简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Monaxa Exposed: How Traders Lost Thousands and You Could Be Next!

Abstract:Monaxa advertises itself as a global broker with advanced platforms and high leverage. Yet regulators have issued warnings, WikiFX found no real office in Australia, and traders report missing funds and blocked withdrawals. Is Monaxa a safe choice or a costly mistake?

Monaxa markets itself as a modern forex and CFD broker with advanced platforms and attractive features. However, a closer look reveals alarming concerns from both regulators and traders, particularly for those in Malaysia.

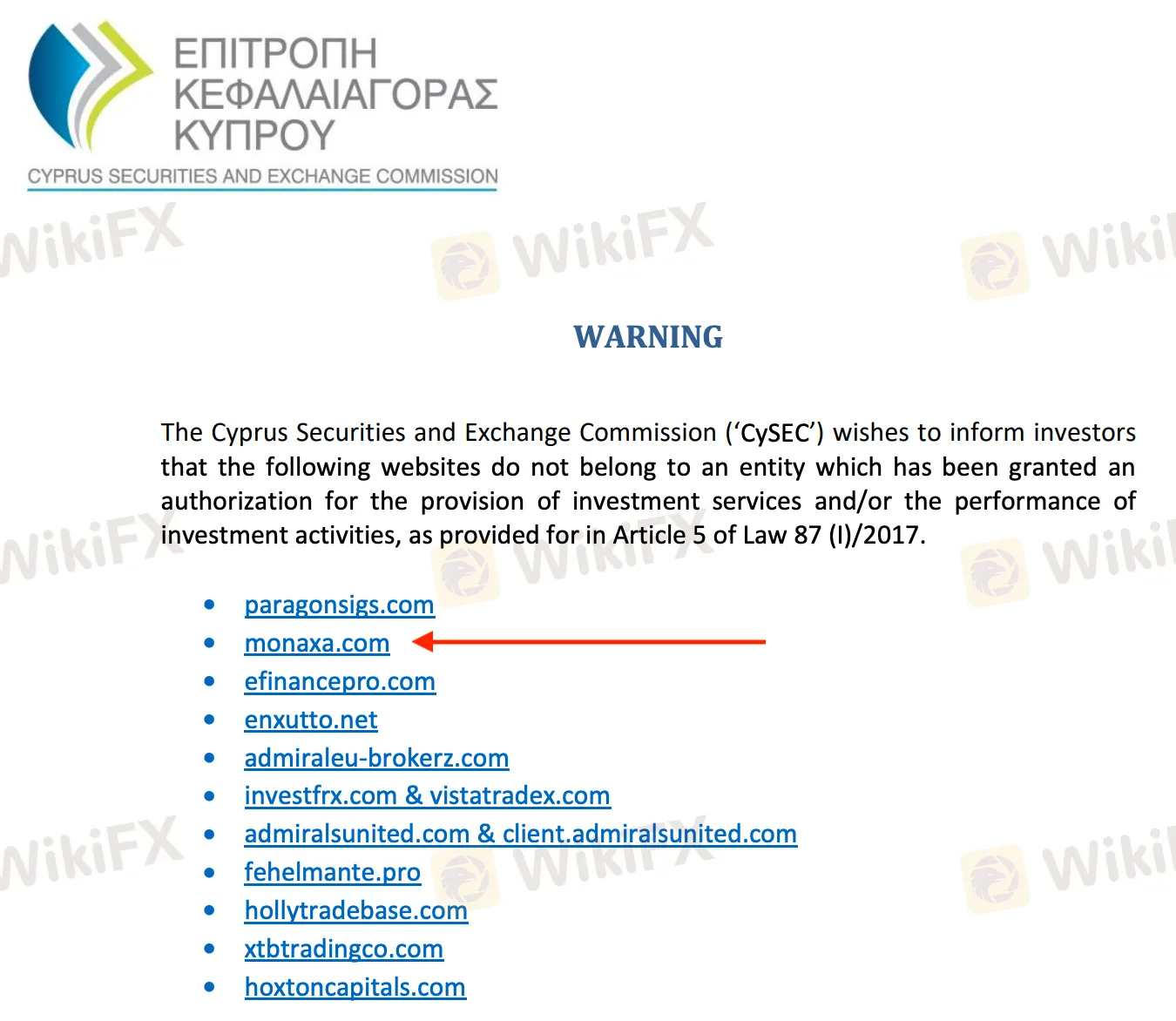

Regulatory Alerts from Cyprus and Malaysia

In early 2025, Cyprus‘s financial regulator, CySEC, issued a public warning naming monaxa.com among several platforms operating without proper authorisation under Cypriot law. This means Monaxa is not licensed to offer investment services in Cyprus. Such a warning signals potential weaknesses in the broker’s transparency and investor protection measures.

