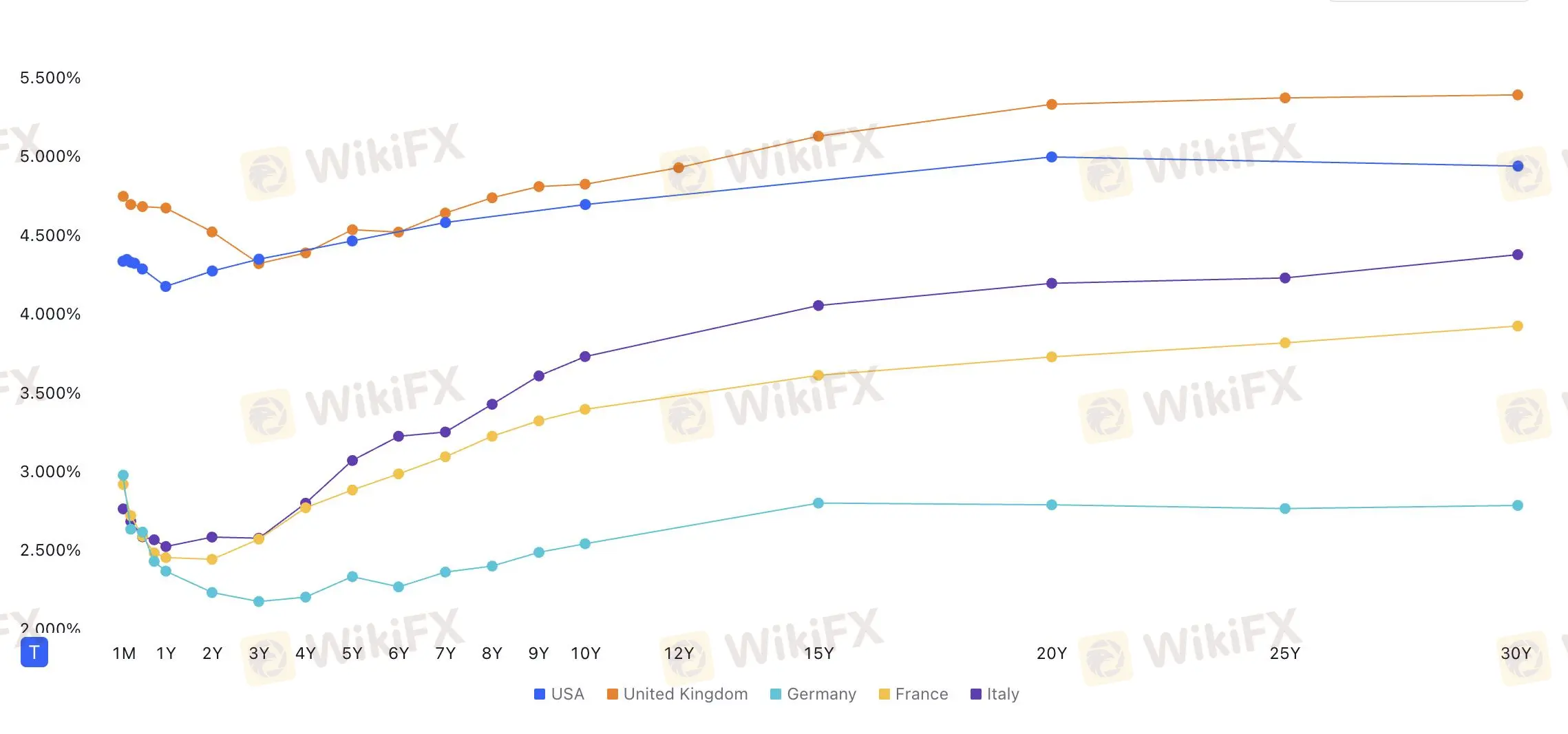

Abstract:Recently, the yield on the U.S. 10-year Treasury bond reached a new high since April 2023, soaring to 4.7%.

The global bond market has experienced a large-scale sell-off. Since mid-September, U.S. Treasury yields have been on an almost continuous rise, increasing by over 100 basis points. This trend mirrors the stock market crashes of 2022 and 2023, when U.S. Treasury yields briefly approached 5%. However, despite the continued rise in bond yields, the stock market has not seen the expected major correction. This may suggest that if yields keep climbing, the stock market could face further downside risk.

