Abstract:Comprehensive review of Just2Trade’s regulatory licenses and jurisdictions, focusing on its Cyprus Market Maker license and global oversight.

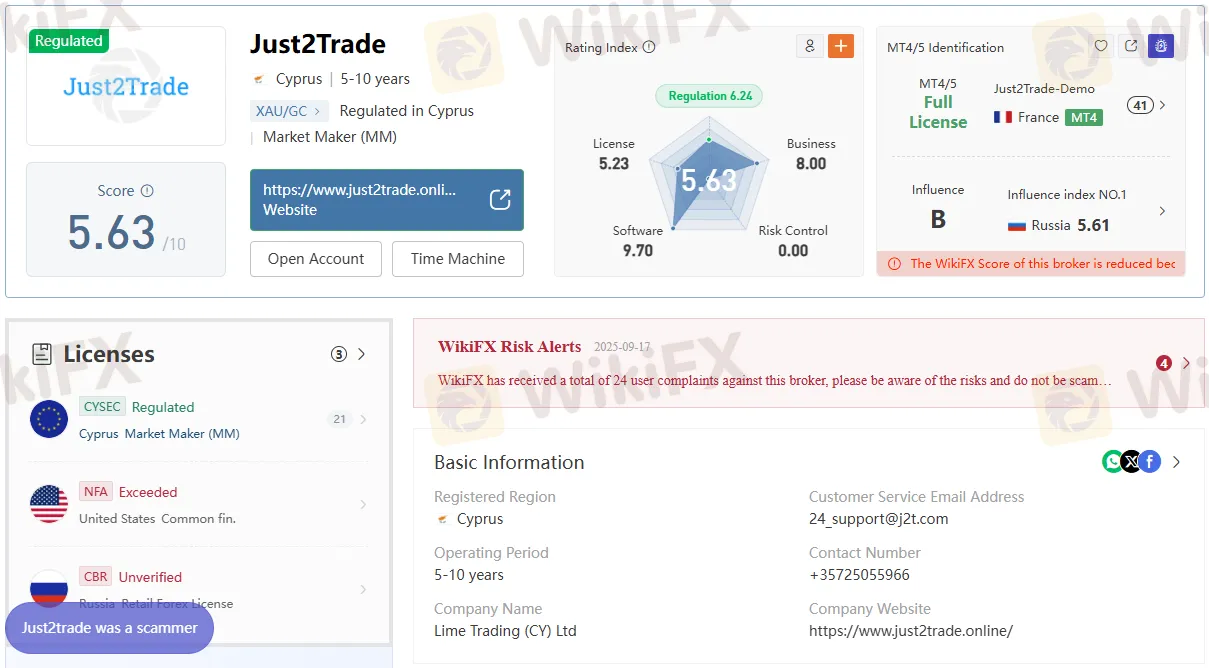

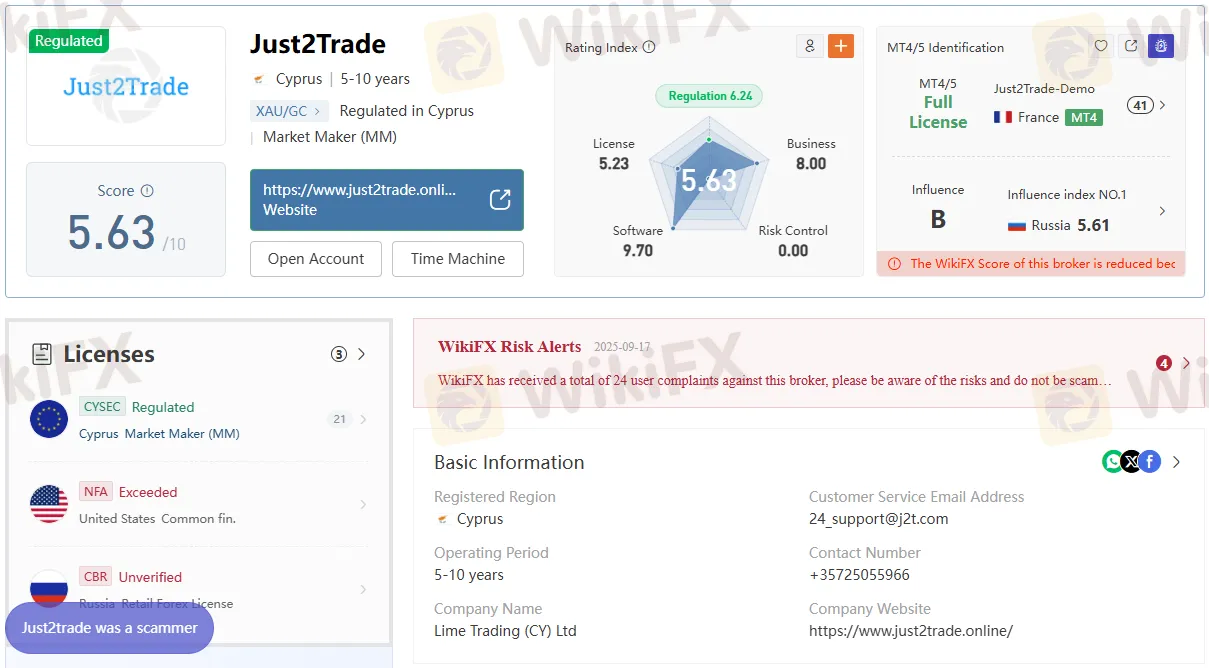

Just2Trade operates as a regulated multi-asset brokerage through Lime Trading CY Ltd in Cyprus, holding a Market Maker (MM) license issued by the Cyprus Securities and Exchange Commission (CySEC) since 2015, with authorization across multiple European countries under its Cyprus authorization framework. The brokers regulatory footprint also references a past or exceeded registration with the U.S. National Futures Association (NFA) via LIME TRADING CORP and an unverified retail forex registration entry in Russia, creating a mixed jurisdictional profile that investors should evaluate with care.

Cyprus Regulation and MM License

Lime Trading CY Ltd is the licensed entity for Just2Trade in Cyprus, operating from Magnum Business Center, Office 4B, Spyrou Kyprianou Avenue 78, Limassol 3076, and provides contact details including +357 25 344 563 and +357 25055966 alongside official websites listed as just2trade.online and j2t.com. The license type is explicitly Market Maker (MM) under CySEC License No. 281/15 with an effective date reported as 2015-09-25, which aligns with the brokers public positioning as a regulated EU investment firm. Under EU passporting frameworks historically applied via Cyprus, the broker lists authorization across approximately 20 countries including Austria, Belgium, Croatia, Denmark, Estonia, and Finland, subject to prevailing EU rules and any subsequent local notifications.

Entity Details and Verification Points

The document identifies the corporate name as Lime Trading CY Ltd and provides a supervisory contact email (supervision@just2trade.online) alongside the primary customer-service email (24support@j2t.com), aiding compliance checks and client communications. Prospective clients should verify the license status directly against CySEC‘s public register using the legal name and the license number format cited, cross-checking the Limassol office address and effective date to confirm current standing. The broker’s “5–10 years” operating period and stated multi-asset offering (forex, stocks, futures, CFDs, bonds, metals, options) should be corroborated with official disclosures and platform access terms before account opening.

U.S. NFA Entry: Exceeded Status

The file shows an “Exceeded” status for the U.S. National Futures Association entry tied to LIME TRADING CORP, with a common financial services license listed under No. 0430385 and an address at 1 Pennsylvania Plaza, 16th Floor, New York, NY. “Exceeded” here indicates that the U.S. registration is not currently active for brokerage operations; investors requiring U.S.-regulated services should confirm active status via the NFA BASIC system before relying on any U.S. permissions. This distinction matters for U.S.-resident traders who generally require firms with current NFA and CFTC authorization to offer leveraged retail forex or futures intermediation.

