Abstract:Finding it virtually impossible to withdraw funds from Dollars Markets? Has your trading account been suspended without any reason? Do you fail to receive any positive response from the customer support officials? Firstly, make sure to get all your money back to your account. This is because Dollars Markets has been grabbing headlines for scamming investors around the globe, including those in South Asia. Many traders have heavily criticized the broker on several review platforms. In this article, we will share their negative reviews. Keep reading!

Finding it virtually impossible to withdraw funds from Dollars Markets? Has your trading account been suspended without any reason? Do you fail to receive any positive response from the customer support officials? Firstly, make sure to get all your money back to your account. This is because Dollars Markets has been grabbing headlines for scamming investors around the globe, including those in South Asia. Many traders have heavily criticized the broker on several review platforms. In this article, we will share their negative reviews. Keep reading!

Top Complaints Against Dollars Markets

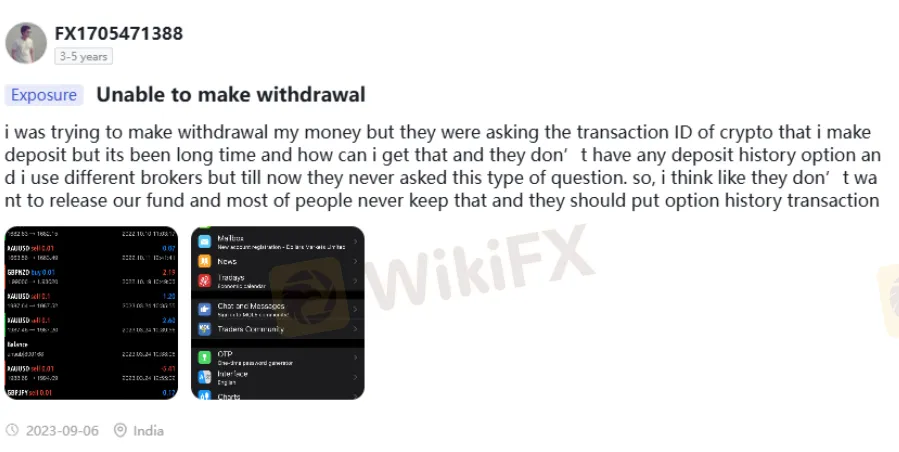

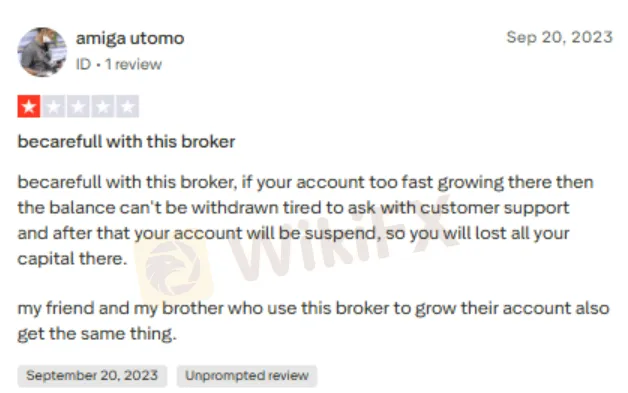

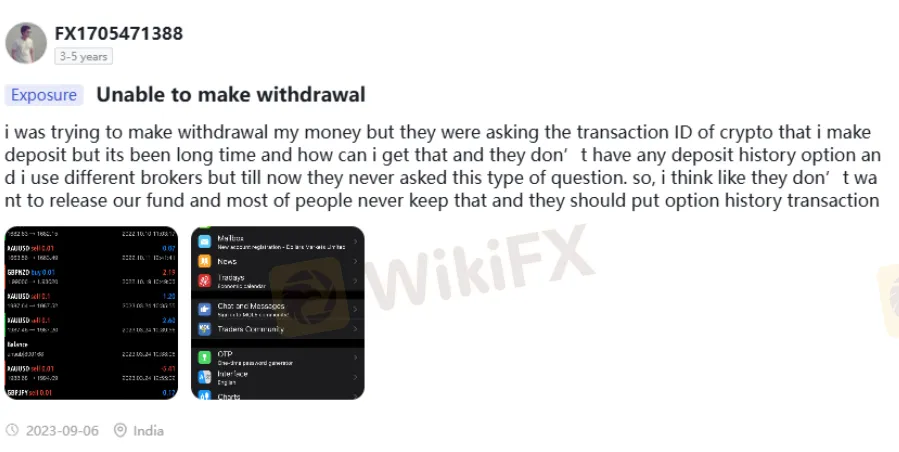

Excuses for Withdrawal Denials