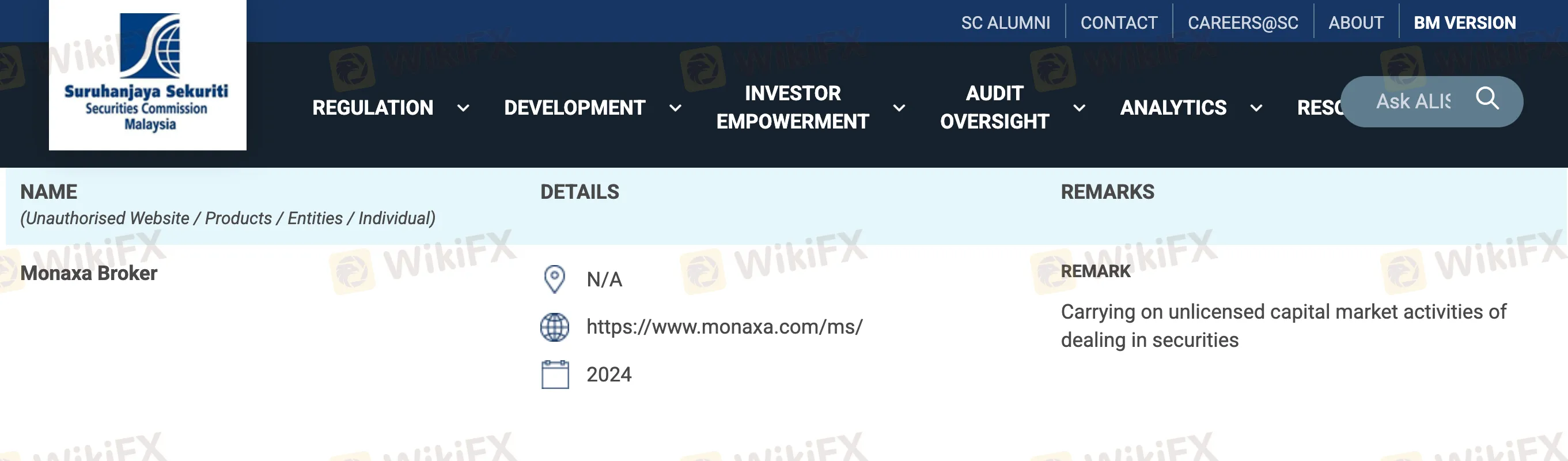

Meanwhile, Malaysias Securities Commission (SC) has also placed Monaxa on its Investor Alert List. According to the SC, the company has been carrying out unlicensed capital market activities involving the dealing of securities (as listed on sc.com.my).

