Abstract:MultiBank Group (MBG/MEX) claims to be regulated by several authorities, such as ASIC, BaFin, CySEC, and SCA, but investigations reveal high risks. Some licenses have been revoked or remain unverified. Many users have reported problems, including slow withdrawals, complicated bonuses, and non-transparent customer service.

MultiBank Group (MBG/MEX) claims to be regulated by several authorities, such as ASIC, BaFin, CySEC, and SCA, but investigations reveal high risks. Some licenses have been revoked or remain unverified. Many users have reported problems, including slow withdrawals, complicated bonuses, and non-transparent customer service.

Even though the broker has a wide customer base, popularity does not equal safety. Investors should always check license status and regulatory risks in each region before depositing funds.

Can You Trust Multi-Licensed Forex Brokers?

MultiBank Group (MBG/MEX) is known globally, but when examining its licenses and regulatory status, significant complexities and risks appear.

Although the broker claims regulation from top-tier authorities such as ASIC (Australia), BaFin (Germany), and CySEC (Cyprus), its WikiFX score is only 2.59, far below industry standards, raising serious concerns about investor fund safety.

Licenses Still in Effect

MultiBank Group holds valid licenses from:

- ASIC (Australia) – adds credibility in the Asia-Pacific region

- BaFin (Germany) – oversees European operations

- CySEC (Cyprus) – applicable for EU clients

- SCA (UAE) – regulates forex activities in the Middle East

These licenses provide a level of legitimacy, but do not cover all of MultiBank Groups global business activities.

Revoked or Unstable Licenses

In some jurisdictions, MBG has faced regulatory setbacks:

- UK – license revoked

- Dubai (UAE) – retail forex license revoked

- Spain – retail trading license revoked

These revocations raise serious questions about transparency and reliability.

Unverified Licenses

In other regions, MBG claims to hold licenses, but verification is pending, leaving investors uncertain about whether their funds are legally protected.

Challenges in Assessing Legitimacy

Even with multiple licenses, regulation does not guarantee full safety. Investors should note:

- Regulatory standards differ by country

- Some licenses provide only basic credibility, not robust investor protection

- Suspensions or revocations are strong warning signals of regulatory risk

Regional Influence vs. Regulation

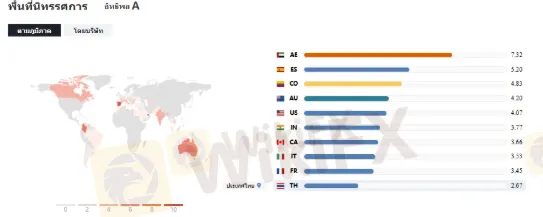

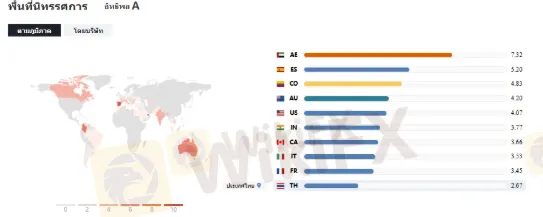

MultiBank Group has rapidly expanded worldwide, with strong presence in:

- UAE (score 7.32) – strong marketing and client base in the Middle East

- Spain (5.20), Colombia (4.83), Australia (4.20), US (4.07), India (3.77), Canada (3.66), Italy (3.53), France (3.45), Philippines (2.85), and Thailand

However, market reach does not equal regulatory safety. For example:

- Valid licenses: Australia (ASIC), Cyprus (CySEC)

- Revoked licenses: Spain, France, UK

This mismatch highlights the regulatory complexity—a global footprint but inconsistent oversight.

Reported Investor Problems

- Withdrawal delays

- Complicated bonus schemes

- High trade volume requirements before withdrawal

- Geographic restrictions on services

These recurring complaints show that, despite holding some valid licenses, MBG cannot guarantee investor safety in all regions.

Key Takeaways for Investors

Before investing with MultiBank Group, consider:

- Check the license status in each country

- Be cautious of bonuses or offers that seem too good to be true

- Assess regional risks where the broker operates but faces regulatory complaints or sanctions

Final Warning

MultiBank Group may appear reputable with its global presence, but the regulatory complexities and risks tell another story.

Popularity and market influence do not equal legal safety. Investors must exercise extreme caution before depositing money or trading with this broker.

Have You Been Scammed or Blocked from Withdrawing?

Don‘t stay silent. If you’ve had negative experiences with brokers—fraud, blocked withdrawals, or shady practices—youre not alone.

You can also verify broker licenses and read reviews directly on the WikiFX app. It also offers trading strategies, analysis, EA VPS service, and more—all in one platform.