WikiFX Invitation Rewards Program

Invite friends and earn points, the more you invite, the more you earn!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we'll look in-depth at TDX Global, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at TDX Global, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

Background:

TDX Global Technologies, also known as TDX Global, is an international brokerage company in various South Asian countries, including China, Singapore, Malaysia, Thailand, Indonesia, Vietnam, and more. They offer different trading options like foreign currencies, precious metals, commodities, global indices, and stocks.

The company is registered under the laws of England & Wales with the registration number 13014221. Their registered office is located at 16, Point Pleasant, Putney, London, SW18, 1GG, United Kingdom, known as TDX Global Technologies (U.K) Ltd.

Types of Accounts:

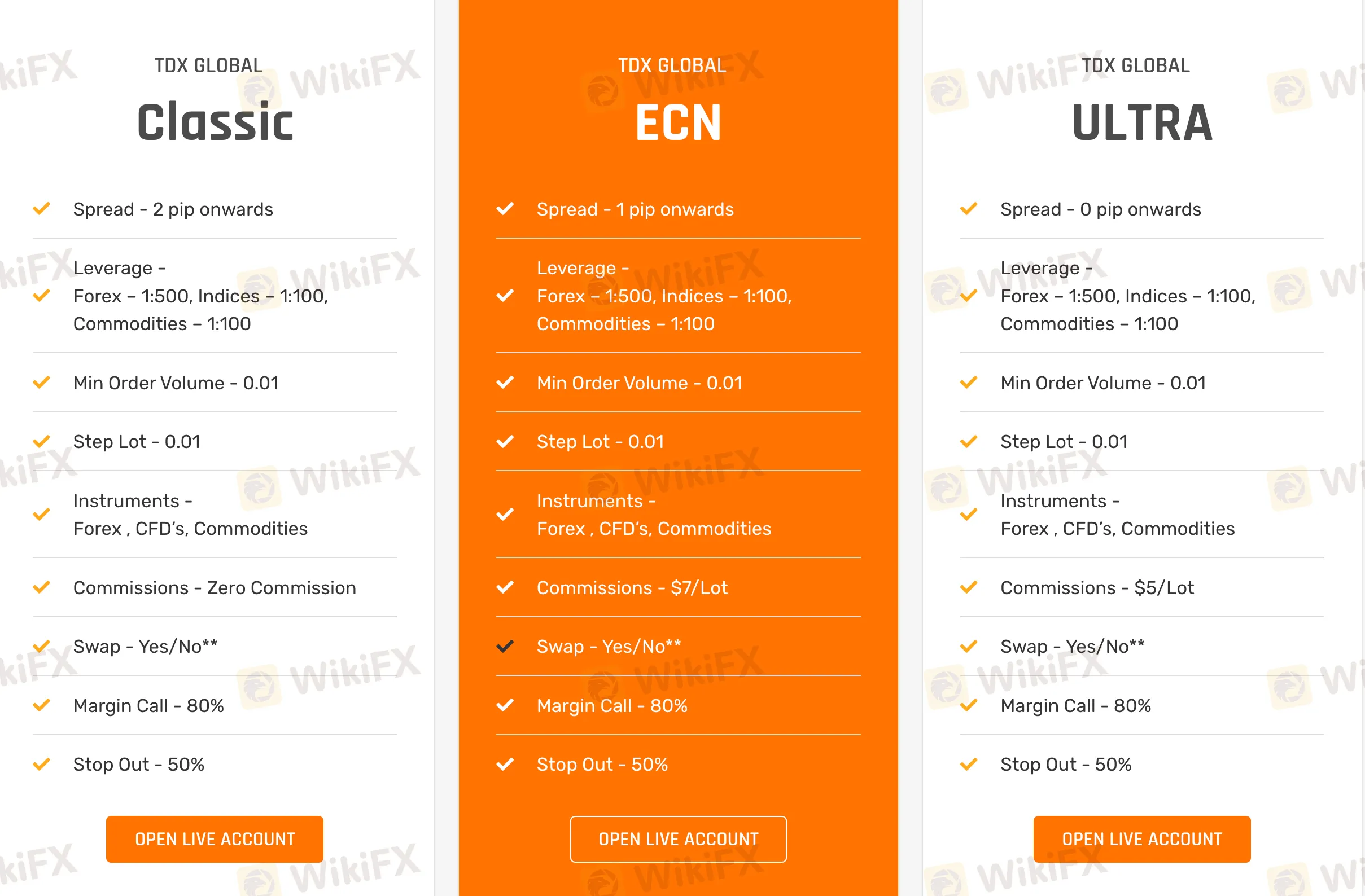

TDX Global offers three types of trading accounts, namely Classic, ECN and Ultra:

The Classic account is a commission-free account. Its spreads start from 2 pips. The maximum level of leverage is 500 times.

The ECN account charges a $7 commission per lot traded with spreads starting from 1.0pips. The maximum leverage is 500 times.

The Ultra account charges a $5 commission per lot traded with spreads starting from 0 pip onwards.

In addition, swap-free Islamic accounts are also available for Muslim traders upon request.

Deposit and Withdrawals:

Clients can finance their accounts through TDX Global's payment options, including E-wallets, Cryptocurrencies, and direct banking. The broker claims to process transactions 24/7 to ensure that payments are handled promptly, with a commitment to completing them within one business hour.

Below are the deposit and withdrawal options that TDX Global offers:

Notably, these options are relatively lacking in comparison to the other brokers.

Trading Platforms:

TDX Global's trading platform is the renowned MetaTrader 5 (MT5). MT5 is a popular multi-asset trading platform that offers a wide range of features, including powerful technical analysis tools, flexible charting tools, advanced order management tools, automated trading, and cross-platform compatibility. It is used by millions of traders and investors to trade forex, CFDs, stocks, and futures. MT5 is available for desktop, web, and mobile devices.

Research & Education:

TDX Global's education resources are relatively lacking in comparison to its peers. The broker only provides daily market outlook and calendar, trading ideas, and technical analysis on certain major currency pairs. There are no comprehensive free lessons or resources that cater to traders at various skill levels.

Customer Service:

TDX Global provides around-the-clock customer service so customers can get the support and assistance they need anytime. TDX Global also provides customer service options in several foreign languages for customers unfamiliar with English, such as Korean, Japanese, Mandarin and more.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has given TDX Global a WikiScore of 6.19 out of 10, indicating that it is only a borderline safe broker within the industry.

Upon examining TDX Global's licenses, WikiFX found that TDX Global operates under the ASIC regulations and the United States' Financial Crimes Enforcement Network.

Although TDX Global is a regulated broker, WikiFX would encourage our users to opt for a more rounded broker. As aforementioned, TDX Global is evidently playing second fiddle to its industry peers in certain areas, such as deposit and withdrawal options and education resources. There are better brokers that traders can opt for. We encourage our users to entrust a broker with at least a WikiScore of 8.0 and above to ensure top-notch products and services.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Invite friends and earn points, the more you invite, the more you earn!

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check