WikiFX Invitation Rewards Program

Invite friends and earn points, the more you invite, the more you earn!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Moomoo, established in California in 2018, swiftly became a leading solution for investors' needs, offering professional-grade trading services and data solutions.

In 2022, Moomoo expanded its footprint to Australia, where it introduced intelligent-assisted technology for investment analysis. This innovation earned the platform four prestigious awards from Wemoney. The following year, Moomoo continued its growth by launching its cutting-edge platform in Malaysia and Japan, providing extensive market information, investor education, and interactive community features.

Moreover, Moomoo set its sights on transforming the investment landscape in Canada. The platform aimed to empower Canadian investors with detailed market insights and educational tools, enabling them to navigate the market effectively and capitalize on opportunities.

Moomoo differentiates itself by offering commission-free trading on stocks and ETFs in the United States, Singapore, Hong Kong (SAR), and China. This can be a major advantage for active traders who place a high volume of trades. In addition, Moomoo allows traders to invest in fractional shares of stocks. This can be a good way to invest in expensive stocks or to dollar-cost average into your investments. Although traders on Moomoo do not have direct access to Forex, commodities, or bonds, they can invest in over 3,000 ETFs that encompass these asset classes.

Types of Accounts:

There are no account variants listed on Moomoos website. Therefore, it seems that Moomoo simplifies its operations by offering only one type of trading account, which covers the trading of all the assets provided by Moomoo, with the option to add a margin account.

Deposits and Withdrawals:

Moomoo offers a range of payment options, including bank transfers, FAST, credit cards, debit cards, PayNow, Wise, ACH transfer, and additional methods. While Moomoo asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

Trading Platforms:

Moomoo offers a user-friendly trading platform available on both desktop and mobile devices, featuring streaming quotes, Level 2 market data, customizable charts, technical indicators, fundamental analysis tools, and paper trading.

Research and Education:

While there do not seem to be educational resources found on Moomoos official website, the Moomoo investment community resembles a social media platform such as Facebook or Instagram, allowing users to like and comment on posts and follow discussion threads. Moomoo always provides financial news and market highlights from their editorial team around the clock, as well as an economic calendar for free.

Customer Service:

Moomoo provides customer support through phone, email, and live chat. Representatives are available to assist from Monday to Friday, between 8:30 AM and 5:30 PM EST.

Conclusion:

To summarize, here's WikiFX's final verdict:

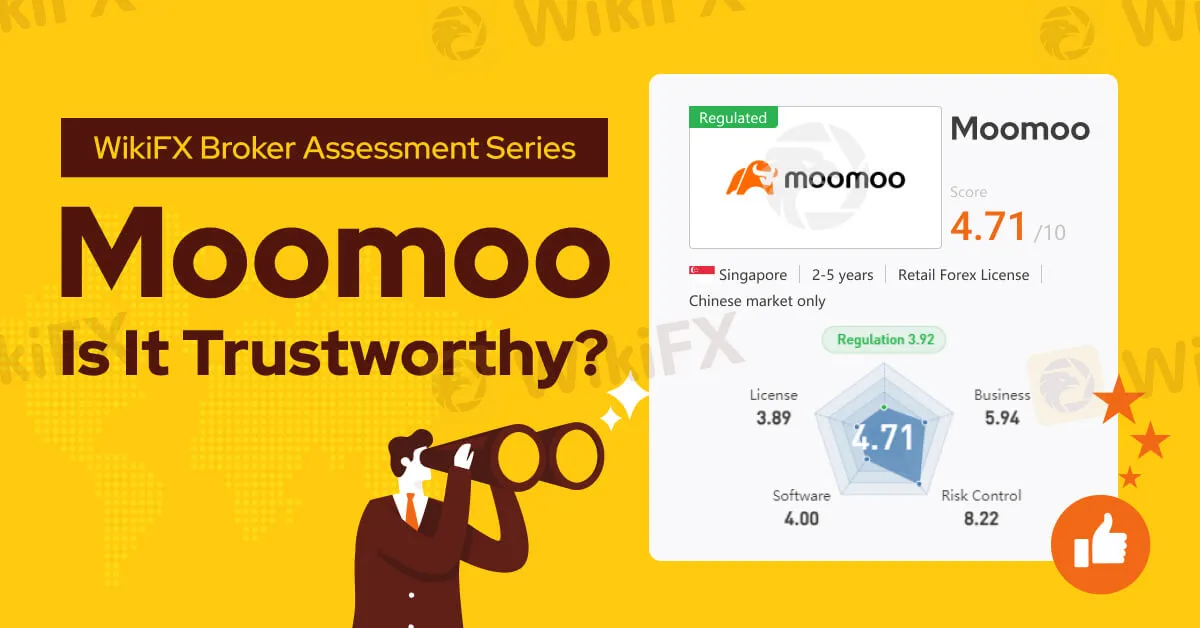

WikiFX, a global forex broker regulatory platform, has assigned Moomoo a WikiScore of 4.71 out of 10.

Upon examining Moomoos licenses, WikiFX found that the broker is regulated by the Monetary Authority of Singapore (MAS) with license number CMS101000.

However, the United States NFA regulation (license number: 0523957) claimed by this broker is suspected to be a clone.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Invite friends and earn points, the more you invite, the more you earn!

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check