Abstract:The release of U.S. Non-Farm Payroll (NFP) data is one of the most closely watched events in the foreign exchange market. But what exactly is NFP, and why does it matter so much to traders? This article explores the significance of NFP, its impact on financial markets, and how WikiFX provides tools to help you stay on top of this and other high-impact economic events.

What is

What is

Non-Farm Payroll (NFP)?

Non-Farm Payroll (NFP) refers to a key U.S. labour market report that tracks employment changes in sectors excluding agriculture, private households, nonprofit organizations, and the military. The data provides insights into the overall health of the U.S. economy.

An NFP release typically includes several components, such as:

- Number of new non-farm jobs created

- Unemployment rate

- Employment rate

- Average hourly wage growth

- Labour force participation rate

The Bureau of Labour Statistics (BLS), under the U.S. Department of Labour, publishes the report monthly, usually on the first Friday of each month at 8:30 a.m. Eastern Time, reflecting employment statistics from the previous month.

Why is NFP Important?

The NFP report is a critical measure of economic activity in both the manufacturing and service sectors. It serves as a major indicator for the U.S. Federal Reserve (Fed) in evaluating the economy and adjusting monetary policy.

The Feds two primary goals are:

- Controlling inflation

- Promoting maximum employment

Because employment is central to these goals, the NFP report carries significant weight in monetary policy decisions. Among the reported figures, the number of new jobs created and the unemployment rate are most closely watched by traders and policymakers alike.

Market Impact of NFP

Financial markets react strongly to NFP releases, particularly when the actual results differ from market expectations.

- Stronger-than-expected data generally signals a healthy economy, leading to higher consumer spending and a stronger U.S. dollar.

- Weaker-than-expected data often points to economic slowdown or recession fears, which can weaken the dollar and drive volatility across asset classes.

This heightened volatility affects not only the foreign exchange market but also commodities, U.S. equities, and global financial markets. As such, the period immediately before and after an NFP release is often marked by sharp price movements, creating both risks and opportunities for traders.

How Traders Use NFP Data

Traders analyze the difference between the actual figures and both the previous and forecasted values to gauge market sentiment. By anticipating how the market will react, traders can develop strategies to capitalize on short-term price swings.

