简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXTM Evaluation Review on WikiFX

Abstract:There are numerous Contract for Difference (CFD) broker platforms, making it difficult to distinguish the good from the bad. This review will introduce my personal experience and compile various publicly available information across several key aspects — including regulatory licenses, fund segregation, available instruments and leverage, spreads and costs, execution speed, platform stability, as well as customer service and education — in order to help you select a safe and efficient trading partner in high-leverage, high-volatility markets.

There are numerous Contract for Difference (CFD) broker platforms, making it difficult to distinguish the good from the bad. This review will introduce my personal experience and compile various publicly available information across several key aspects — including regulatory licenses, fund segregation, available instruments and leverage, spreads and costs, execution speed, platform stability, as well as customer service and education — in order to help you select a safe and efficient trading partner in high-leverage, high-volatility markets.

Disclaimer: This review reflects only my personal experience and does not constitute investment advice. Please approach my review articles with a critical mindset.

Deposit Experience (Score: 4.3/5)

The deposit interface is straightforward and easy to understand. It supports multiple funding methods, including cryptocurrencies, US dollars, euros, and British pounds. Among these, the availability of the BSC-20 smart chain for cryptocurrency deposits is particularly noteworthy, as it helps further reduce transaction fees. Unfortunately, fiat currency deposits are limited to Skrill and credit cards.

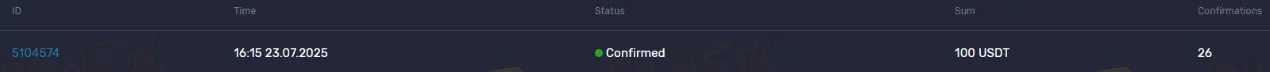

Personally, I made a cryptocurrency deposit at 4:15 PM on July 23rd, and the funds were credited in less than one minute — an extremely efficient process.

Trading Execution (Score: 5/5)

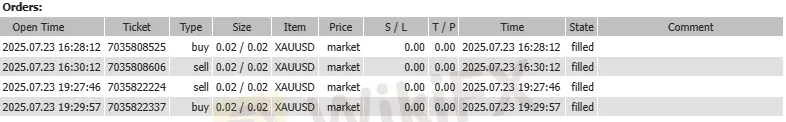

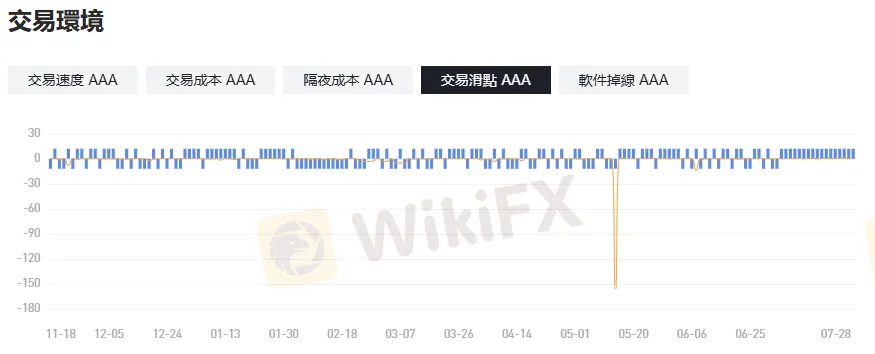

The product I trade is gold. The average spread is around 1 pip, and even during news events that cause significant market volatility, it does not exceed 2 pips. Slippage is very low, with trades almost always executing at or very close to the prevailing bid or ask price. The commission is $8.5 per standard lot.

Customer Service (Score: 5/5)

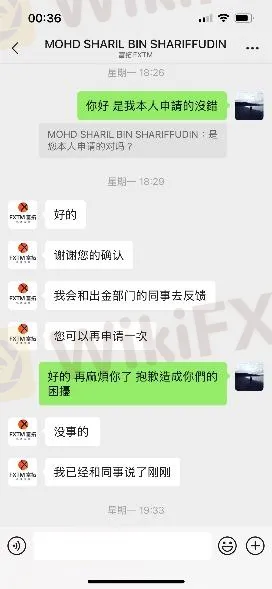

For Chinese-speaking users, the platform provides a dedicated WeChat account manager. The manager is friendly, professional, and communicates efficiently. However, responses are only available on weekdays. For assistance during holidays, users can only reach out via email.

