Abstract:MultiBank Group presents itself as a global, highly regulated FX/CFD group with a long history and a large executive team. However, recently we found out that a string of independent exposures and user complaints has put the broker under renewed scrutiny.

MultiBank Group presents itself as a global, highly regulated FX/CFD group with a long history and a large executive team. However, recently we found out that a string of independent exposures and user complaints has put the broker under renewed scrutiny.

Recent negative issues and public exposures about the MultiBank Group

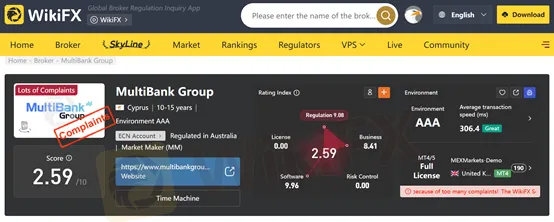

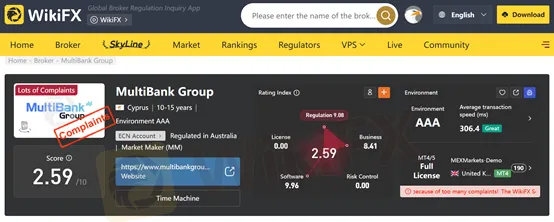

Multiple reports aggregated by WikiFX say complaints against MultiBank Group have surged, reaching hundreds of individual cases in a short period. WikiFXs recent coverage specifically lists more than 700 complaints, most of them alleging withdrawal problems, account blocking, and other service failures.

Common themes in the complaints include:

- Blocked or delayed withdrawals: Traders from Asia and the Middle East reported withdrawals taking weeks to months, frequent “processing” delays from support, and funds not arriving even after repeated follow-ups. WikiFXs warnings and news pieces on these issues make the withdrawal problem a recurring allegation.

- Historical Employee-pay problems: Earlier WikiFX reporting (from 2021) accused MultiBank of owing employees months of unpaid wages, a claim that has been cited again as part of the pattern of internal financial strain raised by critics. That earlier report described unpaid staff salaries and unresolved investor withdrawal issues.

- Regulatory claims under question: MultiBank‘s marketing stresses multiple global licenses and a broad regulatory footprint; at the same time, exposés note that some licenses or registrations are difficult to independently verify, and that some users have accused the group of exploiting people with aggressive bonus/withdrawal terms. That tension—between the company’s regulation claims and the complaints—appears throughout recent coverage.

Taken together, these reports do not prove fraud or criminality on their own, but they do create a clear picture of repeated customer service breakdowns and a high volume of complaints that prospective traders should consider before depositing funds.

Who runs MultiBank Group — the main characters

MultiBanks public materials and independent profiles show a mix of long-standing executives and newer hires. Below are the most prominent names that appear across company pages, whitepapers and press coverage:

- Sophie Squillacioti — Head of China Sales

According to the reports, Sophie Squillacioti joined MultiBank as Head of China Sales and Advisor to the Chairman.

- Other named executives & managers.

MultiBank's public materials list a large senior team, including roles such as CCO (Marc Aspinall), Chief Platform Officer, Global Head of Compliance, Heads of Payments and Trade Operations, and a number of regional CEOs and country managers. The groups whitepaper provides a fairly long “core team / senior leadership” roster.

Quick takeaway for traders

- High complaint volume: dozens to hundreds of recent complaints is a red flag worth attention.

- Check documents yourself: MultiBank publishes a long list of regulatory claims. If you‘re considering the broker, independently verify each regulator entry with the regulator’s public register.

- Watch withdrawal stories: multiple independent reports describe blocked or severely delayed withdrawals; That pattern matters more to retail traders than marketing statements.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.