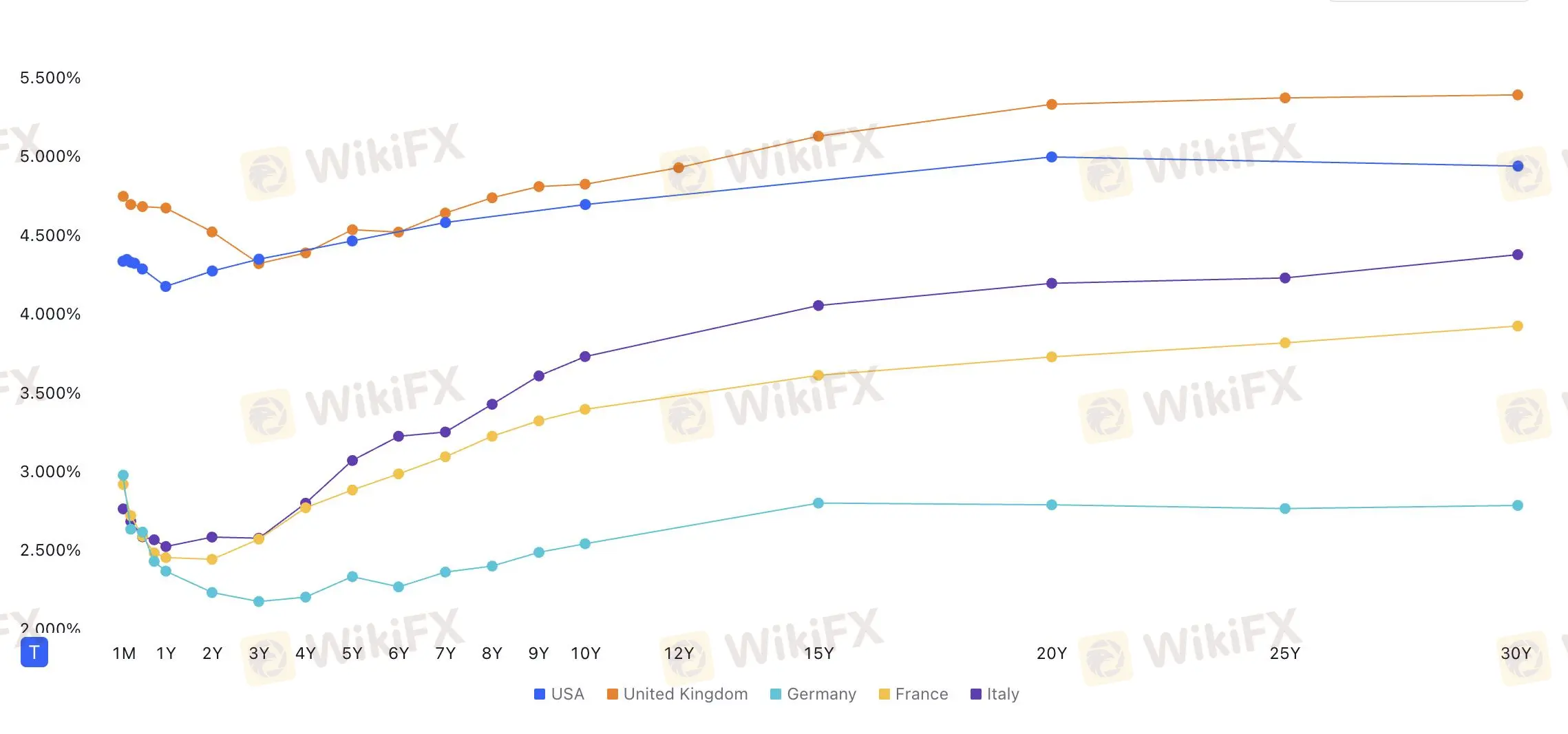

Similar to the U.S. bond market, the European bond market is also in decline. The yield on the U.K. 10-year Treasury bond has hit a new high since 2008, while the 30-year bond yield has reached its highest level since 1998. Although the U.K. Treasury has stated that the bond market is functioning normally with strong demand, the market remains under pressure.

Meanwhile, uncertainty in the European economy is rising, inflationary pressures are gradually increasing, and the economic growth outlook remains bleak, making the situation in the European bond market even more complicated. Weak economic data and concerns about fiscal deficits have left investors uncertain about the future market.

The Federal Reserve's recent stance appears relatively cautious. While the market has re-priced expectations for interest rate cuts, statements from Fed officials indicate that inflation risks remain, and there is limited room for rate cuts in the short term. Fed Governor Bowman mentioned that inflation still poses an upward risk, suggesting that the Fed may maintain a more cautious policy stance in its upcoming decisions. Additionally, differing views on the economic outlook among Federal Open Market Committee (FOMC) members could lead to more policy uncertainty.

Forecast for the Future of the Bond Market

Looking ahead, the bond market may continue to face pressure. According to a Goldman Sachs report, the current rise in U.S. Treasury yields reflects market concerns about U.S. fiscal and inflation risks. If economic data continues to underperform, the bond market could face further selling pressure.

At the same time, the negative correlation between the U.S. stock market and the bond market has increased, which could mean more downside risk for the stock market in the future. Given the uncertainty in economic growth, investors should remain vigilant about future bond market trends.

With high market uncertainty, continued declines in the bond market, and an unclear stock market outlook, investors should exercise caution, particularly considering the interrelationship between the bond and stock markets. Investment decisions need to be made more carefully.

Investors should monitor the trajectory of the U.S. and global economies, assess potential risks with caution, and adjust asset allocations to prepare for potential market volatility in the future.