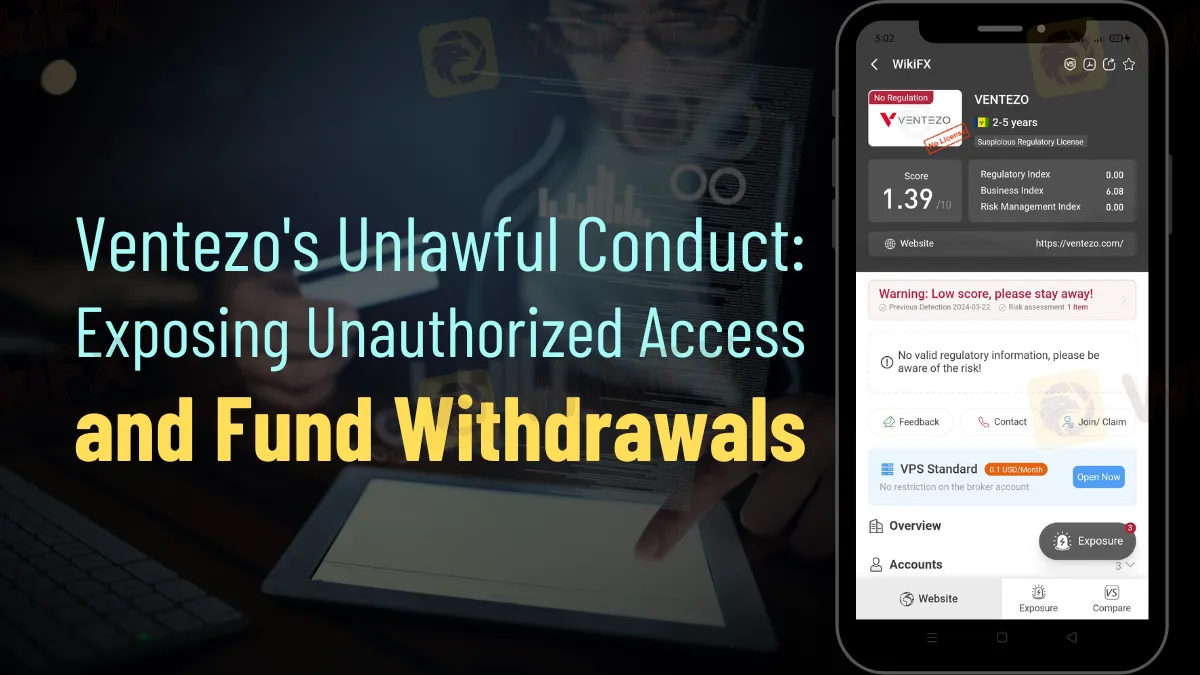

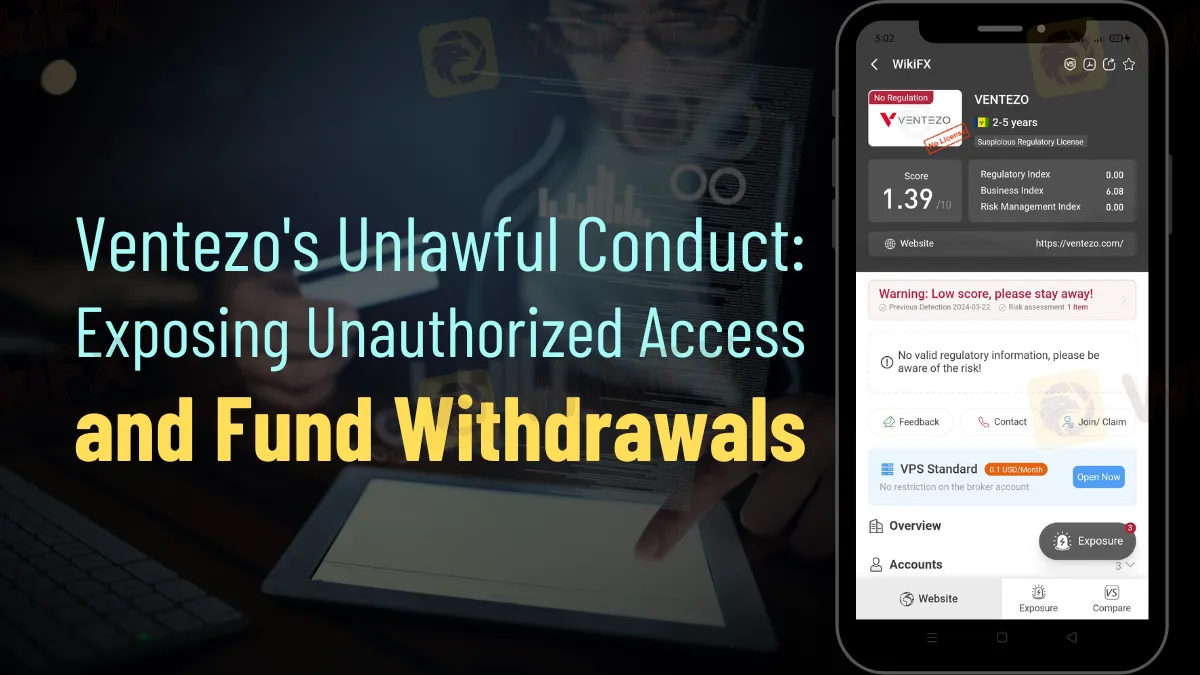

Abstract:Victim exposes Ventezo for unauthorized withdrawal of $851.38, underscoring risks with unregulated brokers in the financial sector.

A Filipino victim has made a shocking disclosure that exposes the questionable activities of Ventezo, a CFD broker that claims to be regulated in Saint Vincent and the Grenadines. This jurisdiction has a poor reputation for regulating trading-related financial activity, including binary options and cryptocurrencies; thus, this assertion is dubious. Potential financial malfeasance and regulatory evasion are an ongoing problem in the industry that becomes apparent from the victim's experience.

The matter in question relates to the unapproved access and withdrawal of cash, namely $851.38, from Ventezo's country manager in the Philippines. On December 6, 2023, the victim got an email notifying them of the completion of a withdrawal—a transaction they had neither approved nor known about until that point—bringing this upsetting episode to light.

Upon the victim's login, it turned out that the withdrawal had occurred against their volition. The unauthorized access and withdrawal of funds constitute a significant breach of trust and demonstrate Ventezo's flagrant disregard for ethical standards and customer security.

Adding to the problem, the victim's brother-in-law was the victim of another fraudulent transaction that included the withdrawal of $637.75, or six hundred thirty-seven US dollars and seventy-five cents. Not only have these acts caused financial damage, but they have also damaged the faith that customers and staff have in financial institutions.

Ventezo ignored and did not say anything when the victim tried to get justice and accountability. After getting vague answers to their questions through the company's chat support, the victim communicated through WhatsApp with Ventezo's owner and CEO, Mr. Ivan Novoselov. They asked for help and an explanation, but unfortunately, they did not get an answer.

To safeguard themselves from unethical activities, investors require stringent regulatory oversight together with solid security measures, as demonstrated in this example. People have doubts about Ventezo's commitment to its client's welfare and the integrity of its business transactions due to its timid and irresponsible management.

The importance of transparency, oversight, and safeguarding consumers in shaping the future of the financial sector is significant. Instances like this highlight the precarious position of consumers and the critical need for regulatory bodies to take prompt action to halt businesses that violate the law and exploit their clients.

Prospective buyers and financiers would do well to take notice of this case since it highlights the importance of conducting thorough research before committing capital to any organization and the risks associated with dealing with brokers who do not possess the necessary licenses. While the plight of the Filipino victim is tragic, it is crucial to recognize that it is indicative of a bigger problem that requires immediate attention if we are to put an end to more instances of exploitation and loss.