Abstract:In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. FXTF is one such firm that has undergone regulatory registration and address verification

FXTF, a Japan-based forex broker, has received a strong WikiScore of 8.49 out of 10 from WikiFX, a global platform that evaluates brokers across multiple criteria. The rating reflects the brokers standing in areas such as regulatory compliance, licensing, trading environment, risk management, and overall business operations.

A key factor contributing to FXTF‘s score is its regulation by Japan’s Financial Services Agency (FSA). As the countrys main financial regulator, the FSA oversees a wide range of financial institutions, including forex brokers. Its responsibilities include supervising service providers, ensuring market stability, and protecting investors, depositors, and policyholders.

FXTF operates under Licence No. 258, which permits the company to offer retail forex trading services. The licence is fully regulated and reflects the brokers adherence to the strict standards set by the FSA. This level of oversight provides clients with assurance that the firm operates within a well-regulated framework.

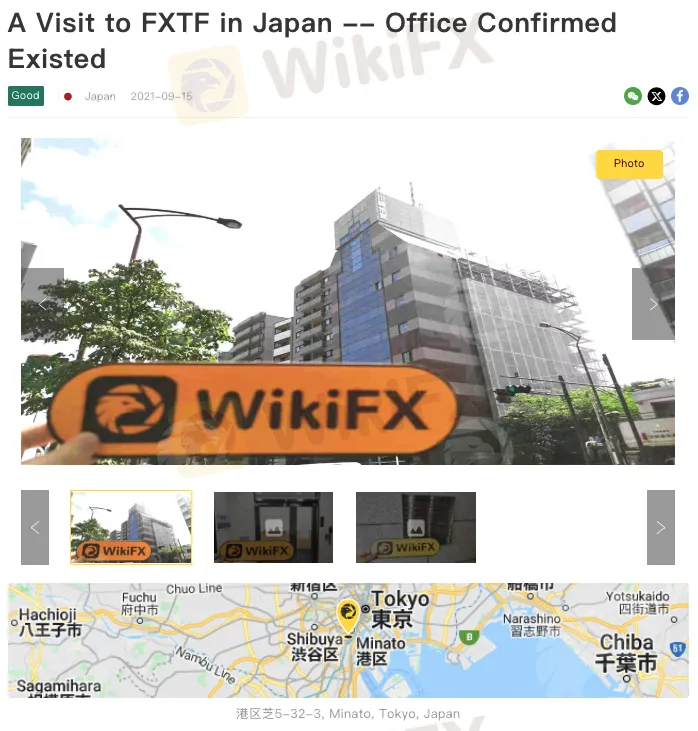

To further verify the broker‘s operational status, WikiFX conducted a field investigation at FXTF’s registered address: the 4th floor of the Mita Kawasaki Building in Minato-ku, Tokyo. The inspection confirmed that FXTF maintains an active presence at the location.

Such physical verifications are an important part of assessing broker reliability. In some jurisdictions, companies may hold valid licences but operate without a physical office, often relying on virtual or placeholder addresses. This can create uncertainty for clients, particularly when dealing with online platforms.

WikiFXs field surveys aim to close this gap by checking whether brokers are genuinely operating from the locations they list. These verifications offer an added layer of transparency, especially for traders choosing between firms that may appear similar on paper but differ significantly in practice.

For investors, knowing that a broker is not only licensed but also physically active at its registered address can provide added confidence. FXTFs confirmed location and strong regulatory standing make it a noteworthy choice for traders seeking a trusted and transparent trading partner.