Abstract:Unlock your potential with forex trading psychology. Master emotions, trading discipline, and market strategies to achieve consistent success.

Understanding the Mindset of Successful Forex Traders

Forex trading psychology is a key factor in achieving success. It involves understanding and managing emotions during trading.

Successful traders know that emotions often lead to poor decisions and losses.

Developing a strong trading mindset is crucial. It helps traders stay disciplined and stick to their plans.

Mindful trading is about being aware of thoughts and feelings, facilitating improved decision-making and performance.

Market psychology also plays a role. It affects price movements and trader behavior.

Books and resources on trading psychology offer valuable insights into master trading psychology.

Unlock your potential by mastering forex trading psychology. It can lead to greater success and confidence.

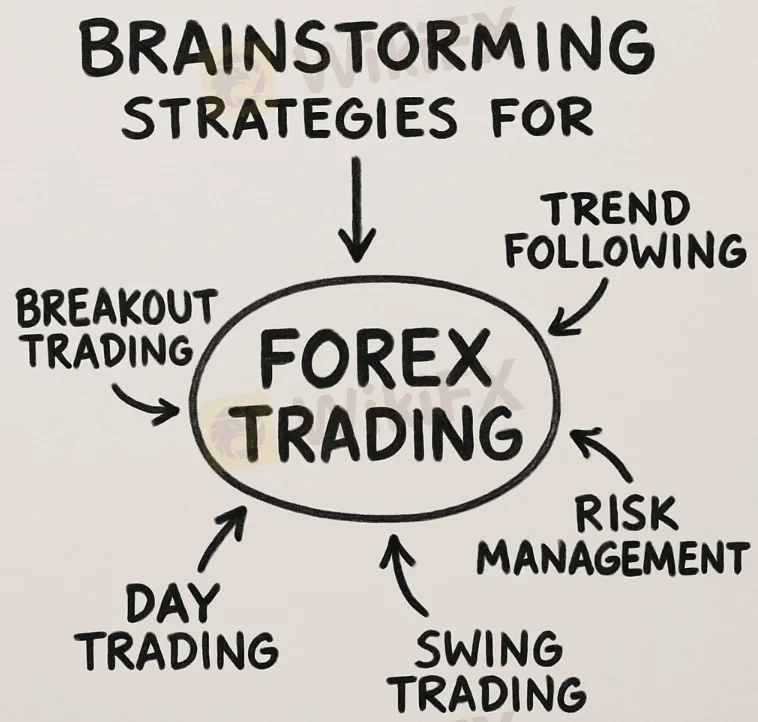

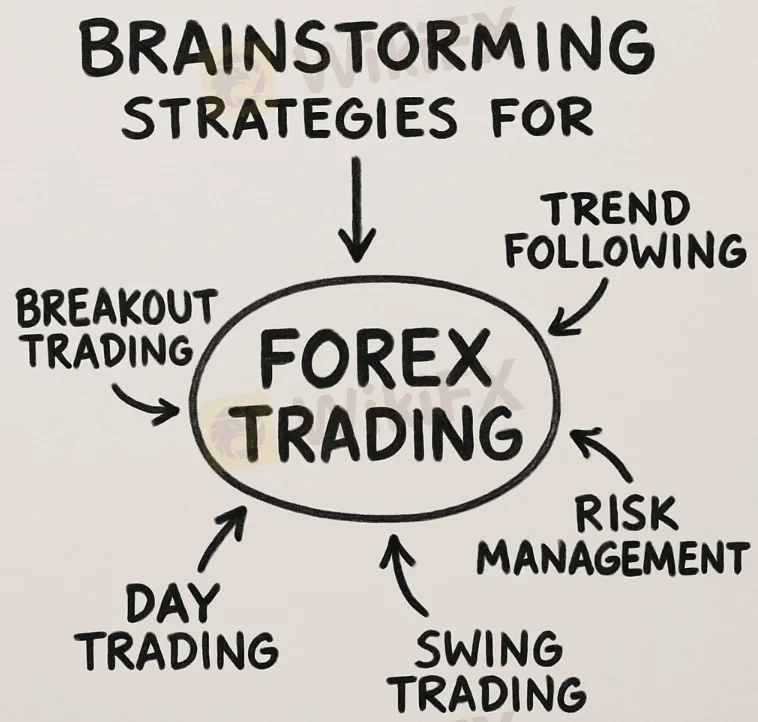

What is Forex Trading Psychology?

