Abstract:The Dallas Fed Manufacturing Index fell more than expected, stoking recession fears and causing the S&P 500 to drop. The US Dollar Index weakened, while gold prices rose. The WikiFX Financial Calendar helps investors stay informed on market developments, allowing them to make well-informed decisions and identify new opportunities.

The Dallas Fed Manufacturing Index report, just issued by the Federal Reserve Bank of Dallas, showed a worse fall than was expected. The indicator declined against the expert estimate of -14.6, dropping from -15.7 in March to -23.4 in April. This fall increases worries about a future recession by showing that the industrial sector is still under pressure.

The research states that “perceptions of the broader business conditions significantly deteriorated in April.” While the new orders index improved, going from -14.6 to -9.6, the production index decreased from 2.5 to 0.9. The future production index, however, fell from 13.5 to 3.0, indicating a minimal increase in output during the next six months.

Treasury rates decreased after the Dallas Fed Manufacturing Index data was released as traders predicted the Federal Reserve would take a more dovish posture to provide more assistance to the economy.

SP500 Drops Amid Fears Of A Recession

Investors focused on the increased possibility of a recession, which caused the S&P 500 to drop from its session highs. The manufacturing sector's difficulties were highlighted further by the Dallas Fed Manufacturing Index's multi-month low.

The U.S. Dollar Index tested its session lows in reaction to the data, and Treasury rates decreased. Forex markets seem to be preparing for a Fed that is less hawkish, which would be negative for the value of the US dollar.

After the report's publication, gold made a comeback and rose over $1,985 once again. The dollar's decline and the drop in Treasury rates both significantly boosted the price of gold.

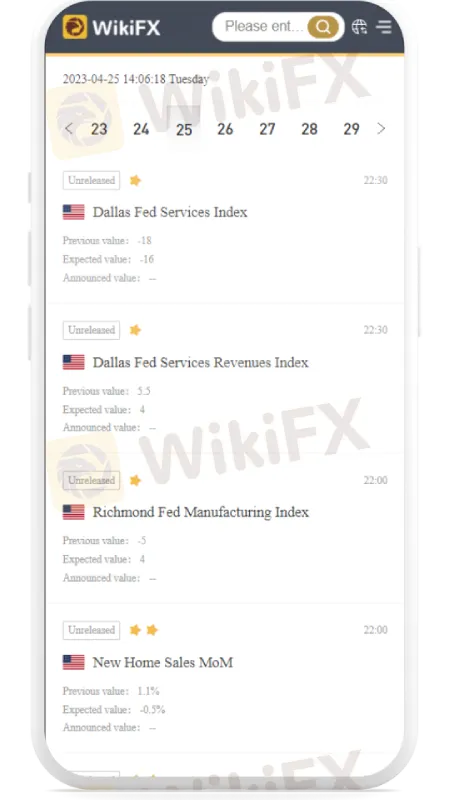

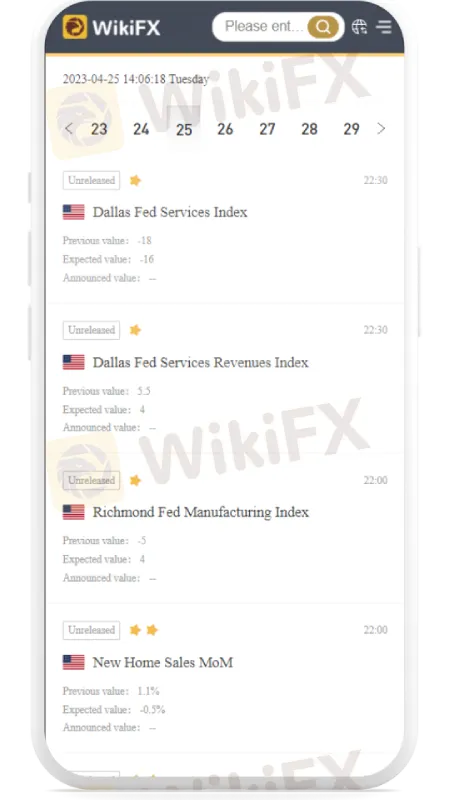

WikiFX Financial Calendar

For effective trading and investing in today's fast-paced financial environment, being updated about market developments is crucial. Using a financial calendar, like the WikiFX Financial Calendar, is one of the best methods to keep informed. Investors may use this effective tool to track the monetary developments that influence the world markets and make well-informed choices based on current facts.

A complete calendar of financial events, data releases, and economic pronouncements that might affect the direction of financial markets is known as a financial calendar. Investors may anticipate market changes, modify their portfolios, and carefully plan their trading activity by regularly reviewing the WikiFX Financial Calendar.

It is impossible to exaggerate the value of daily financial calendar checks. Numerous variables, such as macroeconomic information, monetary policy choices, and company news, have an impact on the financial markets.

Currency and stock values may be greatly impacted by economic indices like GDP, inflation rates, and unemployment rates. Similarly to this, bond yields and investment flows may be impacted by central banks' interest rate choices. Corporate activities like earnings announcements and mergers may also affect the market's mood.

Keeping up with these market-moving events is possible for investors with a daily check of the WikiFX Financial Calendar. Investors may make wise judgments and steer clear of possible traps by being informed of forthcoming data releases and events. Additionally, keeping up with changes in the world economy might aid investors in spotting fresh investment possibilities and trends.

Download and install the WikiFX App on your smartphone to stay updated on the financial market.

Download the App here: https://social1.onelink.me/QgET/px2b7i8n