Russia License Entry: Unverified

The document references an unverified “Retail Forex License” entry under the Central Bank of Russia with license No. 045-13961-020000, listing an effective date of 2015-12-14 and Moscow contact details. Because the status is explicitly marked “Unverified,” it should not be treated as active, and users considering Russian coverage should independently check the Central Bank of Russias official registry to determine any current authorization. The file also notes a 2025-08-15 on-site visit in Moscow reporting “No Office Found,” which further underscores the need for direct verification of any Russian presence or permissions.

Authorized Countries and EU Reach

Within the Cyprus framework, the broker lists authorization in 20 EEA markets, including Austria, Belgium, Croatia, Denmark, Estonia, and Finland, implying reliance on EU cross-border notification regimes historically applicable to Cypriot investment firms. While such passporting allowed cross-border services, market participants should confirm that any current EU/EEA offering remains duly notified and conforms to post-Brexit and evolving EU national requirements. For non-EEA jurisdictions, reliance on Cyprus authorization alone does not automatically confer local permissions, so local regulatory checks remain essential.

Compliance Signals and Risk Alerts

The file aggregates third-party scoring and flags a “Stay away from it” warning in a summary block, citing 24 user complaints and a “Risk Alerts” note dated 2025-09-17; such alerts should be interpreted as prompts for deeper due diligence rather than definitive regulatory judgments. Additionally, an on-site check “Visit Just2Trade in Cyprus, Office Exists” dated 2019-05-28 corroborates a physical presence in Cyprus, contrasting with the Russia visit reporting no office, which together highlight jurisdiction-specific operational differences. Traders should balance user-complaint signals with primary-source verification on regulators‘ registers and the firm’s audited disclosures.

Platforms, Instruments, and Terms Snapshot

The company summary lists platforms including MT4, MT5, CQG, and Sterling Trader Pro, with leverage “up to 1:200,” minimum deposit “100,” and spreads from “0.5,” framed as multi-asset access across forex, stocks, futures, CFDs, bonds, metals, and options. Such commercial parameters should be validated in the firms Key Information Documents, execution policy, and product-scope disclosures, as regulated terms may vary by client classification, instrument, and jurisdiction. The presence of dedicated phone support and 24/7 online chat is noted, but service quality and response times should be tested during trial or demo stages.

How to verify the Cyprus license

- Search CySECs public register for “Lime Trading CY Ltd” and confirm License No. 281/15, license type “Market Maker,” and effective date alignment.

- Match the registered office address to “Magnum Business Center, Office 4B, Spyrou Kyprianou Avenue 78, Limassol 3076,” and confirm the listed websites and emails.

- Review the firms passporting notifications for the cited EEA countries to ensure permissions cover the intended services and client segments.

Jurisdictional Considerations for Clients

Clients in EU/EEA states referenced as authorized may be onboarded under Cyprus investor-protection rules, including capital requirements, segregation, and complaints handling via CySEC frameworks, subject to product-specific limits. U.S. persons should not assume service availability given the “Exceeded” NFA status and should verify any claim of U.S. coverage through current NFA/CFTC records. In Russia, the unverified status and reported lack of a local office suggest no reliable local authorization; trading there should be contingent on independent regulator confirmation.

Expert Perspective and Practical Guidance

Experienced compliance reviewers typically treat EU CySEC authorization as a credible baseline, provided ongoing supervision is confirmed and the firm maintains transparent disclosures on best execution, conflicts, and client-fund safeguards. The divergence between a regulated EU license and non-active or unverified entries elsewhere is not uncommon for brokers with global branding; what matters is onboarding under a currently valid license with clear terms and protections. Practical steps include testing funding and withdrawal with small amounts, scrutinizing fee schedules, and using official regulator portals for license validation before committing significant capital.

Conclusion

Just2Trades core regulatory strength is its Cyprus CySEC Market Maker license via Lime Trading CY Ltd, effective since 2015, with listed authorization across several EEA countries, while U.S. and Russian entries show inactive or unverified status requiring careful verification. With documented Cyprus presence and multi-platform access, the broker presents a regulated EU option, but users should address third-party risk alerts and confirm jurisdiction-specific permissions before account funding.