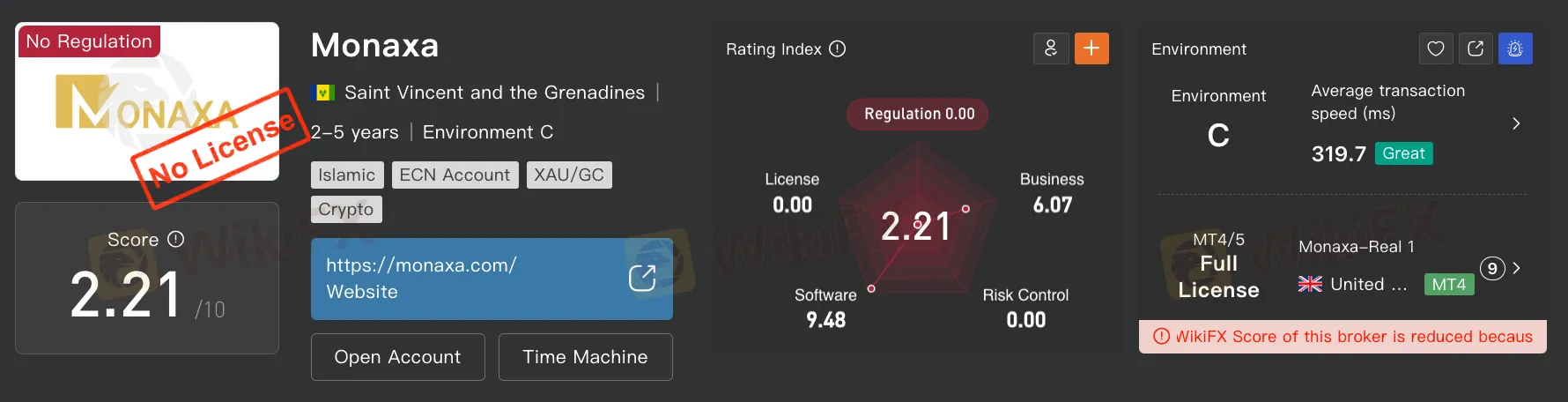

WikiFX has also found that this broker operates without a legitimate licence, raising further doubts about its credibility.

View WikiFXs full review on Monaxa here: https://www.wikifx.com/en/dealer/1237287182.html

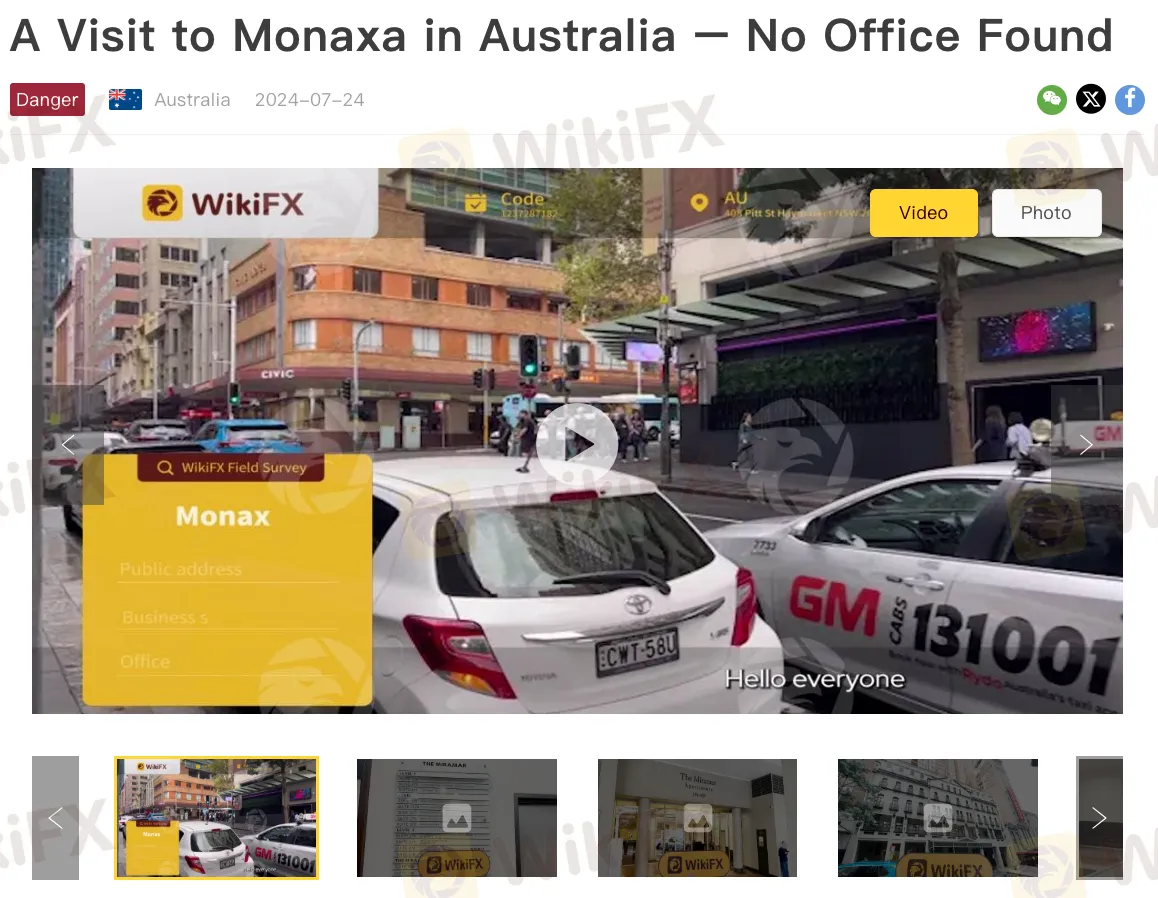

To make matters worse, Concerns grew further when WikiFX conducted a field survey in March 2024 at Monaxas listed address in Sydney (408 Pitt Street, Haymarket). Investigators found no office, no signage, and no staff who had even heard of the company. The findings suggest Monaxa has no real presence at its claimed Australian location and this casts more doubt on its credibility and transparency.

