Abstract:If you are trading with Fortuno Markets, or even just considering it, take this as a serious warning. You may be exposing yourself to significant financial risk.

If you are trading with Fortuno Markets, or even just considering it, take this as a serious warning. You may be exposing yourself to significant financial risk.

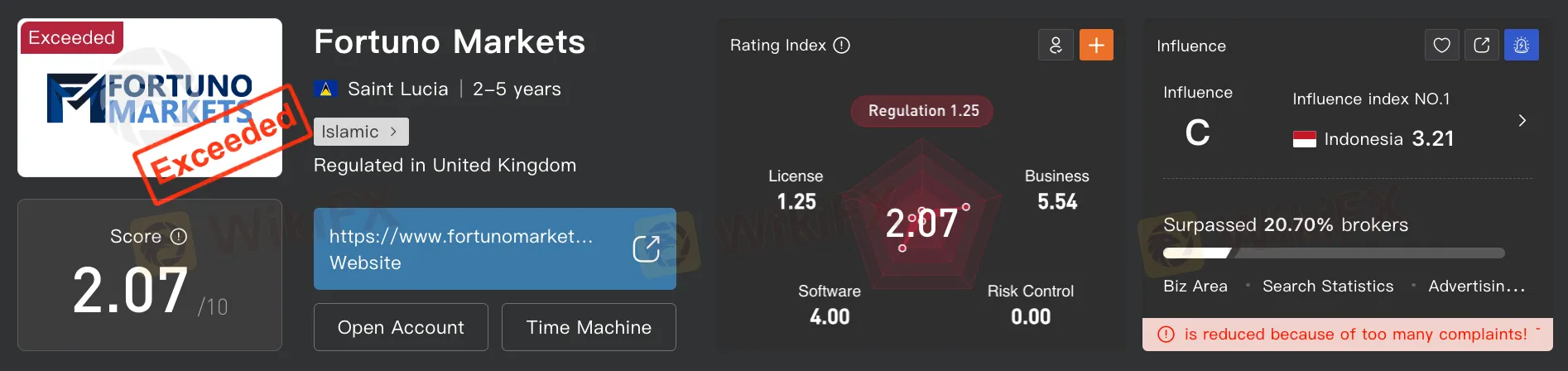

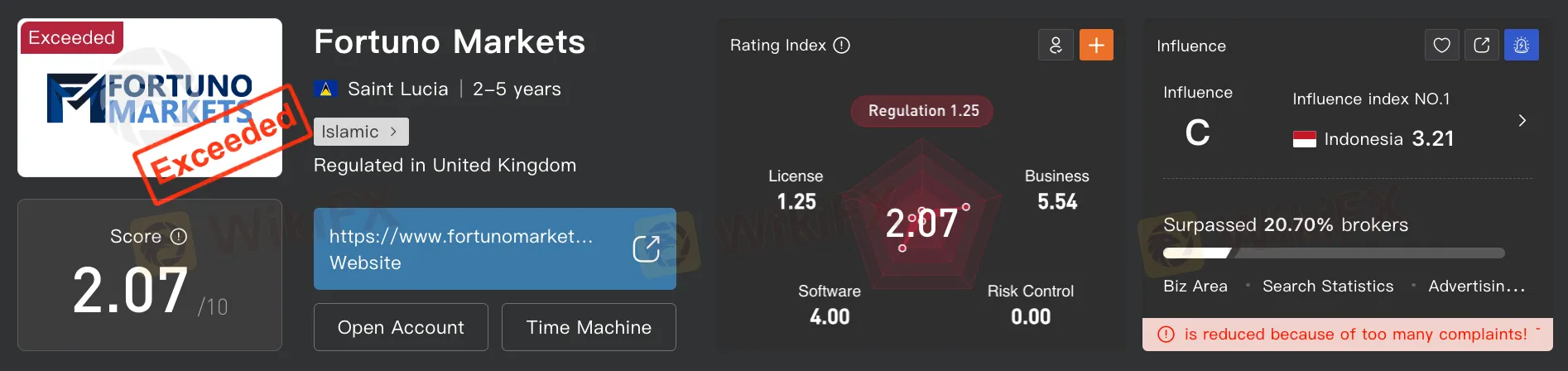

Fortuno Markets, despite claiming registration with the United Kingdom‘s Financial Conduct Authority (FCA) under licence number 15884483, raises serious concerns due to the nature and limits of its authorisation. While the FCA is one of the world’s most respected regulatory bodies, striving to ensure transparency, integrity, and fairness in financial markets, Fortuno Markets is only listed under a Common Business Registration, not a financial services licence. This means the firm is not authorised to offer regulated forex trading services in the UK. Even more concerning, official records indicate that the company has exceeded the business scope permitted by its registration, signalling a direct regulatory red flag.

Further compounding the risk is the brokers registration in Saint Lucia, a jurisdiction known for having no specific regulatory oversight for forex and CFD brokers. While incorporation in such locations is not inherently illegal, it often leaves traders without the protections provided by established financial regulators. In practical terms, this means Fortuno Markets is not subject to the rigorous operational, capital adequacy, and client fund segregation standards enforced in stricter jurisdictions.

The implications of trading with an unregulated or improperly regulated broker are severe. Without adequate supervision, brokers can manipulate trade prices without detection, deny or delay withdrawal requests without justification, lock or delete user accounts without explanation, or even disappear entirely after taking client funds. In these scenarios, affected traders have no governing body to appeal to, no guaranteed investigation, and no legal recourse.

There have also been complaints from traders. One user from Indonesia reported depositing $100 into his Fortuno Markets account, but the funds were never credited. No response was ever received from the broker, and his deposit has effectively vanished.

Another user reported a pending withdrawal request that remains unfulfilled, with no updates provided.

With numerous regulated brokers offering proper investor protection, transparent terms, and legal compliance, there is no reason to put your trust in a company like Fortuno Markets.

Always check a brokers licence, verify their regulatory status, and remember: if a broker is not regulated, your funds are not safe.