Staying Updated with WikiFX Tools

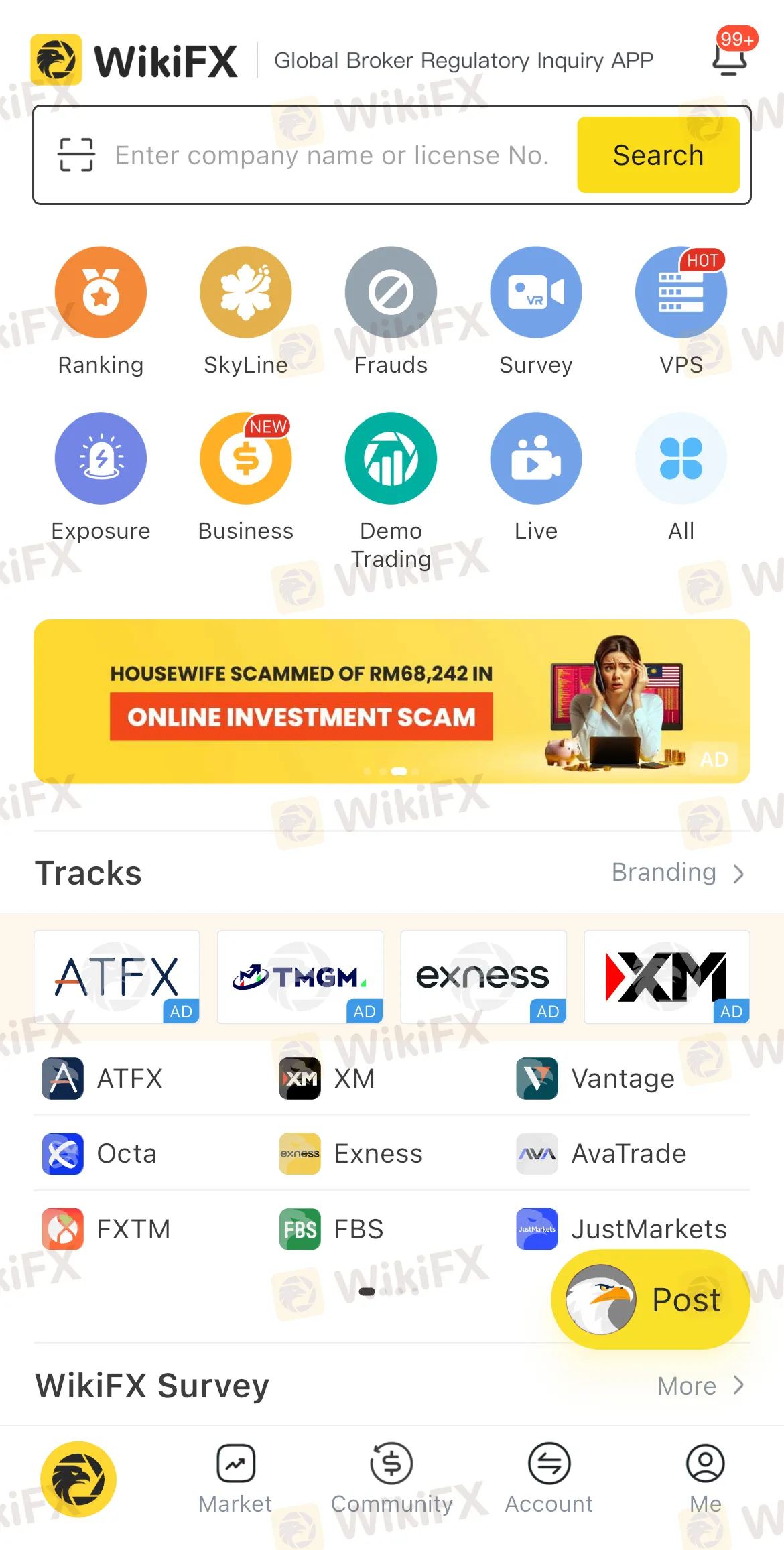

To help investors and traders stay informed, WikiFX offers several free tools designed to make tracking economic events easier:

