Global Brokers Expand Into Crypto Trading While Testing Prediction Market Models

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

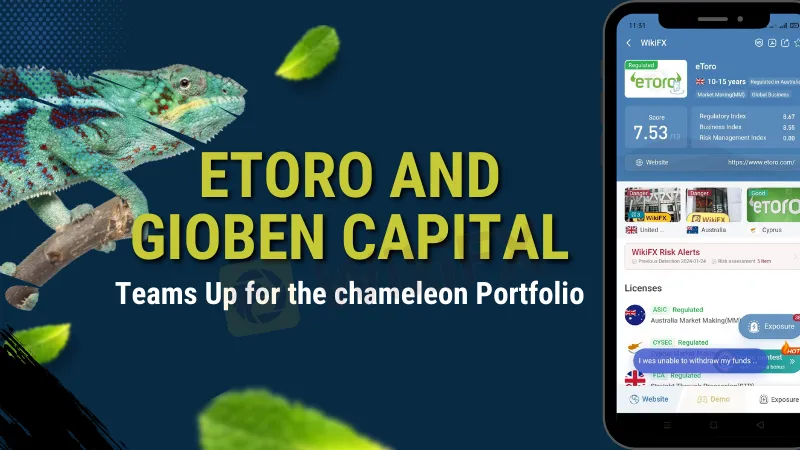

Abstract:Maximize your investments with eToro and Gioben Capital's The-Chameleon Smart Portfolio, blending stocks, bonds, crypto, and commodities for a dynamic, diversified approach.

eToro, a well-known online broker, has introduced its most recent product, The-Chameleon Smart Portfolio. This new solution is the result of a substantial partnership with Gioben Capital, a Chilean Investment Advisor known for its groundbreaking quantitative models, skilled advisory services, and all-encompassing wealth management strategy.

Gioben Capital is renowned for its distinct combination of research, quantitative analysis, innovation, and creativity. These characteristics are central to The-Chameleon Smart Portfolio, making it an exceptional alternative for traders seeking to invest in a diverse variety of assets.

The Chameleon Smart Portfolio, driven by Gioben's patented technology, is an “all-weather” investment. It provides a dynamic mix of stocks, bonds, commodities, and cryptocurrencies that, like a chameleon, adapts to the current economic atmosphere. This flexibility is essential in today's ever-changing business scenario.

Starting your investment journey with The-Chameleon Smart Portfolio is easy and accessible. Traders can begin with a minimum investment of just $500. However, it's important to note that this innovative portfolio is currently not available to users in the United States.

Dive into the Next Generation of Investing

The Chameleon Strategy offers a groundbreaking approach to investment, available exclusively on eToro. It represents a blend of artificial intelligence precision and expert market insights, making it an essential tool for thriving in diverse market conditions.

Mastering Risk Management and Return Maximization

This strategy is particularly focused on managing drawdown risks and maximizing returns, ideal for investors who prioritize the preservation of their capital and seek a buffer against market volatility.

Reinventing the Traditional Portfolio

The Chameleon Strategy deviates from the traditional 60/40 portfolio structure by including crypto assets and alternative investments. This opens the door for a more diverse and forward-thinking investing strategy.

Powered by Proprietary Models

The Chameleon Strategy is underpinned by in-house models, employing advanced algorithms and data analytics. These models are fine-tuned to adapt your portfolio to market dynamics, drawing insights from Macro Weather conditions and trend-following indicators.

eToro's Chameleon Smart Portfolio, developed in conjunction with Gioben Capital, represents a big step forward in the development of investing methods. This portfolio is more than simply an investment product; it's a starting point for a more robust, flexible, and forward-thinking approach to wealth management.

Interested in exploring The-Chameleon Smart Portfolio and mastering the art of modern investing? Visit eToro's dealer page to get started: https://www.wikifx.com/en/dealer/0001283907.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

Failing to transfer funds into or out of your Moneycorp trading account? Have you faced a sudden account closure by a United Kingdom-based forex broker? Has the broker’s customer support service failed to resolve your queries? Did their behavior remain far from good while addressing your queries? You are not alone! Many traders have questioned such alleged trading practices by the broker. In this Moneycorp review article, we have highlighted some of their complaints. Read on!

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.