Abstract:Zero spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

Zero‑spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

IC Markets (Raw Spread Account)

WikiFX Score: 9.10/10

Regulation: ASIC (Australia), CySEC (Cyprus)

Zero‑Spread Feature: Raw Spread accounts start from 0.0 pips on major currency pairs, with an average EUR/USD spread of 0.1 pips. A commission of USD 3.50 per lot per side applies, delivering ultra-tight pricing ideal for scalping and EAs.

Advantages of IC Markets

- Market Connectivity: Aggregates liquidity from 25+ institutional venues.

- Execution Speed: Servers in Equinix NY4 for minimal latency.

Platform Support: MT4, MT5, and cTrader available.

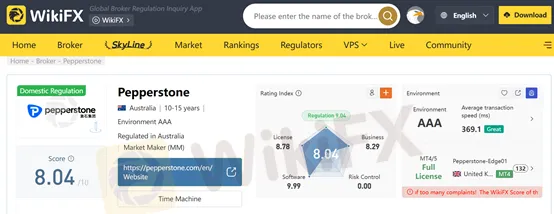

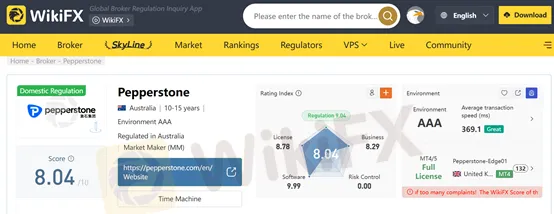

Pepperstone (Razor Account)

WikiFX Score: 8.04/10

Regulation: ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (UAE), CMA (Kenya), SCB (Bahamas)

Zero‑Spread Feature: Razor accounts offer raw spreads from 0.0 pips on forex pairs. Commission-based pricing begins at USD 3.50 per 100,000 units on MT4/MT5, ensuring transparent costs for high-frequency traders.

Advantages of Pepperstone

- Global Footprint: Offices in Melbourne, London, Düsseldorf, and beyond.

- Platform Variety: Native app, MT4, MT5, TradingView, cTrader.

- Volume Rebates: Professional clients can earn commission rebates.

Tickmill (Raw Account)

WikiFX Score: 8.93/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSA (Seychelles)

Zero‑Spread Feature: Raw accounts start from 0.0 pips on major FX pairs, with a commission of USD 3.00 per side per standard lot. Ideal for scalpers and algorithmic traders seeking minimal transaction costs.

About Tickmill

- Fast Execution: Average trade execution in 0.15 seconds.

- Client Safety: Negative balance protection and fund segregation.

Education & Tools: Webinars, calculators, and signal center.

FP Markets (Raw Account)

WikiFX Score: 8.88/10

Regulation: ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), FSC (Mauritius), SCB (Bahamas)

Zero‑Spread Feature: Raw accounts offer spreads from 0.0 pips on major pairs, with commissions starting at USD 3.00 per lot per side. Leverage up to 1:500 enhances flexibility for active traders.

About FP Markets

- Award‑Winning: Voted Best Value Broker six years running.

- Deep Liquidity: Direct connections to top-tier banks.

- Trading Suite: MT4, MT5, cTrader, Iress, and proprietary tools.

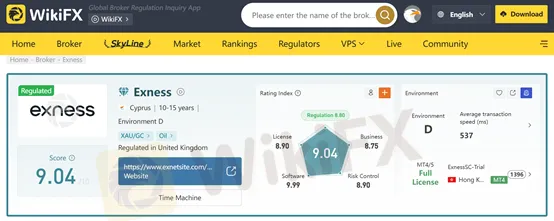

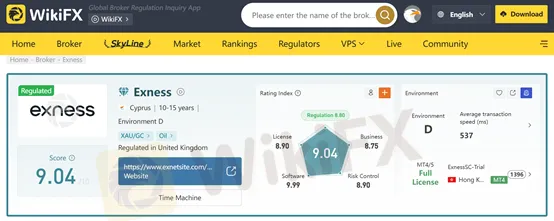

Exness (Zero Account)

WikiFX Score: 9.04/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CBCS (Curacao & Sint Maarten)

Zero‑Spread Feature: Zero accounts deliver 0.0 pip spreads on the top 30 instruments, with commissions from USD 0.05 per side per lot. Market execution with no requotes ensures precision.

Why Choose Exness?

- Unlimited Leverage: Up to 1: Unlimited (subject to local rules).

- Fast Withdrawals: 24/7 automated processing.

Diverse Instruments: Forex, metals, crypto, energies, indices, stocks.

Q&A Section

What are the advantages of a zero‑spread account?

Zero‑spread accounts provide cost certainty, tighter entries, and ideal conditions for scalping and high-frequency trading, as spreads start from 0.0 pips.

Are zero‑spread accounts suitable for beginners?

While the tight pricing benefits all traders, beginners should understand commission models and practice risk management to avoid overleveraging.

Can I use automated trading on zero‑spread accounts?

Yes. All five brokers support EAs and algorithmic strategies on MT4/MT5, with Tickmill and IC Markets offering particularly fast execution.

Conclusion

Choosing a zero‑spread broker with high WikiFX ratings and robust regulation can significantly enhance trading efficiency and risk management. IC Markets, Pepperstone, Tickmill, FP Markets, and Exness each offer compelling zero‑spread accounts.