Complaints from Real Traders

Many traders from Malaysia and other countries have shared troubling experiences on WikiFX:

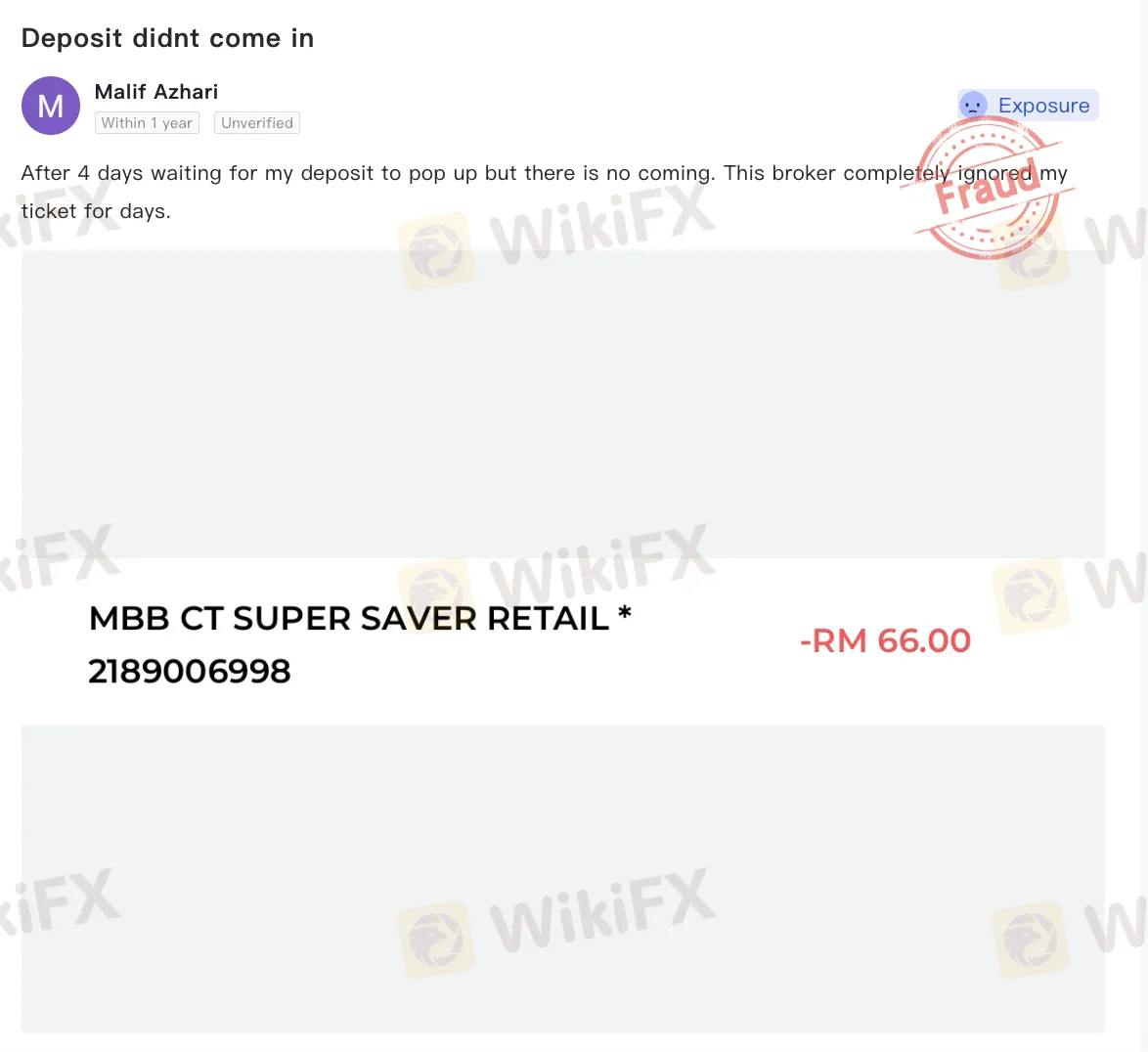

- A Malaysian user reported depositing money, but the funds never appeared in their account. Their support ticket was ignored for several days.

