Abstract:Apex Legal Limited's recent license revocation by the UK's Financial Conduct Authority (FCA) on January 5, 2024, unveils regulatory concerns over the firm's lack of engagement in authorized activities, reflecting broader shifts in the FCA's approach towards ensuring active compliance in the financial sector.

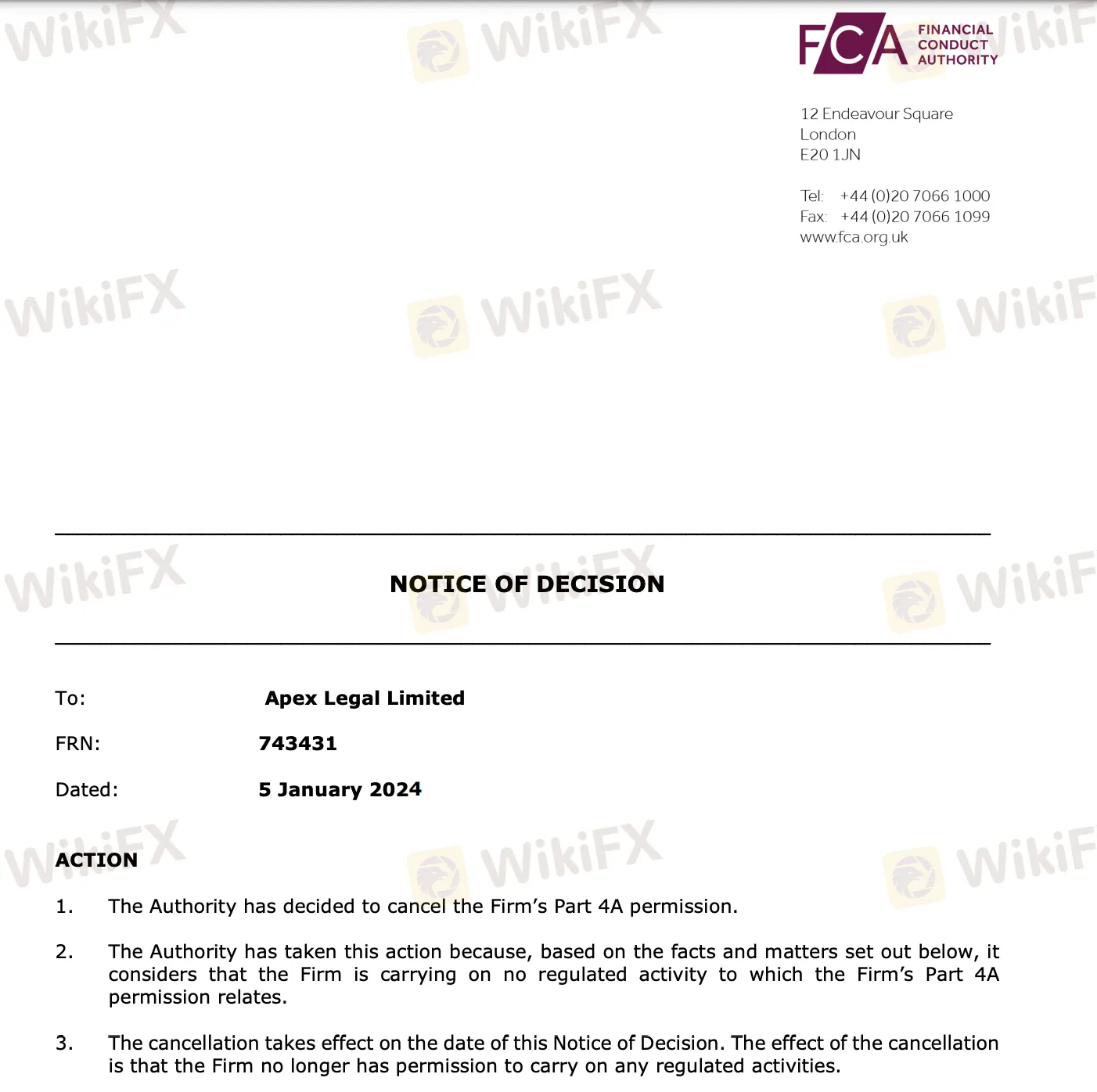

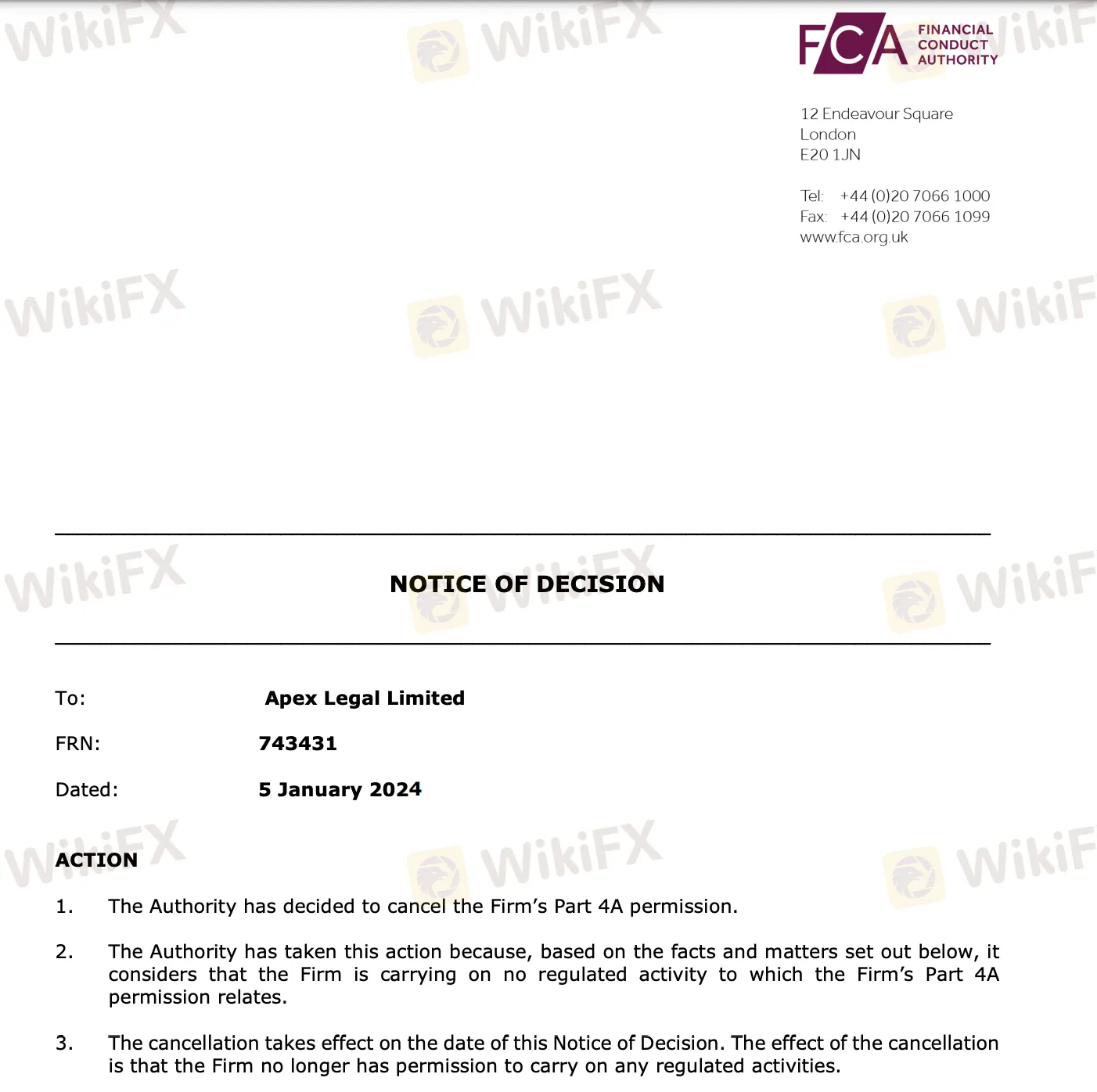

The UK's Financial Conduct Authority (FCA) officially revoked Apex Legal Limited's Part 4A permission, effective January 5, 2024, as the Authority observed the firm's lack of engagement in any regulated activities covered by its Part 4A permission.

Apex Legal obtained FCA authorization on September 1, 2016, enabling specific regulated activities such as arranging investments, assisting in insurance contracts, acting as an agent in investments, organizing transactions in investments, and agreeing to regulated activity.

The FCA issued two notices to Apex Legal, expressing concerns about the firm's non-engagement in regulated activities aligned with its Part 4A permission and proposed cancellation. Despite these notices, Apex Legal did not take the required specified actions.

Information obtained from FCAs official website: https://www.fca.org.uk/publication/decision-notices/apex-legal-limited-2024.pdf

Consequently, the FCA decided to cancel Apex Legal's Part 4A permission. This decision aligns with the FCA's recent efforts to protect consumers by rescinding unused financial licenses across the UK. The regulatory changes empower the FCA to cancel licenses within 28 days, a significant shift from the previous 12-month timeline. This approach aims to ensure active participation in regulated activities by licensed firms, emphasizing the risk of losing licenses for non-compliance.

The FCA emphasizes that dormant licenses could mislead consumers, citing cases where firms with inactive licenses attracted investors to unregulated products, resulting in substantial financial losses. Recent data shows that in 2023, the regulator revoked licenses from 1,266 firms for failing to meet minimum authorization standards, indicating a doubled firm cancellation rate compared to the previous year.

In a landscape where financial regulations and firm compliance are crucial, staying informed is essential. To remain up-to-date with broker-related developments like this, leveraging the free WikiFX mobile application and official website is your best option. WikiFX serves as the ultimate destination for all broker-related inquiries and information. By downloading the app or visiting our official website, users gain access to comprehensive and real-time updates, making WikiFX your indispensable tool to navigate the dynamic world of brokers with confidence and clarity. Stay informed, stay empowered with WikiFX!