Abstract:In this article, we will conduct a comprehensive examination of FLAREGAIN. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we delve into a comprehensive examination of FLAREGAIN, aiming to equip you with the necessary information for an informed decision regarding the utilization of this platform.

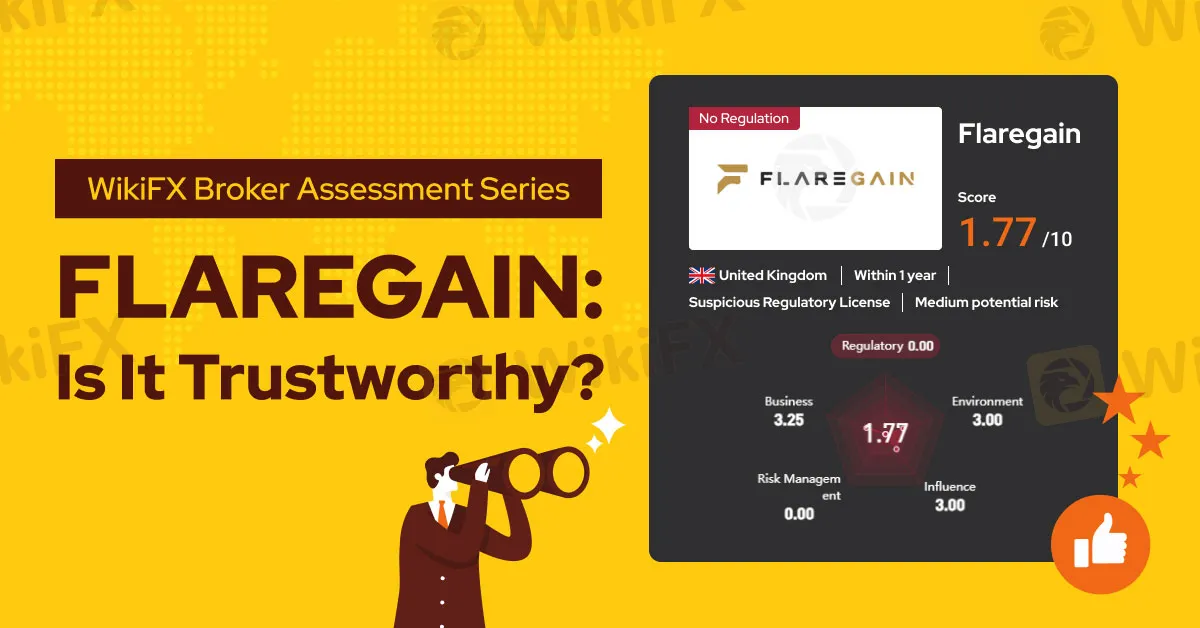

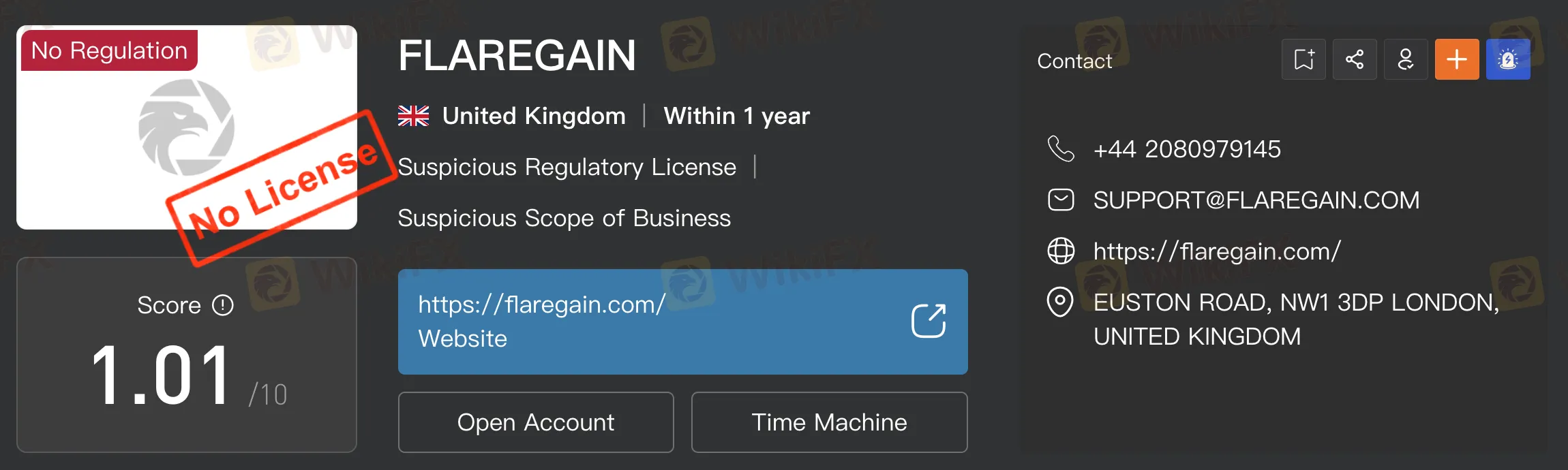

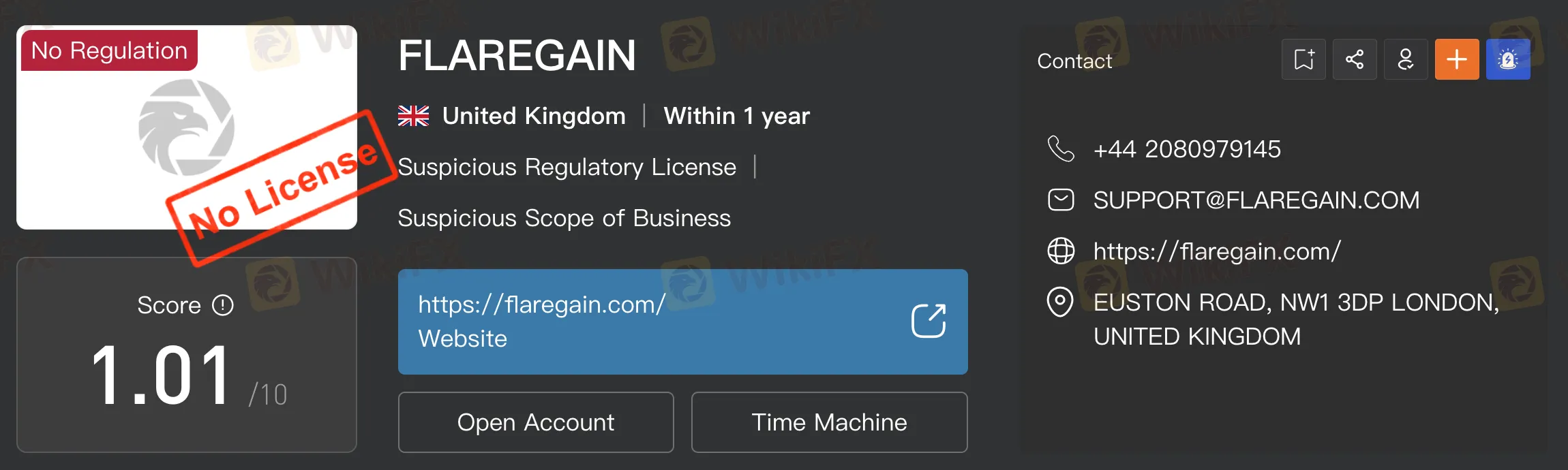

In the realm of online forex trading, the ability to discern potential concerns is crucial, and FLAREGAIN has raised some noteworthy issues. Advertised as a London-based forex broker, the platform lacks a crucial element – a regulatory license. This sets FLAREGAIN apart from reputable competitors, as it operates without the oversight essential for a reliable online trading option.

The absence of a regulatory license poses a significant problem. Regulatory bodies play a pivotal role in ensuring fair practices, establishing standards, and aiding in issue resolution. Without this oversight, traders face potential risks of unscrupulous practices with no proper recourse.