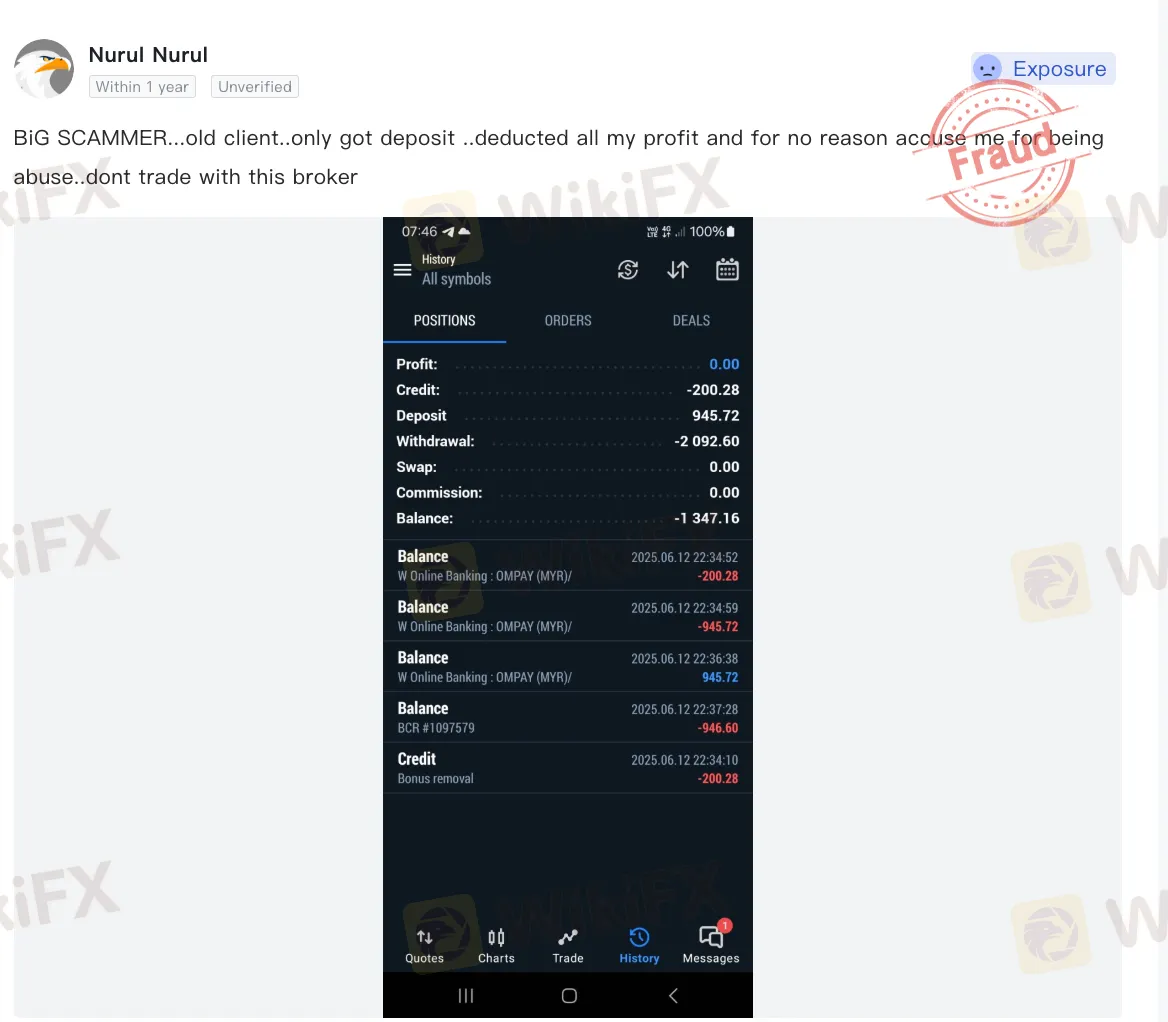

- Another claimed that, despite earning profits, Monaxa blocked their withdrawal and refused to pay out.

