WikiFX Invitation Rewards Program

Invite friends and earn points, the more you invite, the more you earn!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about XS and its licenses.

XS positions itself as a globally licensed broker, holding authorisations from multiple well-known regulatory bodies. At first glance, the list of licences suggests a commitment to compliance, with recognised authorities such as the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), the Labuan Financial Services Authority, and the Cyprus Securities and Exchange Commission (CySEC) appearing on its records. However, a closer look reveals a mix of fully verified approvals, exceeded licence scopes, and unverified authorisations, raising questions about the brokers overall regulatory strength.

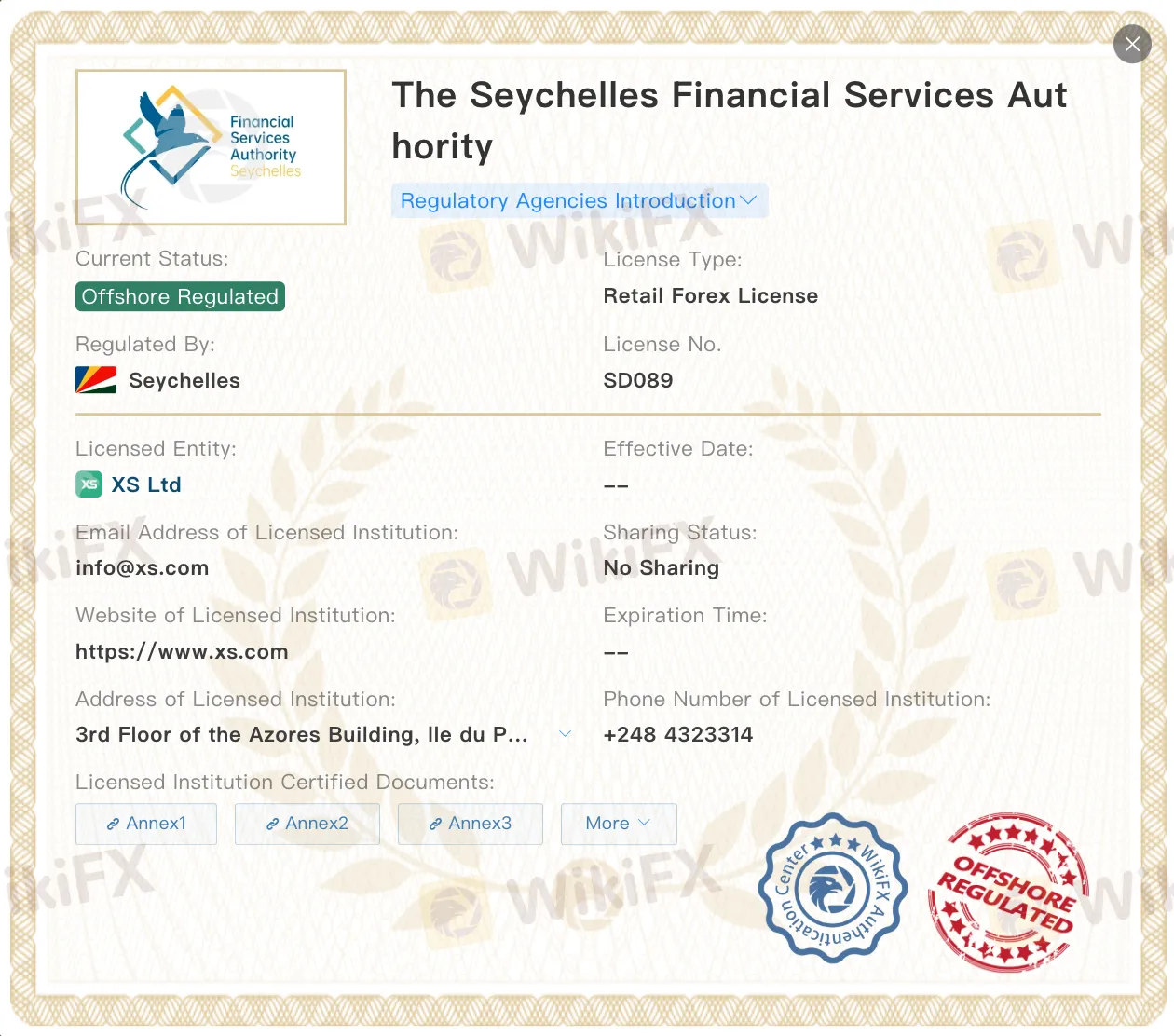

In Australia, XS holds an Institution Forex Licence (STP) under licence number 000374409, issued by ASIC. This is one of the most reputable regulators globally, known for its strict oversight of financial services providers. Similarly, its Retail Forex Licence from the Seychelles FSA under licence number SD089 allows it to operate in offshore markets, and while the FSA does impose certain standards, it is generally considered a lighter-touch regulator compared to ASIC.

XS is also licensed by the Labuan FSA under licence number MB/21/0081, granting it permission to operate under a Straight Through Processing (STP) model in Malaysias Labuan International Business and Financial Centre, which is a mid-tier jurisdiction with defined compliance requirements.

Concerns emerge when looking at the brokers South Africa FSCA licence (number 53199). While the FSCA is a legitimate market conduct regulator, official records indicate that XS exceeds the authorised business scope of its licence. This means the company may be offering services beyond what the FSCA has permitted, which could be an operational risk that traders should not ignore.

Another point of caution is the brokers CySEC licence (number 412/22). While CySEC is a respected European regulator under ESMA guidelines, this licence is marked as unverified, leaving uncertainty about whether it is active, suspended, or still pending full approval.

According to WikiFX, XS has a WikiScore of 6.56/10, a middling score that reflects both the strength of its top-tier licences and the weaknesses from its exceeded and unverified authorisations. For traders, this means that while parts of XSs operations are well-regulated, others operate in a grey area that could affect client protection.

For those considering opening an account, understanding which branch of XS you are dealing with, and under which licence, is essential. Different jurisdictions have different rules for client fund protection, dispute resolution, and operational conduct, meaning your level of safety can vary significantly depending on where your account is registered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Invite friends and earn points, the more you invite, the more you earn!

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check