Abstract:Are FXCL officials calling you to make you a customer by promising a magical profit number? Stop! These officials follow this route to onboard customers and make them deposit at regular intervals. However, when you wish to withdraw, the officials will deny your request. This is nothing but a strong indicator of a scam forex broker. In this article, we will expose the wrongdoings of this Botswana-based broker.

Are FXCL officials calling you to make you a customer by promising a magical profit number? Stop! These officials follow this route to onboard customers and make them deposit at regular intervals. However, when you wish to withdraw, the officials will deny your request. This is nothing but a strong indicator of a scam forex broker. In this article, we will expose the wrongdoings of this Botswana-based broker.

Top Complaints Against FXCL

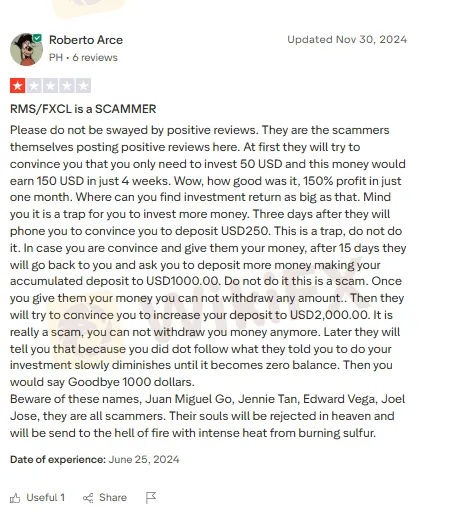

FXCL Promises Too Good to be True Returns

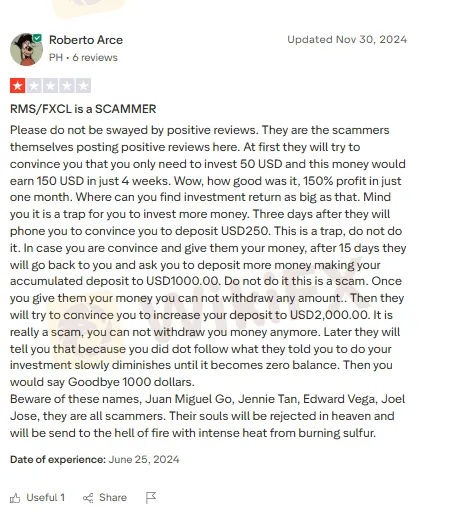

Pitching too good to be true returns to the customers and getting their nod is becoming regular with FXCL. It can even promise 150% returns in four weeks and makes traders deposit a substantial amount. However, nothing of that sort prevails in real-time as the capital does not grow the way as proposed. Check this trader complaint that drew our attention.

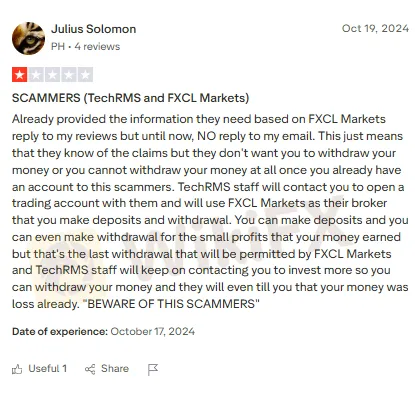

Tons of Pending Withdrawal Claims

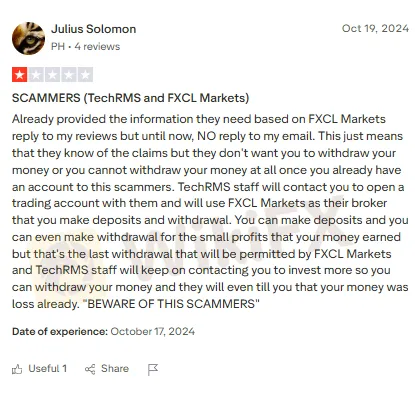

FXCL has received tons of withdrawal claims from traders who constantly email the same to the broker. However, the company officials do not react to these emails. Their non-committal approach indicates a lack of care for traders and their hard-earned capital. It ultimately leads to a scam. Here is one strong complaint against FXCL.

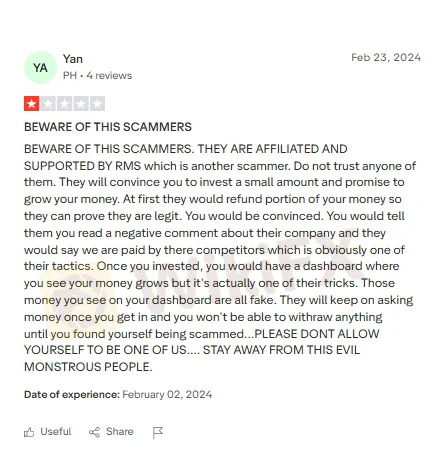

Allowing a Small Withdrawal Earlier is a Tactic to Defraud Investors Later

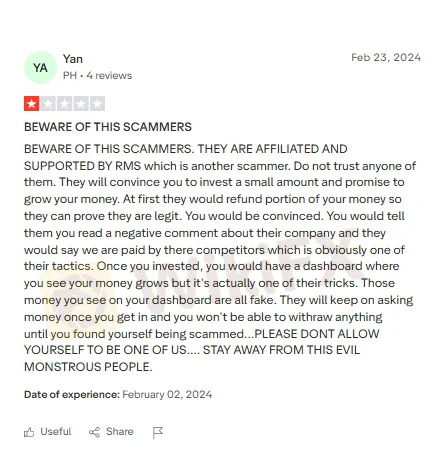

FXCL may allow traders to withdraw a small amount to make them believe that it is a legit forex broker. However, the company will keep asking traders to raise their deposits and disallow withdrawals later. By the time you realize you are scammed, it may be just too late! Sharing a screenshot explaining this growing issue faced by the traders at FXCL.

Why is FXCL Not Trustworthy for Traders?

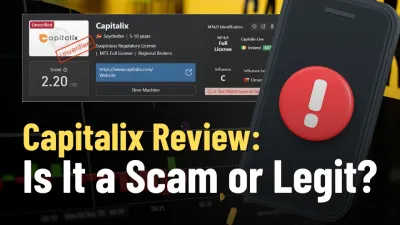

FXCL is not a trustworthy forex broker because it is not regulated by any competent financial authority. Trading with this broker is fraught with investment risks, and therefore, there are many complaints against it. WikiFX, the leading broker regulation inquiry app, has thus given it a score of just 2.23 out of 10.

Want to explore a community where you get forex insights and tips? Join WikiFX Masterminds today!

Here is the pathway to the community.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Great, you have become a community member.