Abstract:PaxForex Review 2025: Discover if PaxForex is a safe broker or a high-risk option. Get insights on regulation, trading instruments, fees, and leverage.

Finding a trustworthy forex broker can feel like searching for a needle in a haystack—and PaxForex is a name that pops up often on many traders‘ radars. But before you get swept up by any promises, it’s wise to pause and take a hard look at what‘s beneath the surface. Recent insights from WikiFX raise more than a few eyebrows about PaxForex’s credibility and safeguarding of client interests. Right off the bat, PaxForex operates without regulation from any major financial authority. You won‘t find licenses from heavyweights like the FCA, ASIC, or CySEC attached to their name. Instead, the company is based offshore, with its headquarters at First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines. That location is notorious for having minimal oversight, which doesn’t exactly inspire confidence if problems arise or money goes missing.

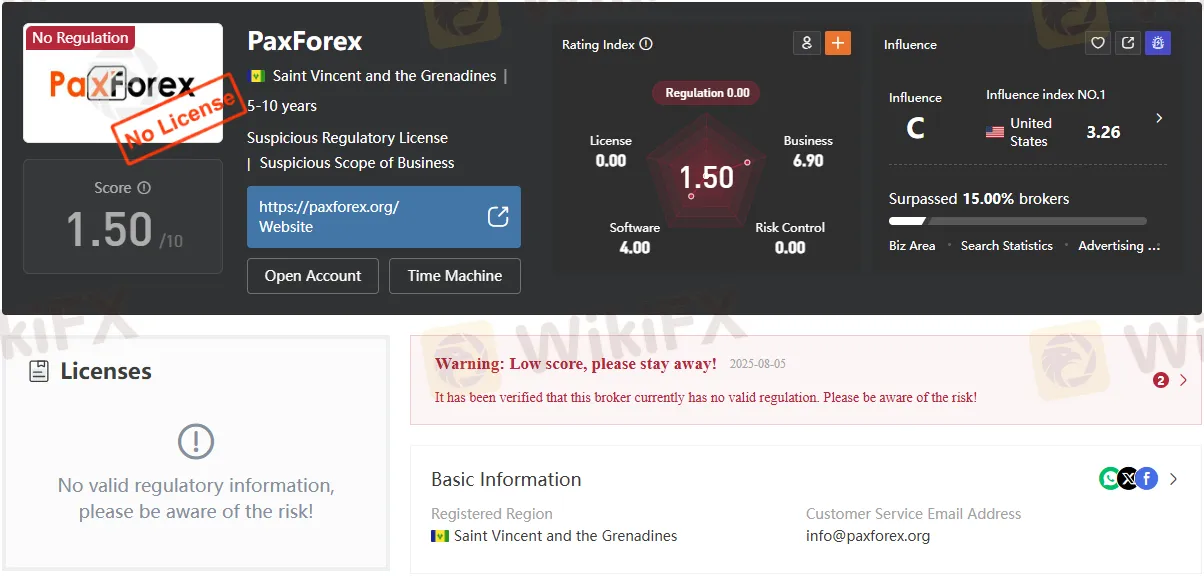

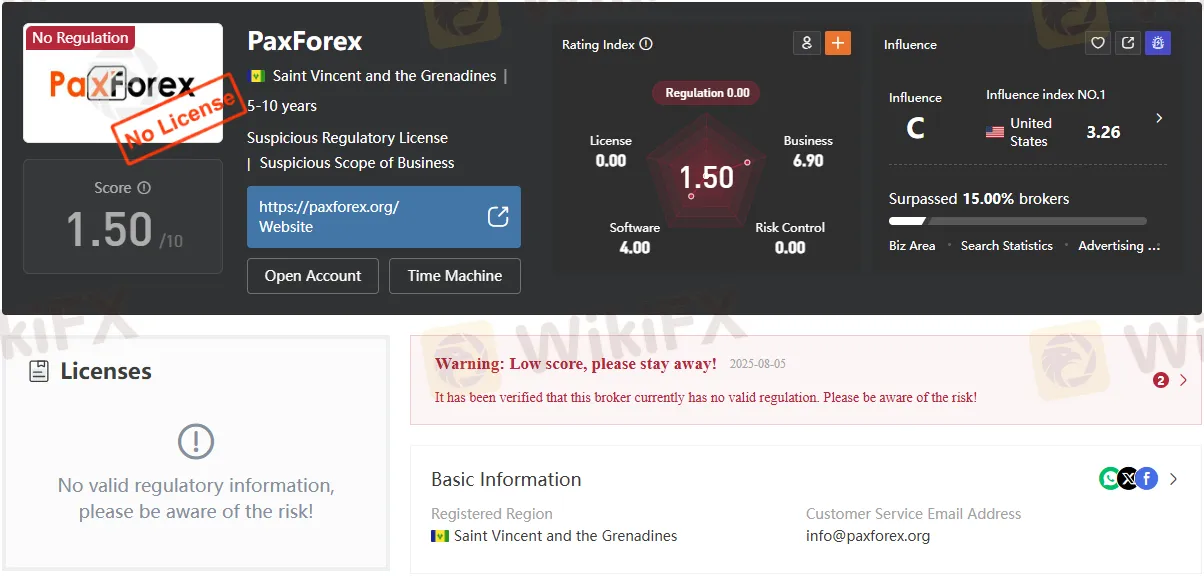

If you‘re the type who puts their trust in independent assessments, consider this: WikiFX—a platform known for its stringent broker evaluations—gives PaxForex a mere 1.34 out of 10. That’s about as low as it gets and serves as a glaring red flag. This underwhelming score comes from multiple factors, including lack of regulation, transparency issues, gaps in software reliability, and overall risk exposure. Plus, user complaints keep coming in, making it hard to ignore the pattern.

Now let‘s talk trading conditions. PaxForex touts a broad array of assets for you to trade: major and exotic currency pairs, precious metals like gold and silver, high-profile market indices, select commodities, and even cryptocurrencies such as Bitcoin. When it comes to account options, there’s a little something for everyone: Cent, Mini, Standard, and VIP accounts—each tailored to different experience levels and deposit sizes. For newcomers or cautious risk-takers, a demo account is available so you can get your feet wet without diving in headfirst.