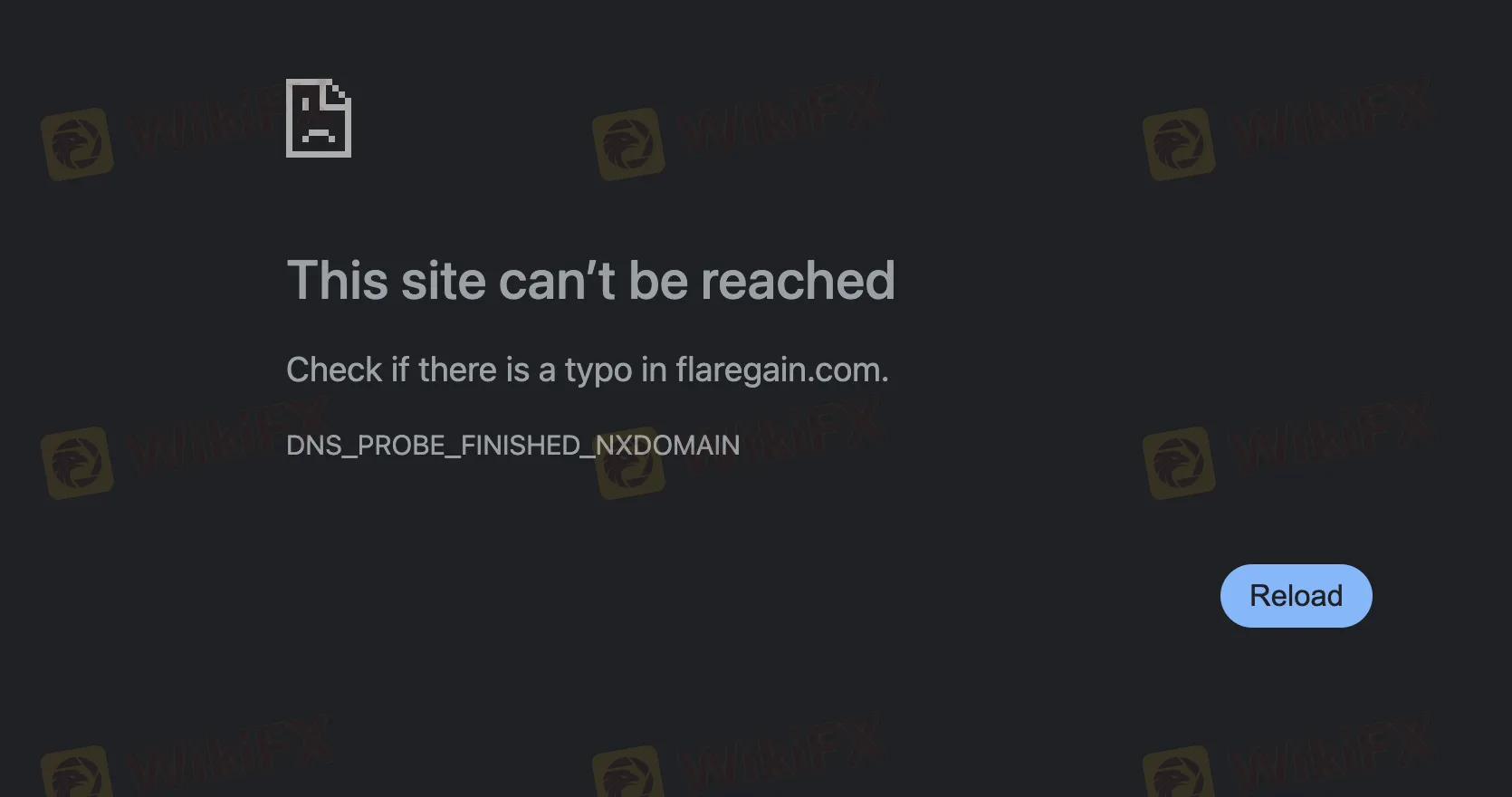

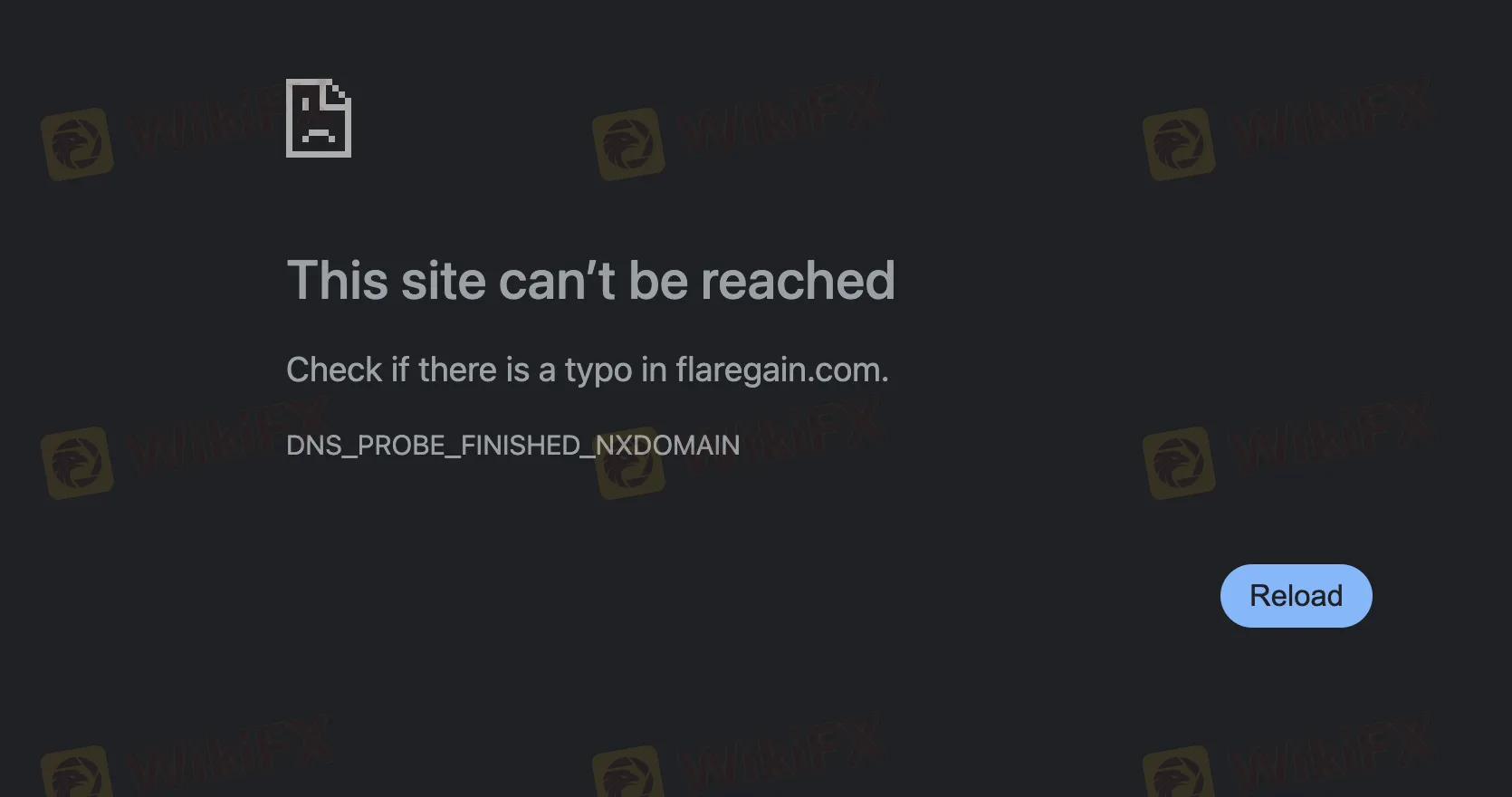

In assessing the legitimacy of a forex broker, the accessibility and reliability of its official website are paramount. FLAREGAIN, however, adds to existing concerns by having its official website, flaregain.com, shockingly unavailable. A trustworthy forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for vital information about services, policies, and regulatory compliance. The unavailability of FLAREGAIN's website not only obstructs potential traders from accessing crucial details but also raises substantial questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden disappearance of FLAREGAIN's website raises red flags, contradicting industry standards. Clients rely on brokers to deliver a secure and informative online environment, and the absence of FLAREGAIN's website disrupts this critical aspect of the client-broker relationship. This unforeseen development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and location of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, FLAREGAIN's missing official website casts doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

FLAREGAIN's position as an unlicensed and non-regulated online forex broker, coupled with the sudden disappearance of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are of utmost importance, FLAREGAIN's current circumstances underscore the significance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.