Withdrawal Smoothness (Score: 4.8/5)

For the first withdrawal with this broker, a call will definitely be made from their UK headquarters to confirm whether it is the account holder initiating the withdrawal. If the call is not answered, they will follow up via email to inquire.

In my case, I missed the call and, coincidentally, it was a holiday, which led to the withdrawal failing. However, on Monday, after notifying my dedicated account manager, I resubmitted the withdrawal request at 6:31 PM. The manager contacted me via WeChat one hour later to confirm, and once I approved, the funds were received in my account in less than 15 minutes.

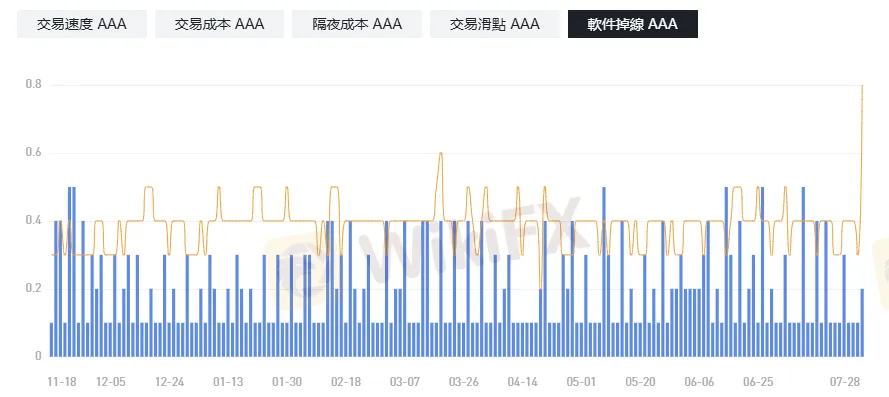

Platform Stability (Score: 5/5)

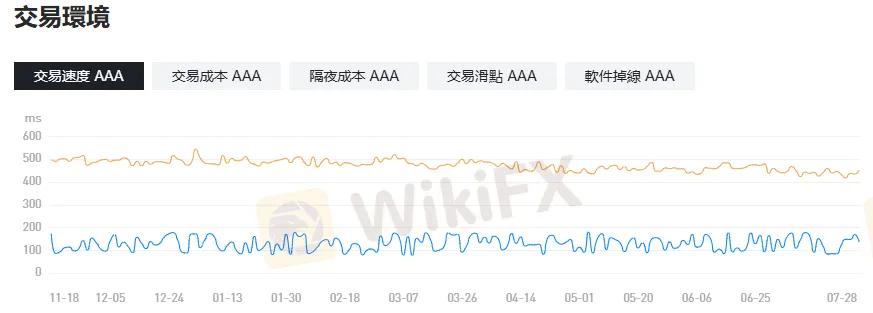

During my usage, the platform operated smoothly without any lag or freezing. When connecting and placing orders via MT5, there was almost no delay. Overall, the performance was excellent.

Mobile App Experience (Score: 4/5)

The app is designed to be simple and user-friendly. On the trading interface, you can quickly access your favorite products by tapping the top-left corner, or directly search for the product you want. However, the app does not have any particularly standout features.

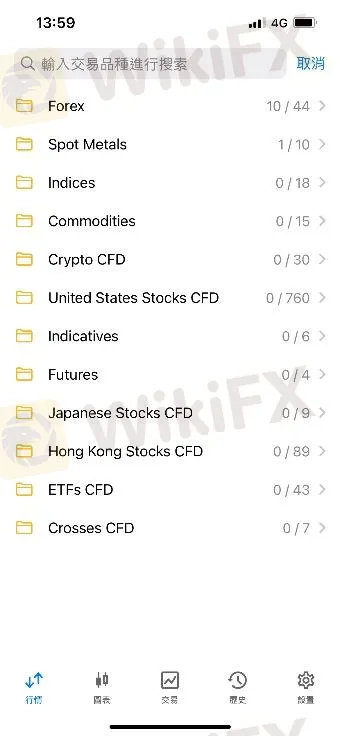

Product & Tool Support (Score: 5/5)

This broker offers a fixed leverage of 1:500 across all account types, which cannot be adjusted. However, the range of tradable instruments is highly diverse, with up to 1,035 available assets. In addition to standard offerings such as forex, commodities, and a wide selection of U.S. stocks, the platform also includes Hong Kong stocks, Japanese stocks, cross pairs, ETFs, and — notably — is among the few brokers that provide both indices and futures.

