages of utilizing a multi-trading platform broker since it enables traders to spread their money across several markets and assets. Traders may diversify their assets across several industries by having access to a variety of financial instruments, which lowers the danger of their portfolio being overexposed to one industry or asset.

Cost-Effective: Brokers with several trading platforms may also be less expensive since they often provide cheaper trading fees, commissions, and other associated costs. They may provide competitive pricing and access to a variety of marketplaces, which can result in substantial savings for dealers.

Convenience: Another benefit of having a broker with many trading platforms is that it makes trading easier for traders. Traders may access several trading platforms and instruments using a single account rather than having numerous trading accounts with various brokers. Traders can manage their assets, monitor their performance, and make well-informed choices more easily as a result.

Access to Global Markets: Multi-trading platform brokers provide traders access to international markets, especially developing areas that may not be accessible via conventional brokerage services. This gives traders new investing chances, enabling them to benefit from the expansion of the world economy and make the most of trends and movements in the market.

Cons of a Broker with Multiple Trading Platforms:

Complexity: For traders who are new to the trading business, utilizing a broker with many trading platforms might be challenging. The abundance of accessible platforms and financial tools might be confusing and result in bad investing choices. To prevent making expensive errors, traders must take the time to comprehend each trading platform and instrument they want to use.

Security risks: Multi-platform brokers often demand that traders deposit money into their trading accounts before they can begin trading. This poses a security concern since traders must make sure that their financial and personal data is safe from fraud and cyberattacks. To protect their assets and information, traders must choose a reliable broker with strong security measures.

Overtrading: Using a broker with a multi-trading platform has the potential to result in overtrading as well. Because utilizing several trading platforms is so simple and convenient, traders may be tempted to trade often. In the end, this might result in losses due to bad investment choices, and overexposure to specific markets or assets.

Platform and technical challenges: Traders who use several trading platforms are more likely to have platform downtime or connection issues, which may impair their ability to execute profitable trades. To reduce the danger of technical issues, traders must make sure they have a dependable internet connection and are utilizing the most recent software.

There are several brokers that provide services on multiple trading platforms. Several well-known brokers with several trading platforms are:

Access to several trading platforms and financial instruments, such as stocks, FX, commodities, cryptocurrencies, and more, is provided by these brokers. Trading fees, commissions, security features, and customer service are just a few of the variables that traders should examine before selecting a broker that best suits their requirements and trading style.

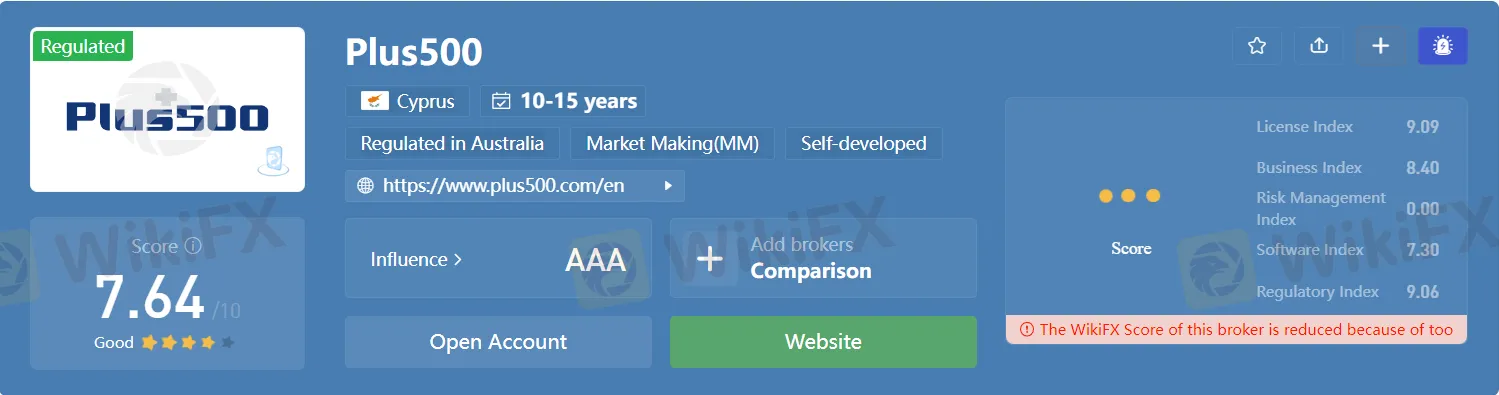

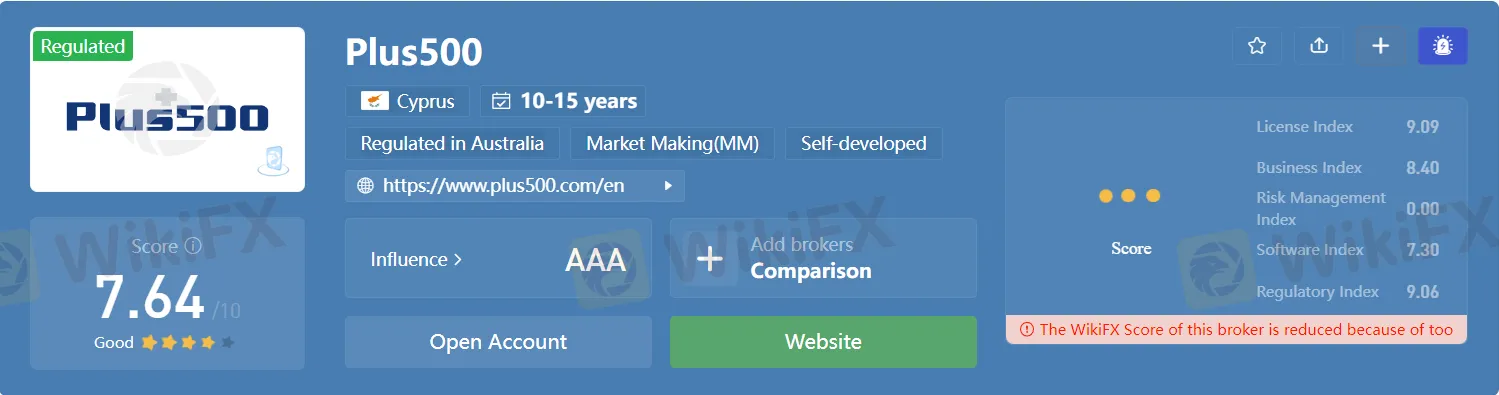

WikiFX on Veryfing Broker's Regulation

Talking about Forex brokers, WikiFX, a platform that provides information on forex brokers, can help traders verify a broker's regulatory status. It explains how WikiFX's system works, which includes checking the broker's registration and licenses, regulatory authorities, and any past regulatory violations. The article also emphasizes the importance of verifying a broker's regulatory status to avoid potential scams or fraud. Overall, WikiFX can be a useful tool for traders to ensure that they are working with a reputable and regulated broker.

In conclusion, there are benefits and drawbacks to choosing a broker with several trading platforms. It gives traders access to a variety of financial products and marketplaces, but it may also be difficult to understand, encourage excessive trading, and present security problems. A reliable broker that fits their demands and trading style must be selected after carefully weighing the advantages and disadvantages. In the end, comprehensive research, a solid trading plan, and ongoing monitoring and evaluation of one's assets are the keys to successful trading.

Download and install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://social1.onelink.me/QgET/px2b7i8n