Forex trading psychology refers to the mental and emotional factors influencing a trader's decisions. It encompasses traders' behaviors, decisions, and reactions in the market.

Successful traders understand the impact of psychology on their trading performance. They view it as a crucial component alongside technical skills and strategies.

Several aspects define forex trading psychology:

- Emotional control

- Discipline

- Self-awareness

- Risk management

Mastering these components allows traders to manage stress and emotions effectively. A well-balanced psychological state can lead to better focus and decision-making.

Developing strong trading psychology involves identifying and controlling emotional responses. Traders must regularly evaluate their mental state to ensure it aligns with their trading goals.

The Impact of Emotions on Trading Performance

Emotions play a powerful role in trading, often directing decision-making. Understanding their impact can enhance trading results significantly.

Emotional trading can lead to knee-jerk reactions. These responses often cause traders to deviate from their strategies. Recognizing emotion-driven decisions is crucial for maintaining discipline.

Trading psychology underscores the importance of controlling emotions like fear and greed. These emotions can lead to large financial swings, translating to either losses or gains.

Key emotions impacting trading include:

- Fear

- Greed

- Anxiety

- Overconfidence

Developing emotional intelligence is vital. It involves identifying, understanding, and managing emotional responses to foster a stable trading environment.

Practicing mindful trading helps traders focus on current market conditions and reduces emotional influence, leading to more rational decisions.

Common Psychological Challenges in Forex Trading

Navigating the forex market involves more than technical and fundamental analysis. The reason is that psychological hurdles can significantly impact trading outcomes.

Traders often encounter challenges that stem from deep-seated emotional responses. Overcoming these is crucial for sustained success.

Some common psychological challenges include:

- Fear of losses

- Greed for more profits

- Overtrading

- Inconsistent discipline

Fear and greed, often dubbed “the twin forces,” can skew perceptions and lead to irrational choices. Balancing these emotions is essential to keep thriving in a dynamic forex market.

Overconfidence may make traders underestimate risks. Impulsiveness can lead to actions without analysis. Both issues can deplete trading accounts swiftly.

Cognitive biases, such as confirmation and anchoring, distort decision-making. Recognizing these biases and overcoming these help improve judgment.

Addressing these challenges requires self-awareness and continuous learning. Developing specific strategies based on these can mitigate their impact, leading to improved consistency.

Fear and Greed: The Twin Forces

Fear and greed are common emotional challenges in forex trading. They drive traders to extreme actions. Managing these emotions is vital for success.

Fear can lead traders to exit positions too early, missing potential gains. Greed often pushes traders into risky trades.

To manage these emotions, traders should:

- Develop a solid trading plan

- Set realistic profit and loss targets

- Use stop-loss orders

Recognizing signs of fear and greed allows traders to adjust their behavior, leading to improved trading performance.

Overconfidence and Impulsiveness

Overconfidence, which stems from a few successful trades, often pushes traders to potential risks and disastrous consequences.

When traders act impulsively, they overlook critical analysis. This behavior often results in poor decision-making.

To counteract overconfidence and impulsiveness:

- Reflect on past trading experiences

- Maintain a trading journal

- Regularly review and update strategies

Implementing these practices helps maintain a balanced perspective. This approach ensures logical and rational decisions, leaving out emotions.

Cognitive Biases in Trading Decisions

Cognitive biases are mental shortcuts that often cloud judgment. Traders are not immune to these biases, affecting their decisions.

Confirmation bias leads traders to favor information that supports their views. It results in overlooking critical contrary data.

Anchoring bias raises reliance on initial information. This leads traders to stick to initial forecasts despite new evidence.

To combat cognitive biases:

- Question assumptions regularly

- Stay open to alternative viewpoints

- Continuously educate oneself about market dynamics

Being vigilant about cognitive biases leads to more objective trading decisions. This awareness can significantly enhance trading success probabilities.

Building a Strong Trading Mindset

A strong trading mindset is crucial for thriving in the volatile forex market. It defines a trader's ability to handle stress and adapt swiftly.

To build a resilient mindset, traders must cultivate a mix of psychological traits and skills. This blend can significantly impact trading success.

