Abstract:Saxo Bank Japan reduces spreads on 7 major currency pairs, improving trading efficiency and reaffirming its commitment to superior financial services.

Tokyo, Japan - Saxo Bank Securities Co., Ltd., the esteemed Japanese arm of the global investment giant Saxo Bank, has announced a significant reduction in the spreads of seven widely traded currency pairs, marking a major step forward in forex trading efficiency.

In a move that is set to benefit a broad range of investors and traders, Saxo Bank Japan has adjusted the spreads on these pairs, ensuring more cost-effective trading experiences. This strategic change underscores Saxo Bank's commitment to providing superior trading conditions and underscores its position as a leader in the financial services sector.

The updated spreads are as follows:

USD/JPY (US dollar/yen): 0.2 pips

EUR/JPY (Euro/yen): 0.5 pips

AUD/JPY (Australian dollar/yen): 0.7 pips

GBP/JPY (British pound/yen): 1.2 pips

EUR/USD (Euro/US dollar): 0.4 pips

AUD/USD (Australian dollar/US dollar): 0.6 pips

GBP/USD (British pound/US dollar): 0.9 pips

These changes will be effective during specific trading hours, which are delineated as follows:

It is important to note that these fixed spreads are applicable only during the stated target periods. At other times, the spreads will vary according to market conditions.

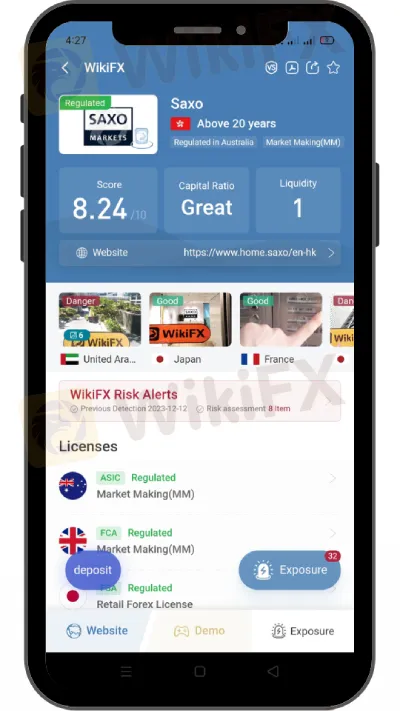

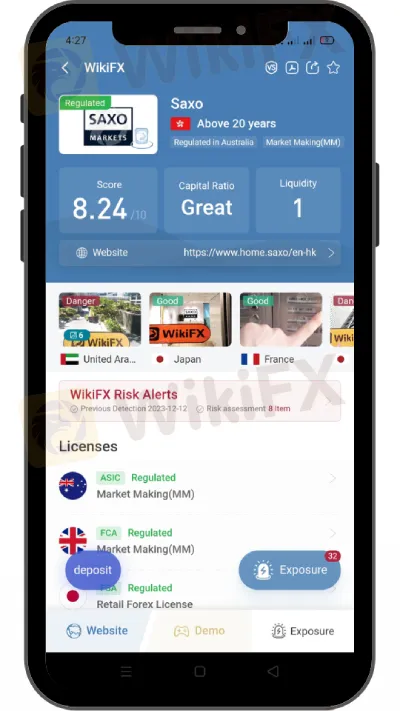

About Saxo Bank

Saxo Bank Japan is a fully licensed subsidiary of Saxo Bank, a worldwide leader in online trading and investing. Saxo Bank, founded in Denmark in 1992, has extended its services globally, offering a solid platform for trading in FX, stocks, CFDs, futures, funds, and bonds. Saxo Bank Japan maintains this heritage by providing unrivaled access to global financial markets as well as better trading technology suited to the requirements of Japanese customers.

Regulatory Body

Saxo Bank Japan works under the stringent supervision of Japan's financial regulatory authorities, assuring adherence to the highest standards of openness and financial integrity. The regulatory environment in Japan is meant to safeguard investors and preserve the integrity of financial markets, making Saxo Bank Japan a trusted partner for both individual and institutional traders.

Bottom Line

This reduction in spreads by Saxo Bank Japan represents not only an opportunity for traders to engage in forex transactions more cost-effectively but also highlights Saxo Bank's ongoing dedication to enhancing client experiences and fostering accessible global trading environments. With its strong regulatory foundation and commitment to technological innovation, Saxo Bank Japan continues to set the standard for excellence in the world of online trading.