Abstract:Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license.

Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license. This prestigious license not only broadens Exness regulatory portfolio but also reinforces its dedication to maintaining the highest standards of client security, regulatory compliance, and market transparency within the South African financial landscape.

Strengthening Client Protection and Trust

The ODP license is a testament to Exness unwavering commitment to client protection. It mandates rigorous risk management protocols and stringent reporting standards, offering clients an additional layer of security in their trading activities. By adhering to these elevated regulatory requirements, Exness continues to solidify its reputation as a trusted broker for local traders, ensuring a secure and reliable trading environment.

Paul Margarites, Exness Regional Commercial Director, highlighted the significance of this achievement:

“The ODP license acquisition signifies a significant stepping stone for Exness in South Africa. Our promise to provide a frictionless trading experience doesn‘t stop at trading conditions and a seamless client journey. Still, it extends to robust safety and security measures that put our clients first. In today’s online trading landscape adherence to the FSCAs stringent standards ensures that our South African clients have an extra layer of peace of mind when trading with Exness.”

Elevating Industry Standards Through Technology and Ethics

Exness is known for leveraging advanced technology and ethical practices to set new benchmarks in the trading industry. The company‘s proprietary platform, renowned for its superior performance and unique market protections, offers clients a seamless and frictionless trading experience. This latest regulatory achievement is a reflection of Exness’ ongoing efforts to create favorable conditions for traders, ensuring that their market interactions are secure, efficient, and transparent.

With the FSCA ODP license, Exness not only enhances its regulatory stature but also reaffirms its dedication to providing top-tier trading services in South Africa. This development is poised to instill greater confidence among traders, further establishing Exness as a leading force in the global financial markets.

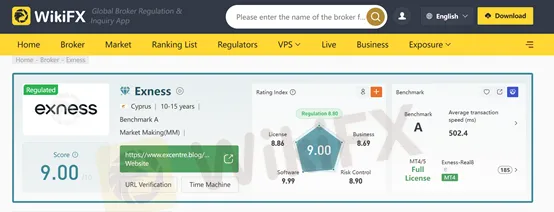

Exness on WikiFX

Exness is a globally recognized forex broker, operating in over 170 countries, offering a diverse range of tradable assets, including currencies, commodities, and cryptocurrencies. With a daily execution of over 300,000 trades and monthly trading volumes exceeding $1 trillion, Exness is a high-volume broker known for its transparency. Regulated by CySEC , FCA FSCA, and FSA in different jurisdictions, Exness adheres to strict financial standards. In this Exness review, we'll explore the broker's offerings in detail to reveal the real exness.