Abstract:Equiti faces mounting scam allegations, including withdrawals blocked and fund deductions, despite mixed regulatory claims and office verifications.

Introduction

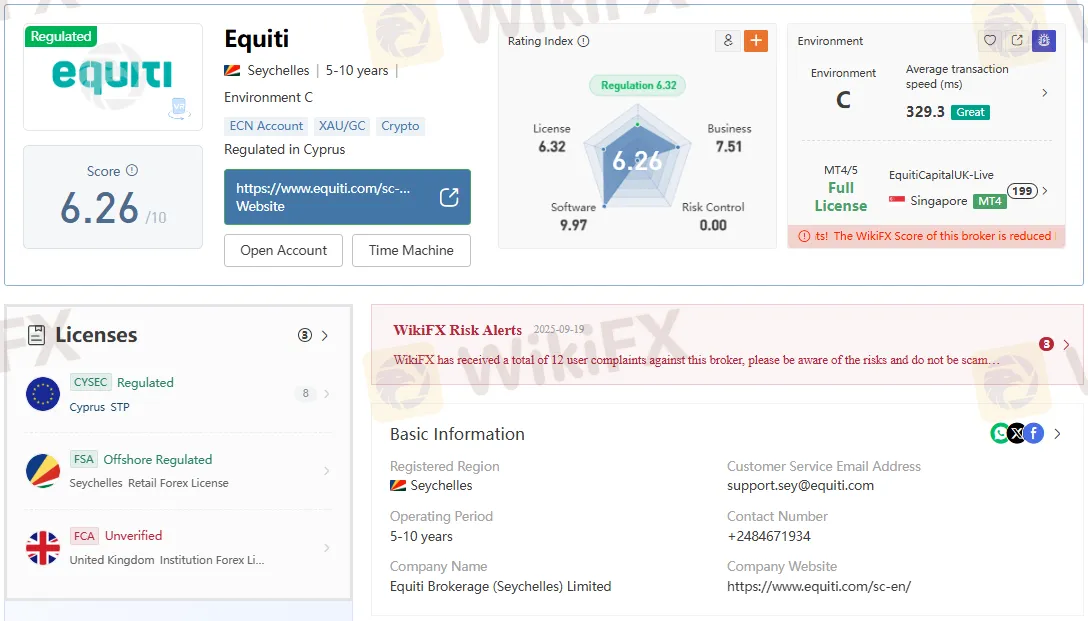

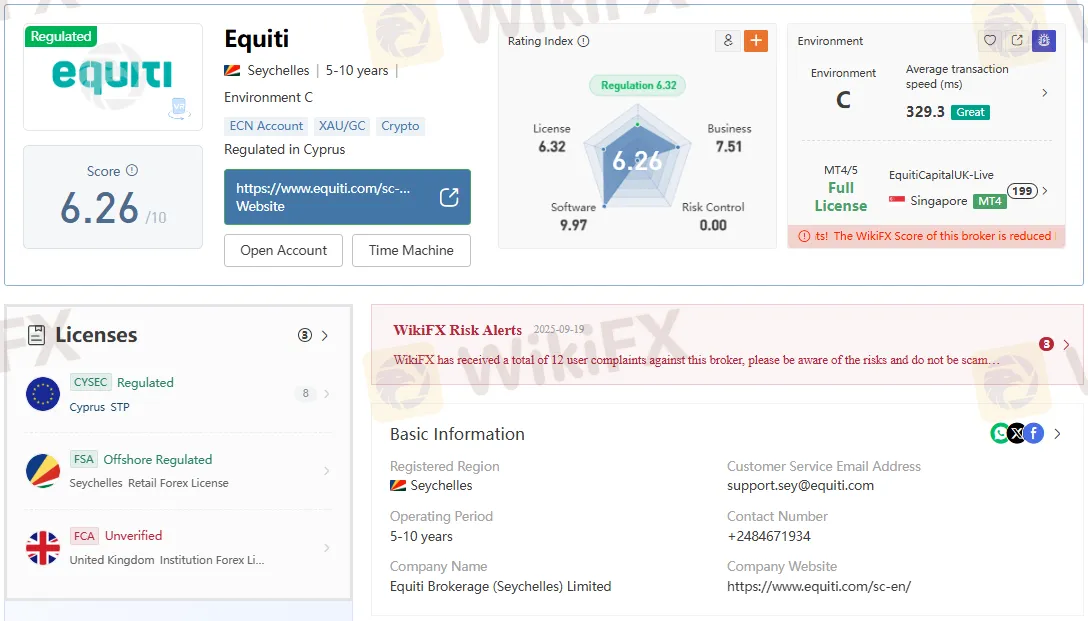

Equiti is confronting a growing series of user-reported allegations ranging from blocked withdrawals to unexplained balance deductions and disabled trading privileges, according to multiple recent exposure posts and broker data snapshots compiled in September 2025. These reports, primarily from users in Hong Kong within the last year, claim extended withdrawal “disabling,” email non-responsiveness, and bans on trading after disputed deductions, intensifying scrutiny of Equitis risk controls and client fund handling. These allegations coexist with mixed regulatory representations that include a Cyprus STP license, a Seychelles retail forex license, and an “unverified” FCA entry, underscoring a complex compliance footprint that traders must evaluate carefully.