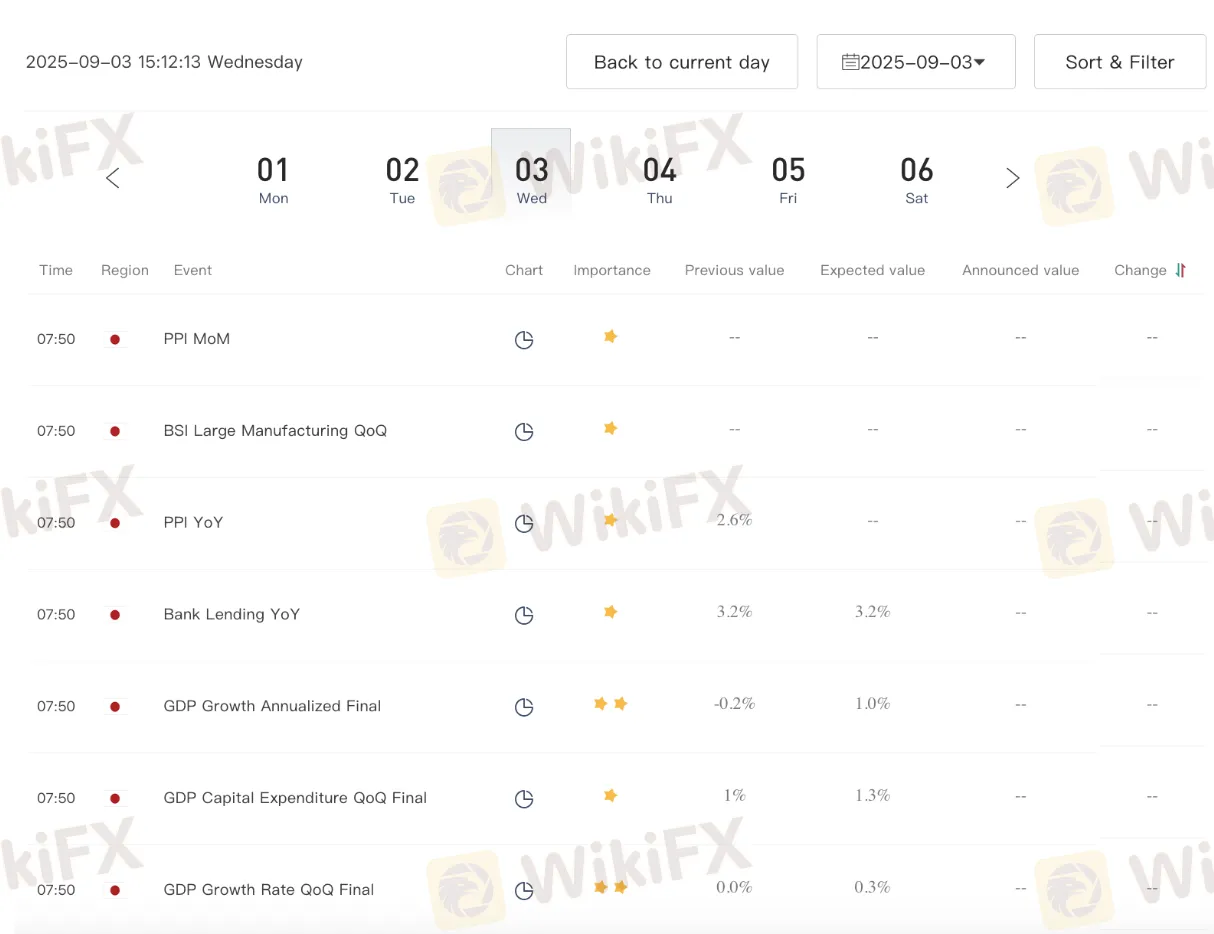

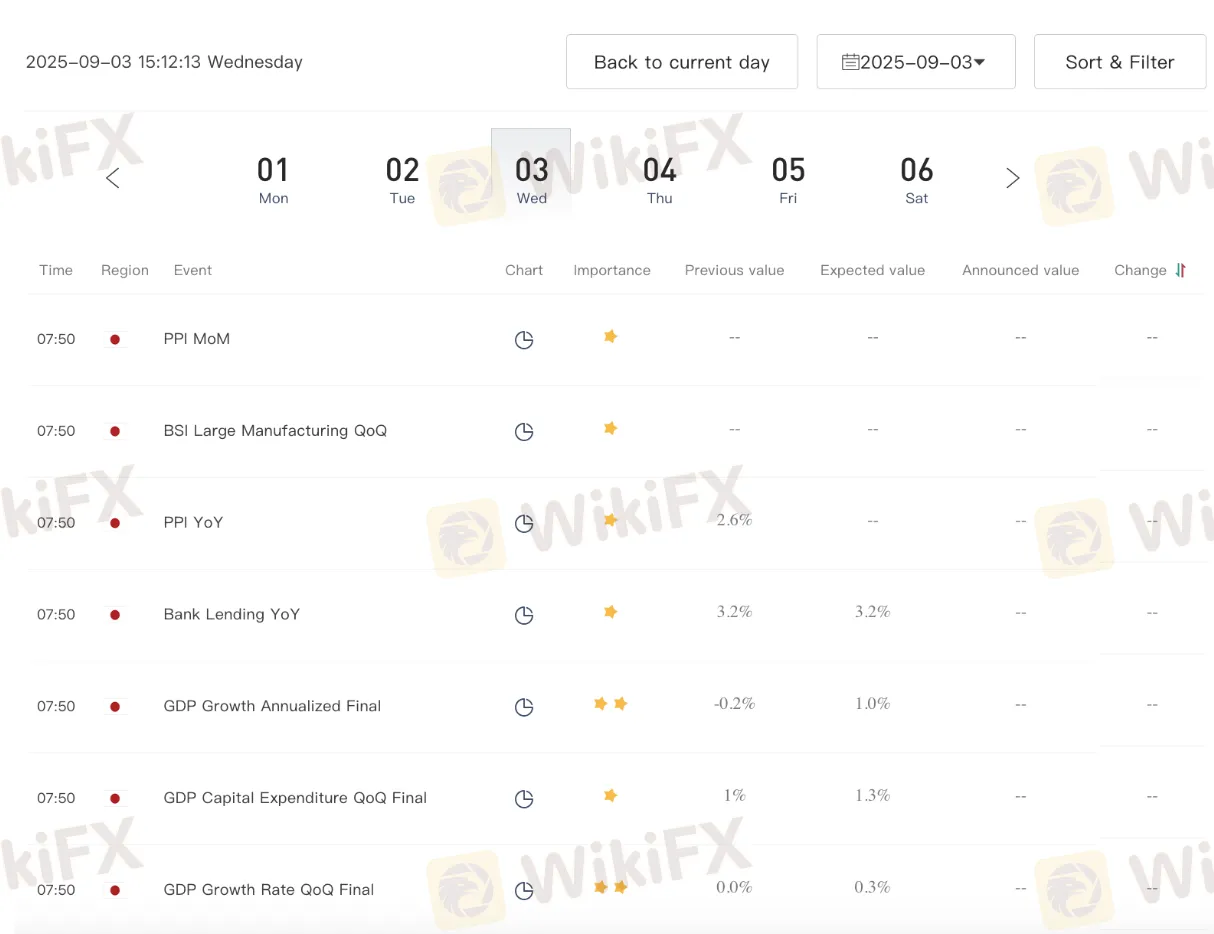

1. WikiFX Financial Calendar

Accessible via the WikiFX Financial Calendar, this tool organizes all upcoming and past economic events in chronological order. Each event includes:

- Importance level

- Previous value

- Forecasted value

- Actual reported value

- Degree of change

The calendar allows users to view both past and upcoming events, making it a valuable resource for planning trading strategies.