Key elements in developing a robust trading mindset include:

- Emotional control

- Consistent discipline

- Flexibility

Emotional control is foundational, helping traders stay calm under pressure. Discipline ensures adherence to a strategic trading plan, minimizing impulsive trades.

Flexibility allows traders to adapt to market changes, ensuring they make informed decisions. Balancing these factors is vital for long-term trading success.

Developing Trading Discipline

Trading discipline is the backbone of consistent success. Achieving it requires dedication to following a set plan and resisting spontaneous urges.

Maintaining discipline involves strict adherence to predetermined strategies. Traders must avoid the trap of diverting from their plan in the heat of the moment.

To foster discipline, consider these tactics:

- Set defined entry and exit points

- Stick to your trading routine

- Review and refine strategies regularly

These practices create a structured environment for decision-making. By internalizing them, traders can avoid emotional deviations and enhance their profitability.

Mindful Trading: Staying Present and Focused

Mindful trading centers around staying aware and focused amid market chaos. It involves observing thoughts and emotions without immediate reaction.

Practicing mindfulness can lead to improved decision-making. With this, traders can efficiently manage stress and avoid knee-jerk reactions.

To achieve mindful trading, try these approaches:

- Practice meditation before trading sessions

- Take breaks to refocus

- Engage in breathing exercises

Mindfulness reduces emotional responses, fostering calmness and clarity during trading. This approach supports maintaining a clear perspective on market movements.

Psychological Strategies for Consistent Success

Successful trading requires not only technical skills but also psychological strategies. Traders must integrate mental techniques to sustain success.

One key strategy is maintaining emotional equilibrium. Keeping calm helps make rational decisions amid a fluctuating market.

Additionally, mental preparation is essential to handle unexpected market shifts. Prepared traders can quickly adapt, shielding themselves from panic.

Implement these strategies for consistent success:

- Regular mental exercises

- Visualization techniques for confidence

- Stress management practices

Each method can enhance focus and sharpen decision-making capabilities. By strengthening psychological resilience, traders can navigate markets confidently.

Setting Realistic Goals and Managing Expectations

Setting realistic goals is essential for trading success. Unrealistic targets can lead to frustration and impulsive actions.

To manage expectations effectively, traders should:

- Assess personal skill levels

- Consider current market conditions

- Set achievable and measurable goals

Clear goals prevent overtrading and maintain motivation. By understanding personal limits, traders can strive for steady improvements without undue pressure.

Journaling and Self-Reflection

Journaling is a powerful tool for understanding trading behavior. Keeping a journal helps track decisions and outcomes.

Through regular self-reflection, traders can identify patterns and biases. This practice leads to better decision-making and strategy adjustments.

Implement journaling practices like:

- Daily trading logs

- Periodic performance reviews

- Noting emotional states and reactions

Continual reflection promotes growth and keeps traders grounded in reality.

Risk Management and Emotional Control

Risk management is crucial for any trader aiming to preserve capital. It's about making informed decisions to minimize potential losses. Emotional control plays a significant role in effective risk management. By mastering emotions, traders can avoid rash decisions that can lead to losses.

Key practices for managing risks include:

- Setting stop-loss orders

- Defining risk-to-reward ratios

- Diversifying trading portfolios

These strategies ensure that traders stay calm and rational. By managing emotions and risks, traders can maintain their financial stability even during volatile market conditions.

Resources for Mastering Forex Trading Psychology

Mastering forex trading psychology requires access to diverse resources - books, courses, and online communities. These can offer valuable insights and support.

Consider diving into trading psychology books for in-depth understanding and strategies. These books often cover topics like emotional control and trading discipline. Some recommended resources include:

- “Trading in the Zone” by Mark Douglas

- Courses on mindful trading techniques

- Trading forums and support groups

Using these resources, traders can enhance their psychological skills and tailor their forex trading strategies for successful outcomes.

Conclusion: Unlock Your Potential with Forex Trading Psychology

Understanding forex trading psychology can transform your trading journey. It enables you to make informed decisions and manage risks effectively.

By mastering your emotions and biases, you strengthen your resilience against market uncertainties. This foundation helps build a robust trading mindset and achieve consistent results.

Continuous learning and self-awareness are crucial in this process. Embrace challenges as opportunities to grow. Implementing psychological strategies can unlock your true potential, turning psychological struggles into strengths. As you harness the power of trading psychology, your path to success becomes clearer and more attainable.