Equiti At A Glance

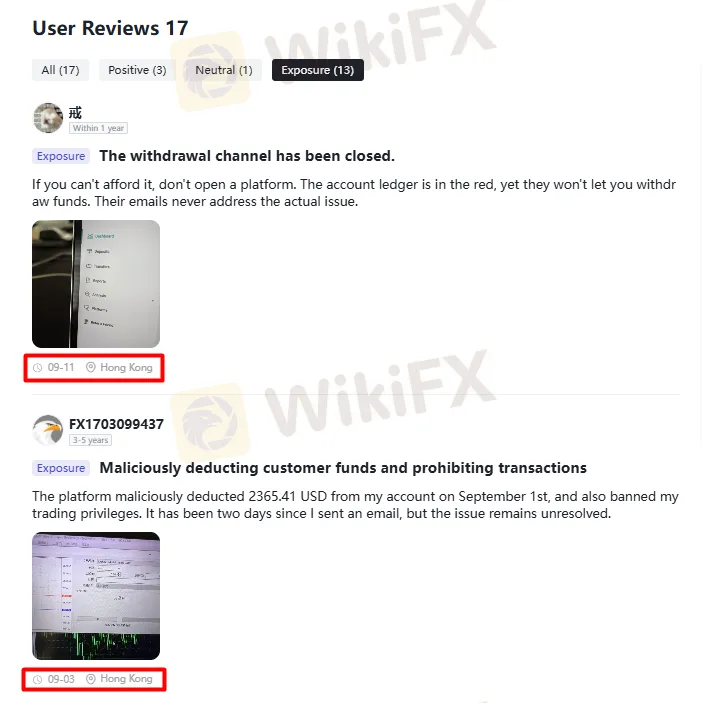

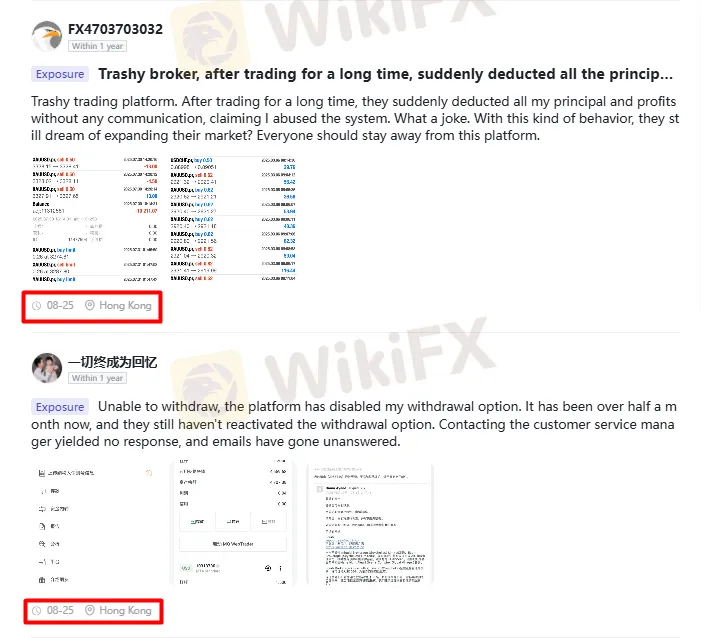

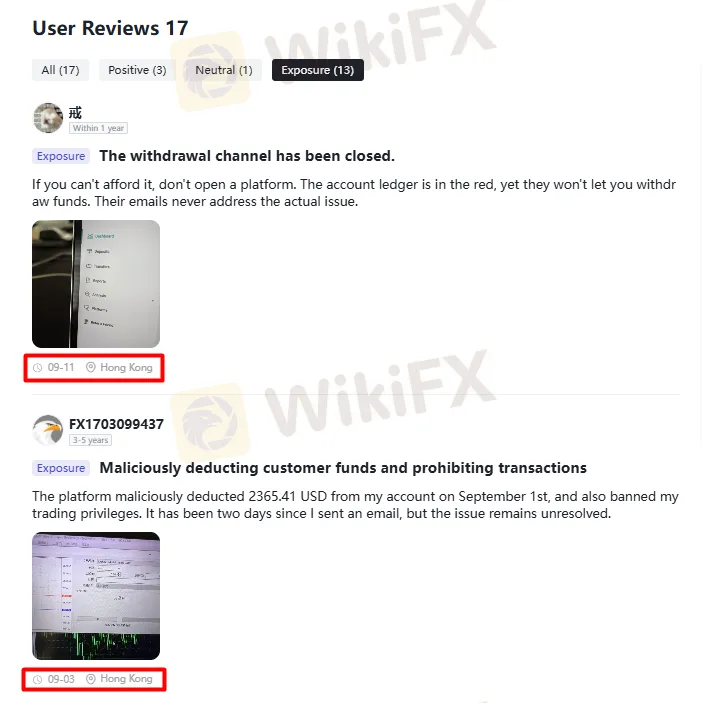

User complaints reviewed in the source show 17 total reviews, including 13 labeled as “Exposure,” with repeated themes of withdrawal problems and account restrictions. Specific posts describe the withdrawal channel being “closed” for weeks, malicious deductions such as 2,365.41 USD on September 1, bans on trading privileges, and platform claims of “system abuse” following the removal of principal and profits without prior notice. The platform is presented as operating 5–10 years under Equiti Brokerage (Seychelles) Limited, with a Seychelles registration, while parallel entries list Cyprus STP authorization and an unverified United Kingdom FCA firm record, indicating uneven verification status across jurisdictions.

Regulatory Status and Verification

Documentation in the source depicts a CYSEC Straight Through Processing license (License No. 415/22) for Equiti Global Markets Ltd with an effective date of 2022-09-12 and authorized countries including Denmark, Estonia, Germany, Italy, Malta, and Poland. In Seychelles, the materials show an FSA “Retail Forex License” under SD064 for Equiti Brokerage (Seychelles) Ltd, categorized as “Offshore Regulated,” alongside corporate contact details and an Eden Island address. A separate UK Financial Conduct Authority entry lists Equiti Capital UK Limited under Firm Reference Number 528328 but flags the status as “Unverified” in the cited snapshot, contrasting with the Cyprus and Seychelles entries that are marked as regulated or offshore regulated.

On-site Office Checks and Operations

Site-visit summaries in the source indicate the Cyprus office was found and assessed as “Good” on 2024-01-08 in the Limassol area, while a Seychelles office check conducted on 2022-04-15 confirmed existence and also rated “Good.” Basic operational descriptors associate Equiti with MT4/MT5 platforms, ECN accounts, and instruments spanning FX pairs, gold, crypto, shares, ETFs, and indices, with leverage reportedly up to 1:2000 and spreads around 1.4 pips for a standard account. These operational highlights, however, sit alongside a risk alert noting 12 complaints recorded by September 19, 2025, and an overall score of 6.26/10 with “Risk Control 0.00,” which is material for assessing platform safeguards.

