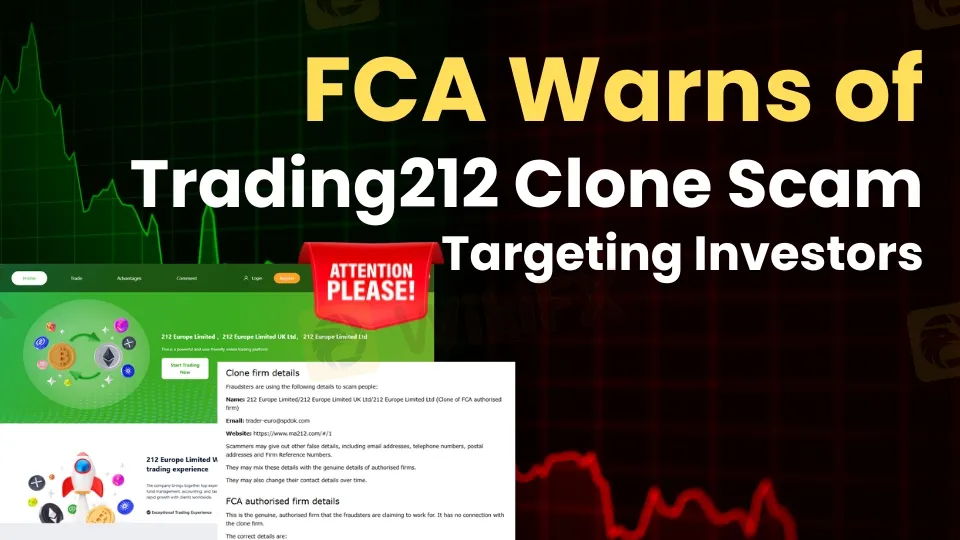

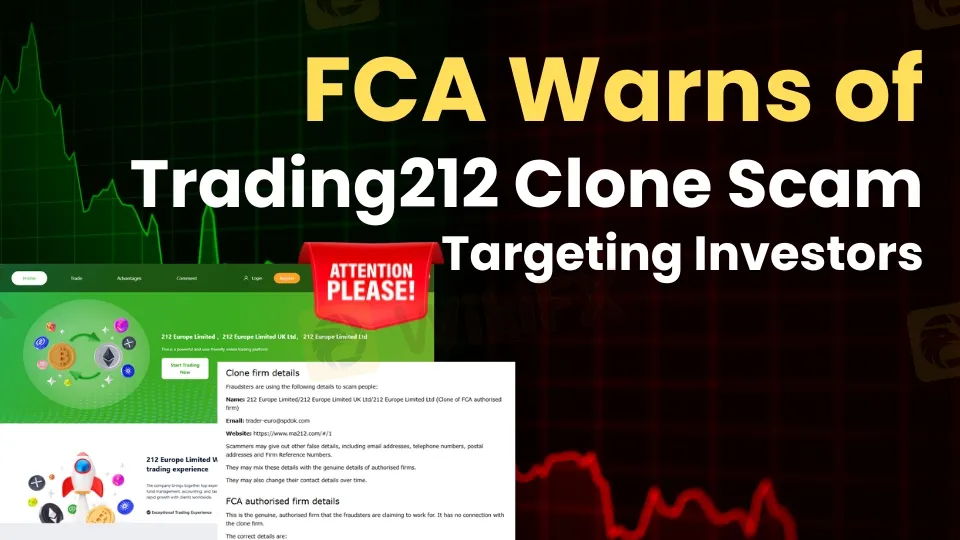

Abstract:FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

The UK Financial Conduct Authority (FCA) has issued a warning against a fraudulent clone firm impersonating Trading212 to scam unsuspecting investors. Fraudsters often create fake companies using the details of regulated firms, including their name, address, website, and branding, to appear legitimate and deceive victims into depositing funds.

Clone Firm Details

The FCA has identified the fraudulent company using the following details:

- Name: 212 Europe Limited/212 Europe Limited UK Ltd/212 Europe Limited Ltd

- Email: trader-euro@spdok.com

- Website: https://www.ma212.com/#/1

Official Trading 212 UK Details

The genuine Trading212 UK Limited is fully authorized and has no connection with the fraudulent clone. Below are the verified details:

- Firm Name: Trading212 UK Limited

- FCA Reference Number: 609146

- Address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX, UNITED KINGDOM

- Telephone: +44 020 3857 1320

- Email: info@trading212.com

- Website: www.trading212.com

Why This Matters

If you unknowingly engage with a clone firm, you wont be eligible for financial protections such as the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS). If the fraudulent firm collapses, your money is likely unrecoverable.

WikiFX database has found several clones of Trading212 that need your attention:

How to Stay Safe

To avoid scams like this, always:

✔ Verify broker details on the FCAs official register.

✔ Be cautious of unsolicited emails or investment offers.

✔ Use the WikiFX app, a trusted platform to verify broker legitimacy and detect fraudulent firms before investing.

About the FCA

The Financial Conduct Authority (FCA) is the UKs regulatory body overseeing financial markets. It ensures firms operate fairly and transparently, protecting investors from fraud and misconduct.

Stay informed, verify brokers, and secure your investments.