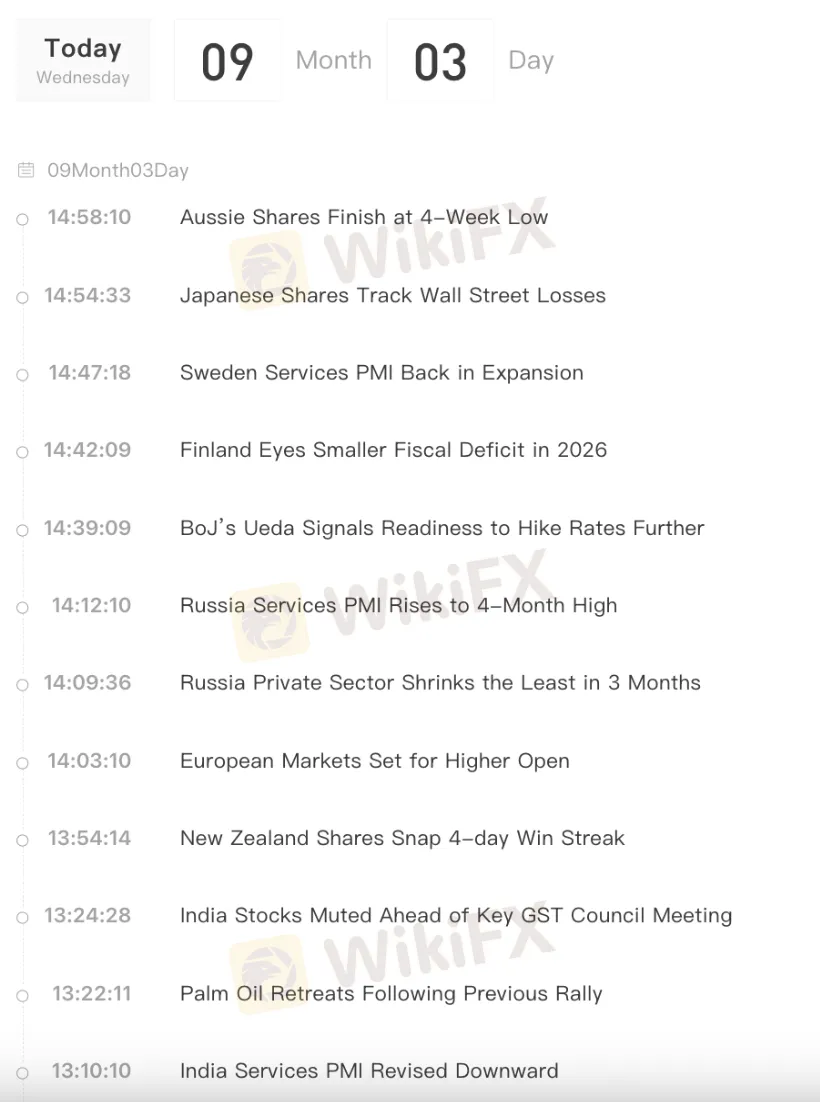

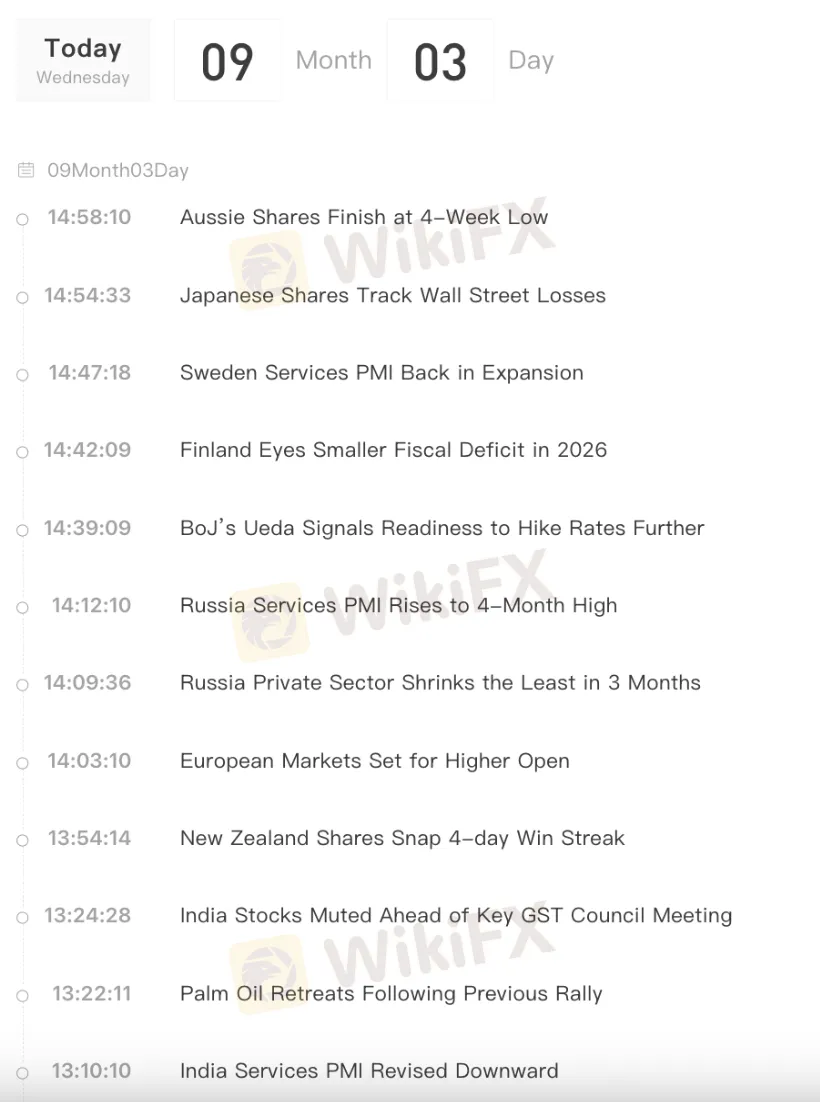

2. WikiFX 24/7 News Flash

The WikiFX News Flash provides real-time updates in concise, easy-to-read summaries. Users can set voice reminders and desktop notifications, ensuring they never miss important events. This feature is especially useful for traders who prefer quick updates without reading lengthy reports.

