Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Hantec Financial and its licenses.

Hantec Financial is a forex broker operating under multiple regulatory licenses. It holds a WikiScore of 8.61 out of 10 on WikiFX, a global platform that assesses brokers based on regulatory status, platform performance, and user feedback.

Hantec Financial is licensed in several jurisdictions, including both tier-one and offshore regulatory environments.

In Australia, the broker is regulated by the Australian Securities and Investments Commission (ASIC) under License No. 000326907. ASIC is considered a major financial regulator that oversees financial service providers in Australia.

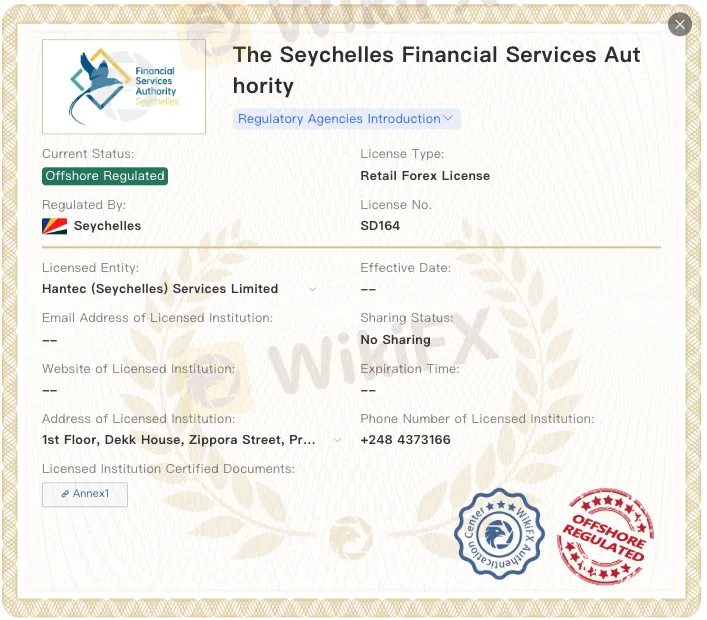

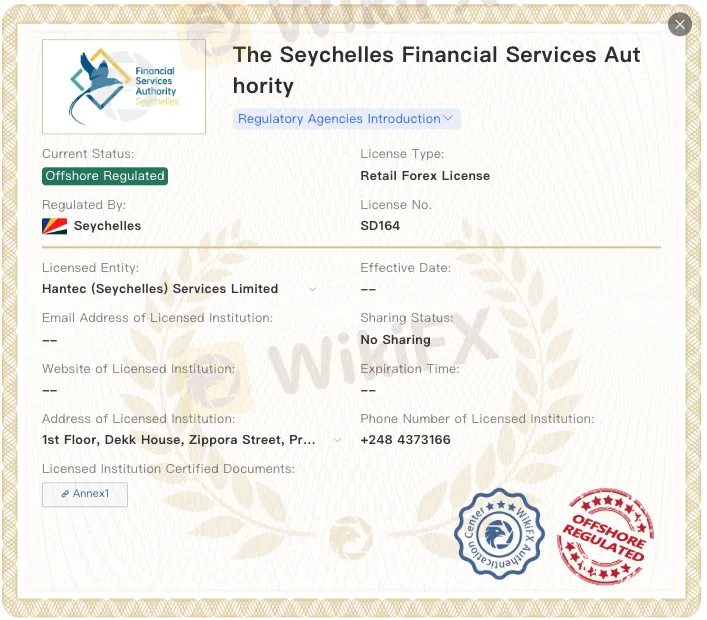

The broker also holds a Retail Forex License issued by the Seychelles Financial Services Authority (FSA), under License No. SD164. The FSA provides regulatory oversight for non-bank financial institutions operating in Seychelles.

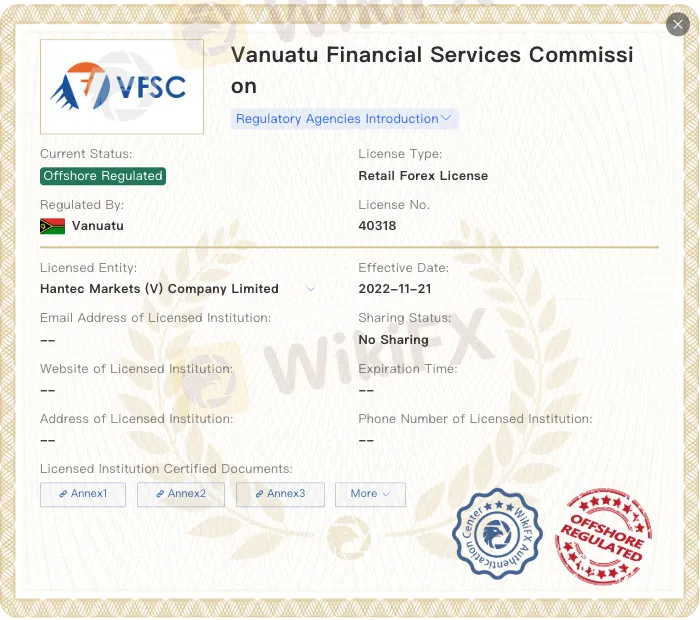

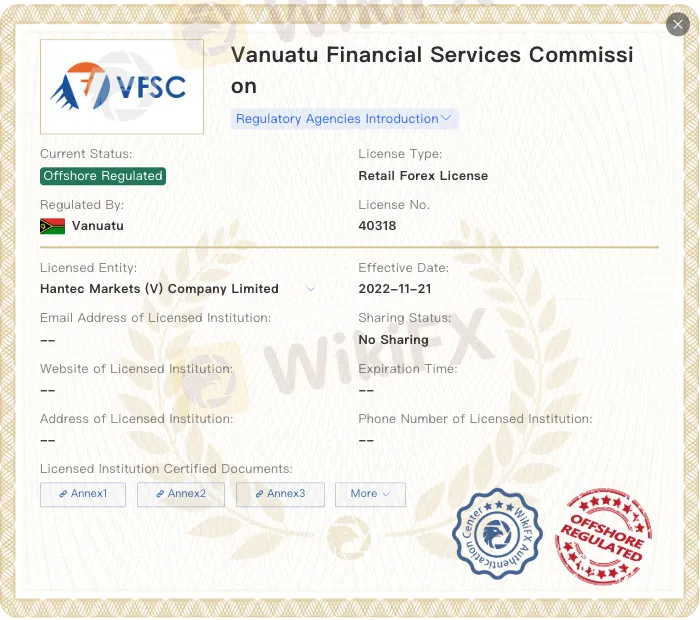

Additionally, Hantec is licensed by the Vanuatu Financial Services Commission (VFSC) under License No. 40318. Like Seychelles, Vanuatu is classified as an offshore jurisdiction and imposes a formal set of requirements for licensed entities.

With both tier-one and offshore licenses, Hantec Financial is positioned to serve a broad international client base. Its ASIC license enables it to operate in highly regulated markets, while its offshore licenses support access to other regions where regulatory requirements may differ.

The brokers WikiFX score of 8.61 is based on factors such as trading environment, platform stability, customer service, and regulatory compliance. The score reflects publicly available information and third-party evaluations.

Conducting due diligence carefully before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.