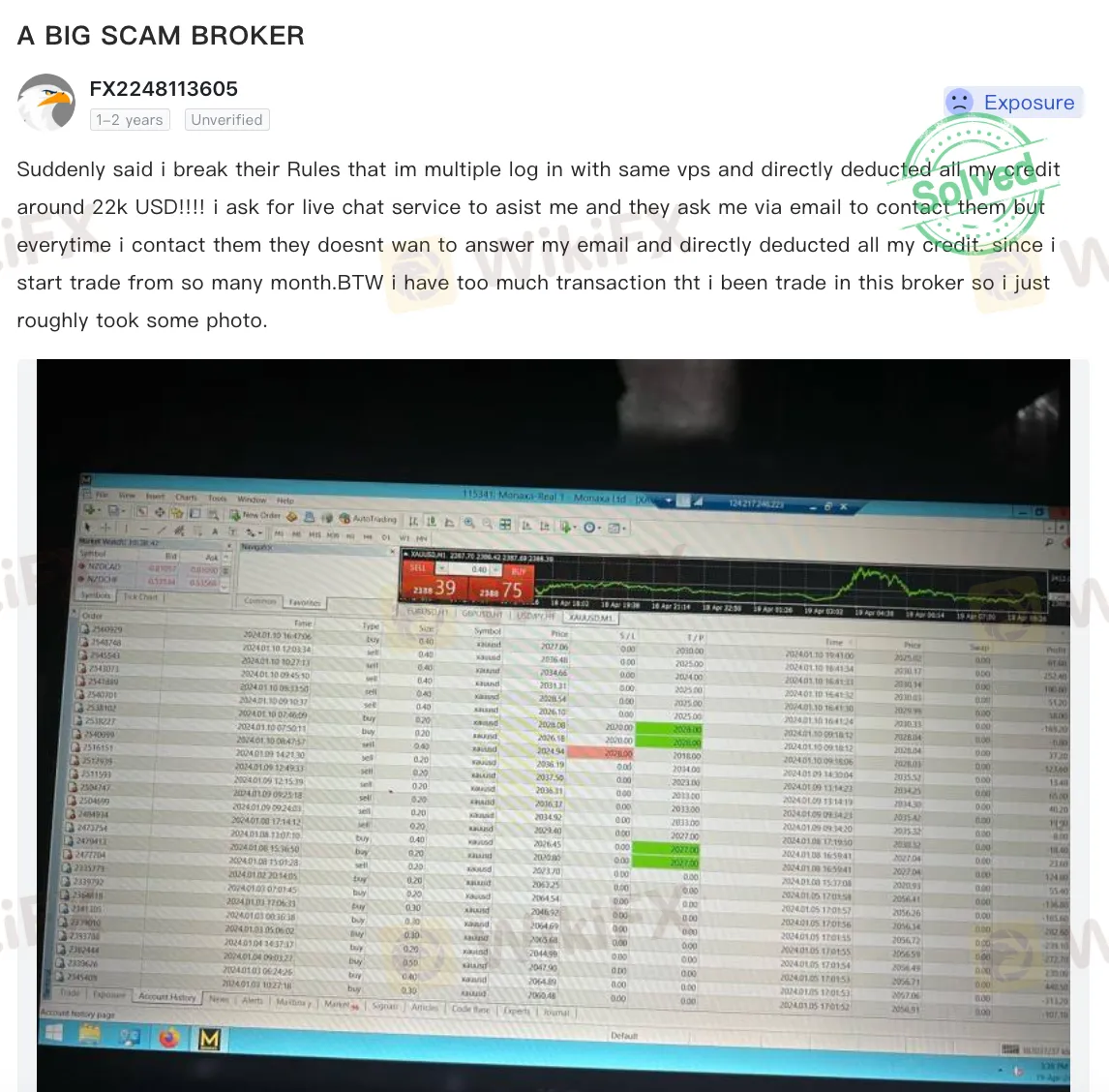

- A severe case involved a Malaysian trader who reported losing around USD 22,000. Monaxa labelled them an “abuser” but gave no further explanation.