One feature that jumps out to seasoned traders is leverage—PaxForex offers up to 1:500, which can be a double-edged sword. While it opens doors for potentially larger earnings, it can also usher in steep losses, especially for those still learning the ropes. Spread costs start from 0.4 pips and float according to account type, and most accounts dont charge commission—although more premium account types (like ECN or VIP) might tack on a fee per lot. Be prepared for additional expenses as well, such as overnight swaps, withdrawal fees, and penalties for inactivity, which is par for the course with offshore outfits.

When it comes to trading platforms, clients get access to MetaTrader 4 (MT4)—a favorite in the industry for good reason, offering flexibility across desktop, web, and mobile. PaxForex also pitches some extra goodies, including AlPips trading signals and partnership programs for those interested in introducing brokerage or white-label plans.

All things considered, PaxForex might catch your eye with its wide selection of markets and tempting trading terms, but these perks pale next to the glaring lack of recognized regulation and its offshore paperwork. The persistently low rating and wave of negative feedback on WikiFX should give anyone pause. If youre new to trading, or simply want peace of mind when it comes to your funds, sticking with a well-regulated, transparent broker with a strong reputation is a smarter—and safer—bet. At the end of the day, while PaxForex could suit high-risk takers seeking unusual leverage, most traders are likely better off searching for alternatives with firmer grounding. Before handing over your capital, take your time, dig deep, and make sure your chosen broker truly has your interests at heart.

Dont let a flashy marketing campaign fool you—unregulated brokers can come with serious risks. To stay safe, download the WikiFX app by scanning the QR code below for a quick and reliable verification before you invest.