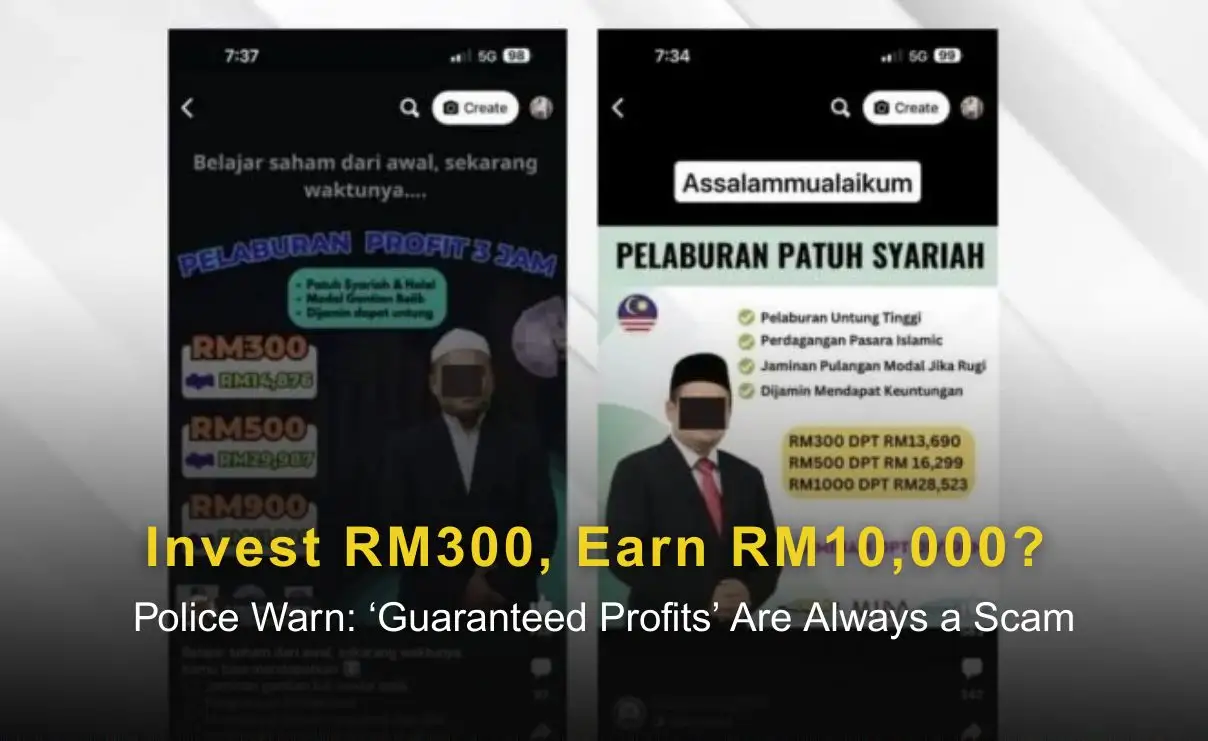

Abstract:A 54-year-old vegetable trader from Tepoh, Kuala Nerus, was scammed out of RM214,700 after falling for a fraudulent investment scheme advertised on Facebook. The victim was lured by promises of quick, high returns with minimal investment

A 54-year-old vegetable trader from Tepoh, Kuala Nerus, was scammed out of RM214,700 after falling for a fraudulent investment scheme advertised on Facebook.

According to Kuala Terengganu OCPD Asst Comm Azli Mohd Noor, the victim encountered the advertisement on December 11 last year and reached out to a man named ‘Zulfikar’ via WhatsApp for further details. She was then directed to another individual who elaborated on the investment opportunity.

The scheme promised lucrative returns—RM30,000 within just three to six hours—with an initial investment of only RM500. Enticed by the offer, the victim proceeded with the deposit. However, she was soon asked to make additional payments to withdraw her supposed profits.

Over time, she made 42 transactions to 16 different accounts, using her savings and proceeds from pawning her jewelry. When the promised returns never materialized, she realized she had been deceived and lodged a police report at 7:24 PM on January 29.

The case is being investigated under Section 420 of the Penal Code for cheating. Authorities urge the public to remain cautious against fraudulent investment schemes.

To protect oneself from such fraudulent schemes, consider the following steps:

- Verify Investment Platforms: Utilize tools like WikiFX, an independent third-party information service platform, to assess the credibility of brokers. WikiFX provides comprehensive details on brokers, including their regulatory status, customer reviews, and safety ratings.

- Be Skeptical of Unrealistic Promises: Exercise caution with investment opportunities that promise unusually high returns with minimal risk.

- Conduct Thorough Research: Before committing funds, research the investment company thoroughly, seek independent financial advice, and consult with licensed financial advisors.

By adopting these measures, potential investors can make informed decisions and protect themselves from falling victim to fraudulent investment schemes.