A trader from India has claimed that he was denied from withdrawing funds as the broker enquired about the transaction ID of the deposit made by him. Since it was done a long time ago, he could not remember. Perfectly understandable! However, the trader highlighted that Dollars Markets did not have a ‘deposit history’ option on the trading platform. Another trader from Pakistan also claimed that withdrawal is virtually impossible at this broker. Here are two different screenshots explaining the withdrawal issues for South Asian traders.

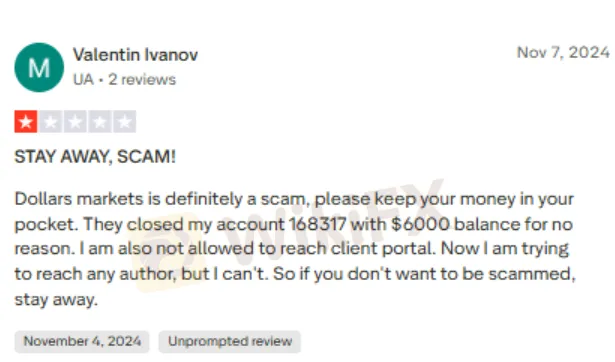

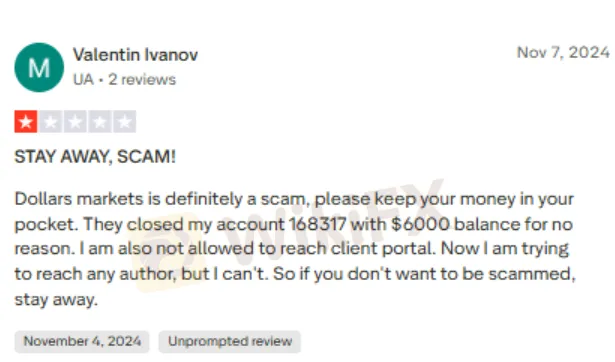

Account Closure Despite Having a Sufficient Balance

Dollars Markets has been closing accounts of traders without any reason, regardless of whether they hold a substantial balance. The screenshot below takes you through the pain of a trader who saw the closure of his trading account, which had a balance of $6,000, without any reason. Adding to the misery, the trader cannot even access the client portal.

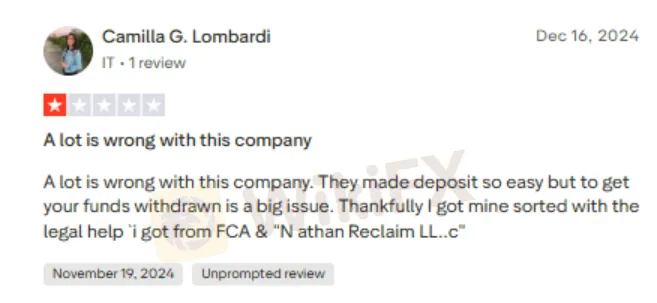

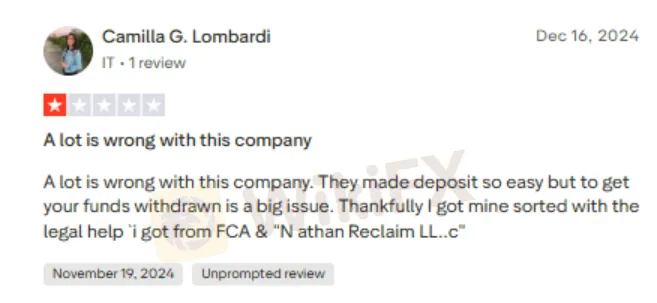

Legal Help Sought to Withdraw the Stuck Funds

The trader claims that one can deposit funds easily. However, it becomes too challenging to withdraw funds. Dollars Markets gives numerous excuses for withdrawal delays. Frustrated by the poor response, a trader had to go legal to recover the funds stuck with the broker. Take a look at the screenshot explaining this problem.