Allegations: Patterns and Timelines

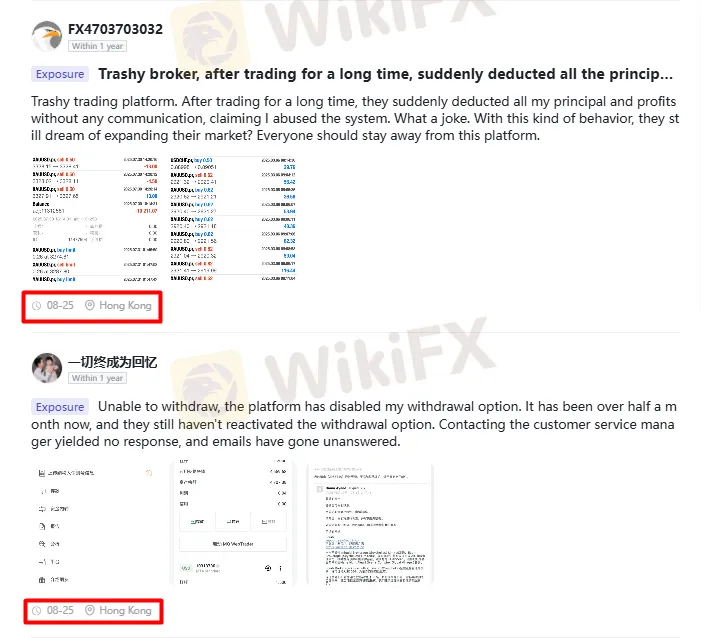

- September 2025: Users report the withdrawal channel “closed” for over half a month, with customer service and email channels not resolving access restoration. These posts emphasize funds remaining locked and ledger discrepancies without substantive replies.

- September 1, 2025: A user cites a precise deduction of 2,365.41 USD and a simultaneous ban on trading privileges, followed by two days of unanswered emails at the time of posting.

- August 25, 2025: Multiple Hong Kong users recount disabled withdrawal options, no reactivation after weeks, and unresponsive account managers, signaling a cluster of unresolved cash-out issues.

- Earlier posts (within 1 year): Reports claim sudden removal of principal and profits justified by “system abuse,” with no prior communication, fueling perceptions of arbitrary enforcement.

Risk Signals To Evaluate

- Withdrawal friction: Repeated and time-stamped user allegations that withdrawal portals were disabled for weeks suggest operational or compliance gating that materially affects access to funds.

- Account sanctions and deductions: Specific dollar-denominated deductions and privilege bans reflect dispute-prone risk controls that may require clearer terms-of-business disclosure and escalation pathways.

- Mixed regulatory footprint: A combination of Cyprus regulation, Seychelles offshore oversight, and an “unverified” FCA listing in the snapshot demands jurisdiction-by-jurisdiction verification before onboarding.

- Risk scoring: A score of 6.26/10 paired with “Risk Control 0.00” in the presented profile is a red flag for governance and surveillance around client asset protection, despite high software marks.

Expert Commentary and User Experience

Seasoned traders often treat offshore retail forex licenses and fragmented verifications as signals to limit balances and verify custodial arrangements before deploying capital; the cited materials echo that caution, given the complaint pattern and risk alerts. Where brokers enforce anti-abuse policies, experts expect transparent advance notice, documented evidence, and a fair appeal process—elements that users in this dataset claim were lacking when funds were deducted or accounts restricted. The presence of office verifications in Cyprus and Seychelles does not, by itself, mitigate the seriousness of withdrawal access complaints and alleged fund deductions, especially when they cluster in a short timeframe.

What Should Prospective Clients Do Now?

- Verify each license: Independently cross-check the CYSEC 415/22 authorization, Seychelles FSA SD064 details, and the FCA FRN 528328 status directly with the regulators public registers before any funding.

- Test withdrawals early: If onboarding, trial a small deposit and immediate withdrawal to evaluate timelines and communication responsiveness under normal conditions.

- Scrutinize terms: Review the brokers client agreement for clauses on profit voiding, “system abuse,” bonus conditions, and grounds for trading bans to preempt disputes.

- Prepare escalation paths: Document all interactions, keep platform logs, and be ready to escalate to the relevant regulator or an ADR channel if withdrawals are delayed or funds are adjusted without a satisfactory explanation.

Disclosure And Methodology

This awareness-style assessment is based entirely on the attached dossiers snapshots of user complaints, regulatory summaries, office checks, and broker metrics consolidated as of September 19, 2025. Allegations reported herein are user claims that require independent verification with primary regulators and direct broker correspondence, and readers should treat complaint logs as signals for deeper due diligence rather than adjudicated findings. No external URLs are included; all facts and figures reference the attached evidence set.