As for cryptocurrencies, in addition to Bitcoin and Ethereum, the platform supports a variety of major digital assets.

Furthermore, the broker provides a range of commonly used charting indicators, each of which allows for individual parameter adjustments to suit your trading strategy.

Compliance & Security (Score: 5/5)

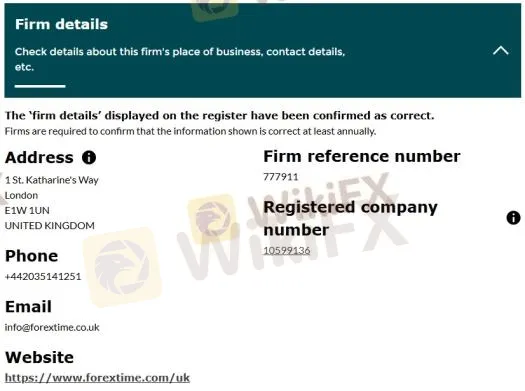

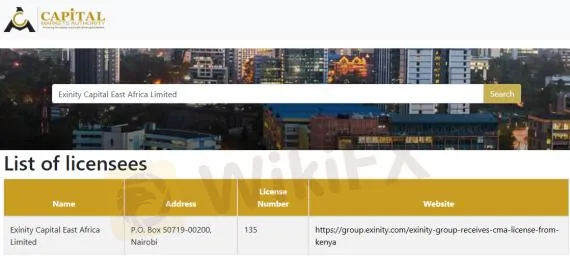

The broker holds a FCA Direct Passport License issued by the UK Financial Conduct Authority (FCA), a Retail Forex License issued by the Financial Services Commission (FSC) of Mauritius, and a Retail Forex License issued by the Capital Markets Authority (CMA) of Kenya. These regulatory credentials demonstrate a strong commitment to compliance and investor protection.

In addition, the entire platform utilizes the SSL/TLS 1.2 secure communication protocol, and applies AES 256-bit encryption at the application layer. Furthermore, no cardholder data is stored on the platform; card details are securely hosted by a PCI-DSS Level 1 certified service provider.

Customer funds are fully segregated from the companys operational capital and are held in multiple top-tier banks in the EU and globally. The broker also partners with the Lloyds Banking Group to provide each client with up to $1,000,000 in compensation coverage through a protection fund.

Additionally, the platform offers a negative balance protection mechanism, which automatically resets any account balance to zero in the event of extreme market movements — such as those caused by global black swan events — ensuring that clients will not incur losses beyond their deposited funds.

Multilingual & Localization Support (Score: 5/5)

The platform primarily offers services in English and Chinese, catering well to a broad international audience.

However, it is important to note that the broker does not provide services to clients residing in the following regions: United States, Mauritius, Japan, Hong Kong (China), Canada, Haiti, Iran, Suriname, Democratic People's Republic of Korea (North Korea), Puerto Rico, Occupied Area of Cyprus, Quebec (Canada), Iraq, Syria, Cuba, Belarus, and Myanmar.

If you are located in or a resident of any of these regions, please be advised that access to the platform is restricted.

Education & Research Resources (Score: 5/5)

FXTM (ForexTime) provides a comprehensive suite of financial education resources designed to support traders at all levels.

For beginners, the platform offers a variety of learning materials including online webinars, trading eBooks, and investment educational videos — ensuring that every trader can acquire essential knowledge in financial investment and build a solid foundation before entering the markets.

For more experienced traders, FXTM also offers advanced online seminars conducted by seasoned market analysts, where you can gain unique market insights, refine your technical trading skills, and enhance overall trading performance.

Overall Satisfaction (Score: 4.9/5)

From the trading environment (ranked second globally), to the wide variety of tradable instruments, and the high-quality customer service — this broker is highly recommended for traders. It is regulated by multiple reputable authorities worldwide, and implements strict encryption and fund protection policies, making it a safer choice for traders.

Thanks to its comfortable trading environment and strong focus on clients in the Asia-Pacific region, I will continue using this broker for my trades and maintain a long-term partnership with them. It is one of the few brokers I personally recommend, especially for new traders.

The brokers educational resources are particularly outstanding compared to many others. In addition to written materials, it offers a wealth of free video tutorials and high-quality lectures by experienced instructors, making it an excellent learning platform for those who are just starting out in trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

Currency Calculator