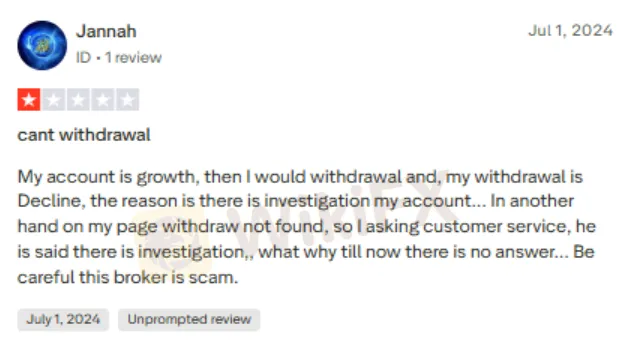

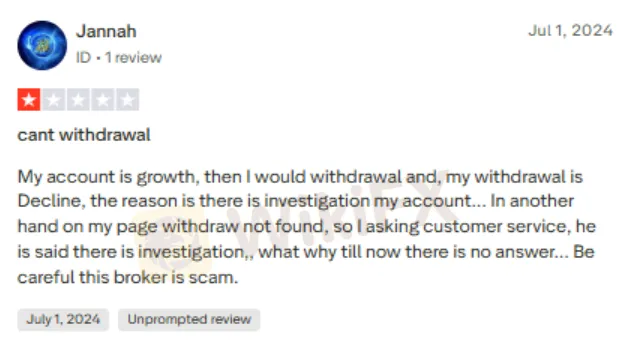

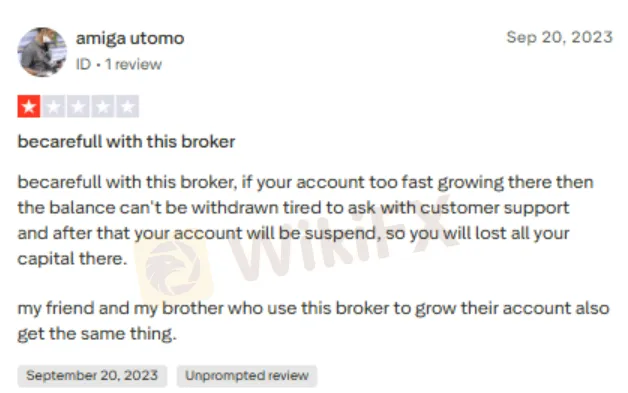

Profitable Account, Yet No Withdrawal Access

Dollars Markets has also been accused of stopping profitable traders from accessing withdrawals in the name of account investigation. It does not even respond to the traders query of how long the investigation will run. The lack of stance on it indicates a potential investment scam. Below are two screenshots wherein traders have expressed their disappointment over such a poor trading practice by the broker.

The Root Cause of Trading Issues at Dollars Markets

The lack of a regulatory license is the primary reason for the mess witnessed by traders at Dollars Markets, a Mauritius-based forex broker that has been in the forex business for over five years. Imagine the plight of the many investors who would have been scammed during this period. Keeping the existing and potential financial perils in mind, the WikiFX team has given Dollars Markets a score of just 2.37 out of 10.

Conclusion

Dollars Markets may showcase itself as a global trading platform, but the reality painted by countless traders tells a different story. From account closures without reason to withdrawal denials and endless “investigation” excuses, the broker has consistently failed to act in good faith. The absence of a valid regulatory license only adds to its lack of credibility, leaving investors fully exposed to financial risks.