Abstract:Finalto Financial Services consolidates UK entities, sees revenue gains but lower profits amid client migration and shifting trading volumes.

Finalto Restructures UK Business

Finalto Group has completed the consolidation of its United Kingdom operations, finalizing the client migration from Finalto Trading to Finalto Financial Services by the close of 2024. The move significantly reshaped financial outcomes for both units, according to recent Companies House filings.

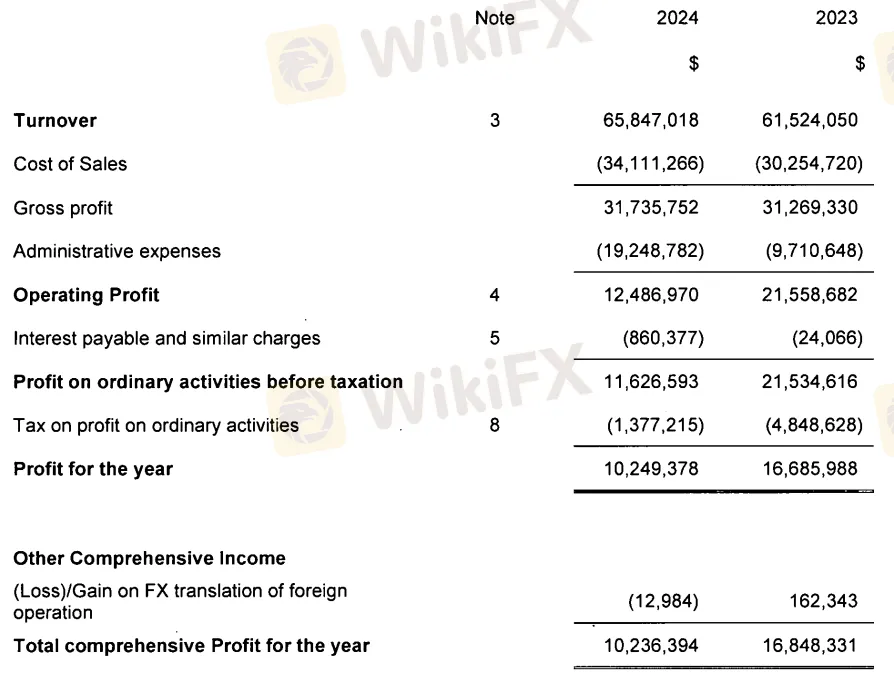

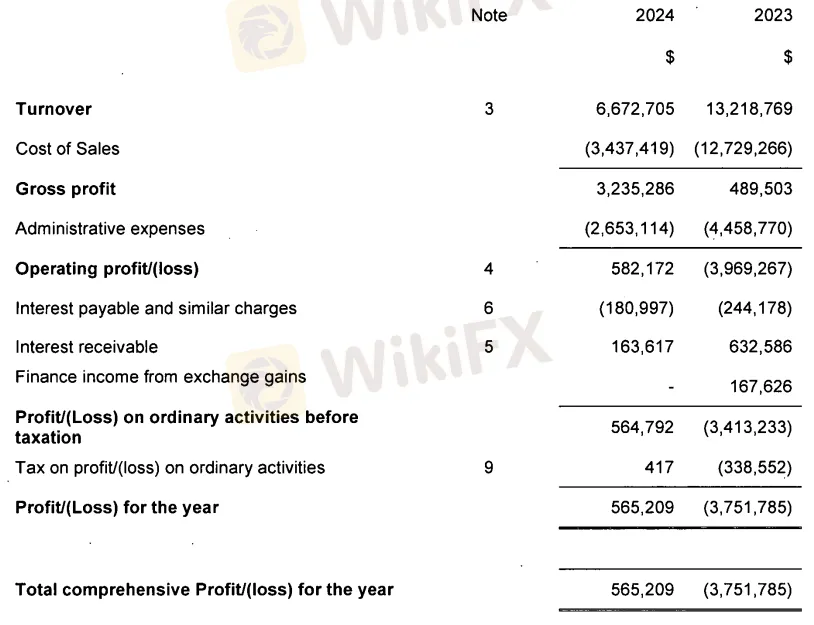

Finalto Financial Services, now serving as the sole UK entity, reported 2024 revenue of $65.8 million, marking a 7 percent year-on-year increase. In contrast, Finalto Tradings revenue declined sharply to $6.6 million, reflecting the client migration strategy that began in 2023.

Profits and Client Migration

Despite increased top-line revenue, pre-tax profits at Finalto Financial Services fell to $11.6 million, down from $21.5 million the year prior. The firm attributed this decline to higher operating expenses, including costs absorbed from Finalto Trading and payments for services provided by other group companies.Trading volume on Finaltos platform also contracted slightly, registering $1.3 trillion for the year compared with $1.4 trillion in 2023. Management explained this was partly due to certain clients onboarding with other Finalto Group entities. Nevertheless, the company emphasized its strong pipeline of geographically diverse clients and ongoing investments in technology platforms.

Finalto Trading Winds Down

Finalto Trading, formerly Tradetech Alpha, wound down most of its activities by the end of 2024. Despite reduced activity, it reported a post-tax profit of $565,209, reversing a prior-year loss of more than $3.7 million. The turnaround was mainly driven by stronger performance in the first quarter, when the firm was still active. Finalto Trading also highlighted its solid liquidity management, asserting that it had sufficient cash reserves to meet all obligations.

Broader Impact on UK Services

The consolidation underscores the shifting landscape of UK financial services and the ongoing focus on efficiency in forex and trading volumes. With technology investment continuing and client migration effectively completed, Finalto Financial Services is positioned as the central hub of the groups UK operations heading into 2025.

About Finalto

Finatlo is a global provider of multi-asset trading solutions, offering liquidity, risk management, and technology-driven services to brokers, banks, and professional clients. Would you like me to also add a brief timeline of Finaltos UK restructuring for stronger SEO value?