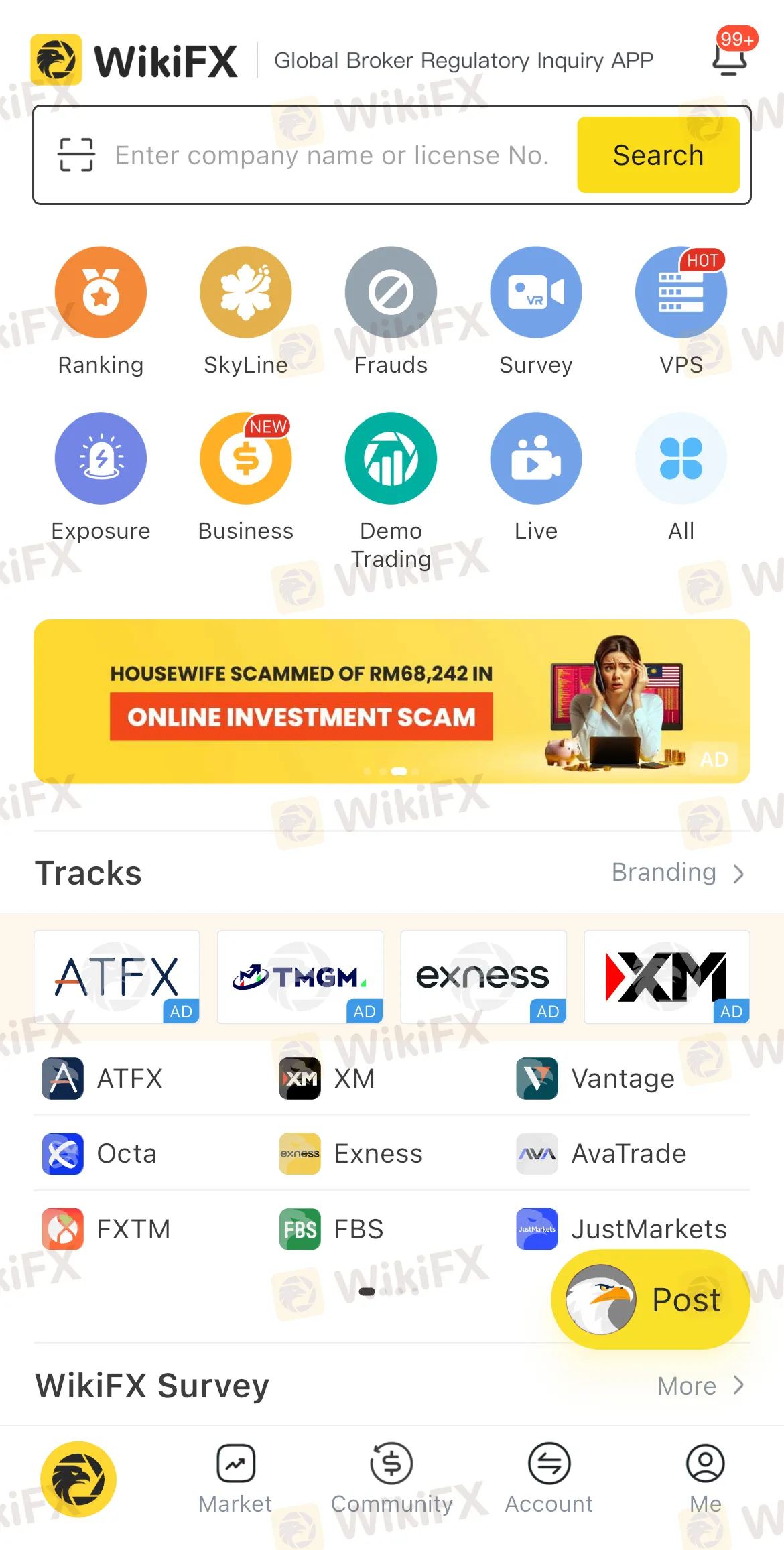

3. WikiFX Mobile App

Both the Financial Calendar and News Flash features are available on the free WikiFX mobile app, which can be downloaded from Google Play and the App Store. The app presents these tools side by side, allowing users to monitor the latest developments with a single scroll. This helps traders avoid being caught off guard by sudden market shifts and ensures they can seize opportunities promptly.

Conclusion

The U.S. Non-Farm Payroll report is one of the most influential economic indicators, shaping expectations for the U.S. economy and driving significant market volatility. For traders, staying updated on NFP releases is crucial to making informed decisions.

With tools like the WikiFX Financial Calendar and News Flash, monitoring high-impact events has never been easier. By staying informed, traders can better manage risks, identify opportunities, and enhance their trading strategies.