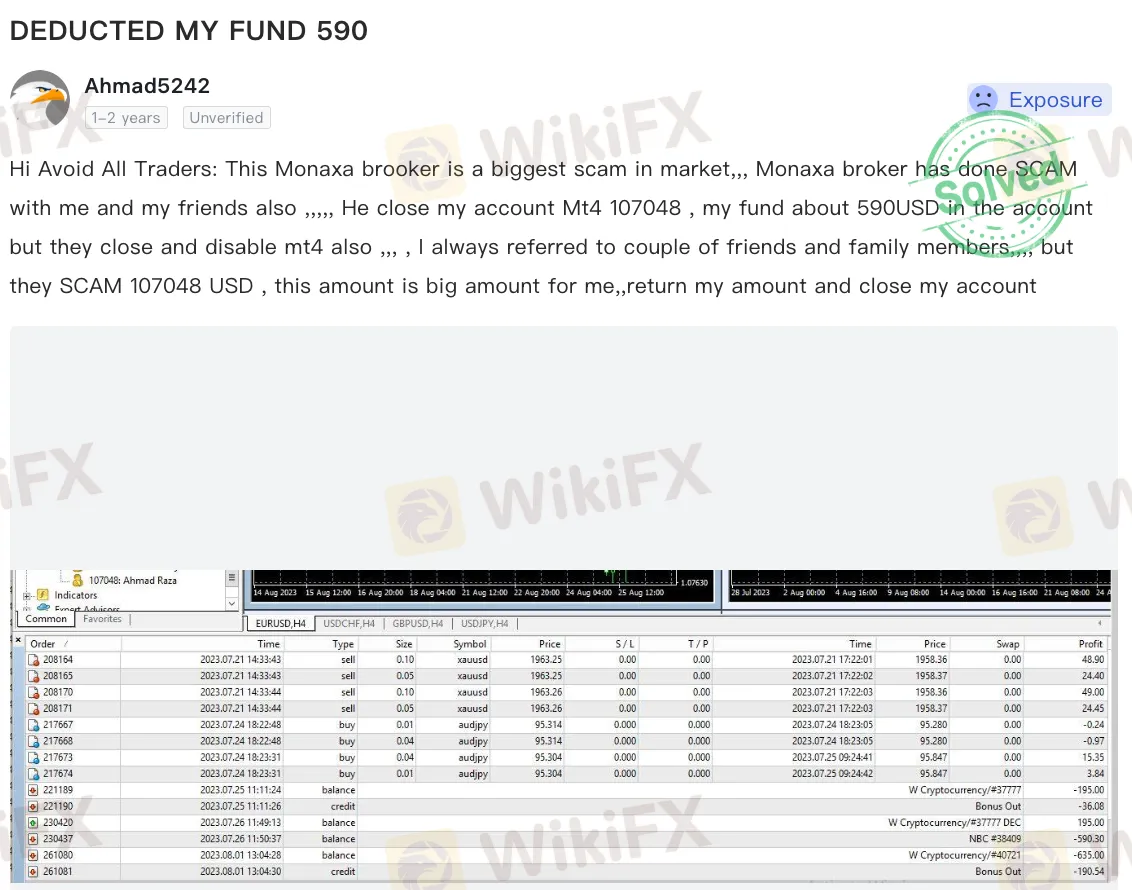

- In Pakistan, one complaint described a sudden MT4 account closure, which resulted in a loss of USD 682.

- Another trader reported that USD 590 disappeared after their account was terminated.

These reports outline repeated problems with withdrawals, fund handling, and poor support. In forex, withdrawals are the ultimate measure of a brokers integrity, and Monaxa seems to have failed this test.

Why Malaysian Traders Must Prioritise Regulation and Reviews

For Malaysian investors, the number one rule when choosing a broker is clear: licence first, reputation second. Both go hand in hand in ensuring a secure trading environment.

- Regulation Equals Protection

A valid licence from a strong regulatory authority ensures client funds are held securely, disputes are arbitrated fairly, and misconduct is punishable. Offshore licences often lack these protections.

- Trader Reviews Reflect Reality

While a broker may claim competitive spreads and innovative platforms, reviews from traders reveal how the broker actually treats its clients, whether withdrawals are smooth, support is responsive, and rules are transparent.

- Local Jurisdiction Is Critical

No matter how attractive a broker may seem, if it is not regulated in Malaysia, traders have no legal recourse under Malaysian law. This leaves investors vulnerable to scams or unresolvable disputes.

Conclusion

Monaxa may present itself as a comprehensive global broker, but the reality is starkly different. A CySEC warning, placement on Malaysias Investor Alert List, and mounting trader complaints all suggest a pattern of risk, not opportunity.

For Malaysian investors, the lesson is clear: being absent from regulated broker lists is not reassurance; it could just mean delayed detection. Always choose brokers that offer clear regulation, genuine fund protection, and a trustworthy reputation. Monaxa fails to deliver on these critical points.

When your finances are at stake, cautious scrutiny should always come first.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Currency Calculator