Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

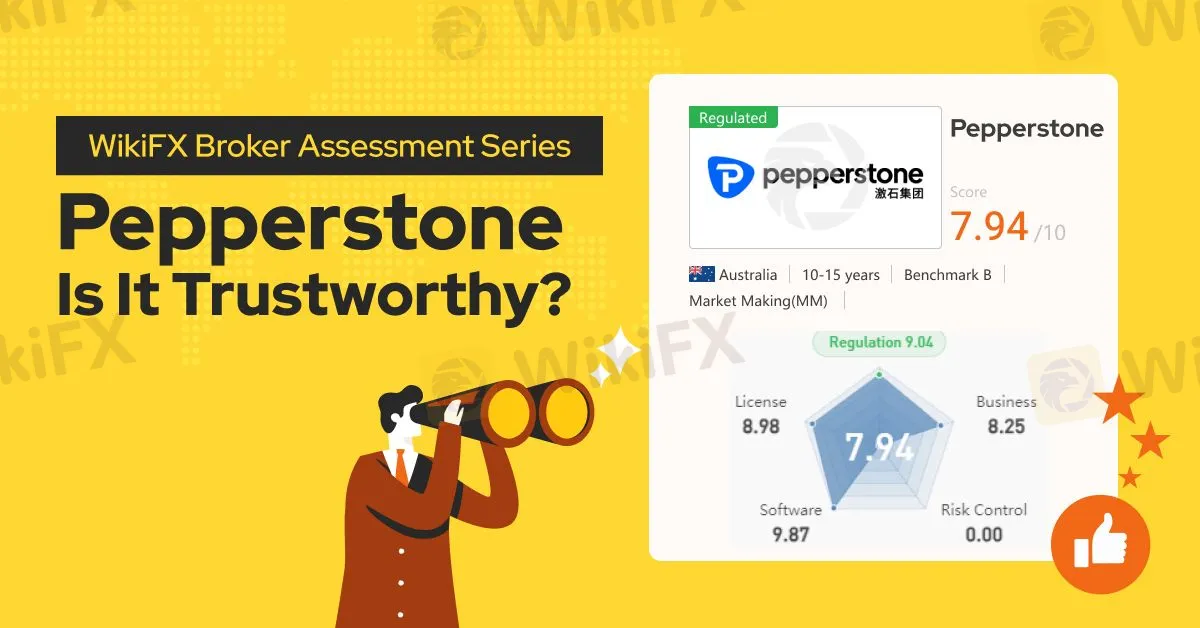

Abstract:In this article, we will conduct a comprehensive examination of Pepperstone, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2010 in Melbourne, Australia, Pepperstone was established by a team of traders on a quest to provide superior technology and low-cost spreads for online trading.

Pepperstone offers a diverse range of over 1,200 tradable assets, including currency pairs, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, and CFD forwards.

Additionally, Pepperstone features several partnership programs for introducing brokers and affiliates to earn commissions by referring new clients to the company, as well as MAM (Multi-Account Manager) services.

Types of Accounts:

Pepperstone offers two account options: the Razor Account and the Standard Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Pepperstone offers a variety of payment options, including bank transfers, Visa, Mastercard, PayPal, Neteller, Skrill, Union Pay, and USDT.

Withdrawal requests received after 21:00 (GMT) will be processed the following day, while those received before 07:00 (AEST) will be processed on the same day.

Due to third-party transaction regulations, funds can only be returned to a bank account registered in the same name (or a joint account) as the Pepperstone trading account.

Any International Telegraphic Transfer (TT) fees charged by the bank are passed onto the client, with most International TTs costing approximately USD $20.

Withdrawals made via Bank Wire Transfer typically take 3-5 working days to reach the clients account.

Trading Platforms:

Pepperstone offers five trading platforms, each designed to cater to the needs of traders at different levels.

Research and Education:

Pepperstone offers a variety of educational resources to support traders at different levels. These resources are available in the form of daily market analysis, videos, webinars, analyst reviews, and trading guides.

Customer Service:

Pepperstone provides 24/5 customer service support in multiple languages, including English, Chinese, Vietnamese, Spanish, Portuguese, Arabic, and Thai. Clients can reach out to Pepperstone via email at support@pepperstone.com or by submitting an inquiry through the broker's question form. Additionally, trading clients have the option to contact Pepperstone by phone at +1 786 628 1209.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Pepperstone a WikiScore of 7.94 out of 10.

Upon examining Pepperstone's licenses, WikiFX found that the broker is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the United Kingdoms Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), and the Securities Commission of The Bahamas (SCB). WikiFX has also validated the legitimacy of these licenses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.