Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Hong Kong Monetary Authority warns of fraudulent websites imitating major banks, urging the public to stay alert and verify official banking portals.

The Hong Kong Monetary Authority (HKMA) has released a public warning about deceptive websites and

fraudulent online banking login screens that impersonate legitimate institutions, aiming to extract sensitive user information. This comes after reports from the Bank of East Asia, Shanghai Commercial Bank, Chiyu Banking Corporation, and OCBC Bank (Hong Kong) Limited, all of which have distanced themselves from these schemes and reported them to the authority. The HKMA has now incorporated these sites into its consumer warning list to help protect the public from falling victim.

These fraudulent platforms replicate the appearance of official banking portals, complete with familiar logos and layouts, to trick users into entering login credentials, one-time passwords, or other personal details. Often disseminated through unsolicited SMS or emails promising urgent account updates or exclusive offers, the scams exploit trust in well-known banks. The affected institutions have reiterated that they never initiate such communications requesting sensitive data.

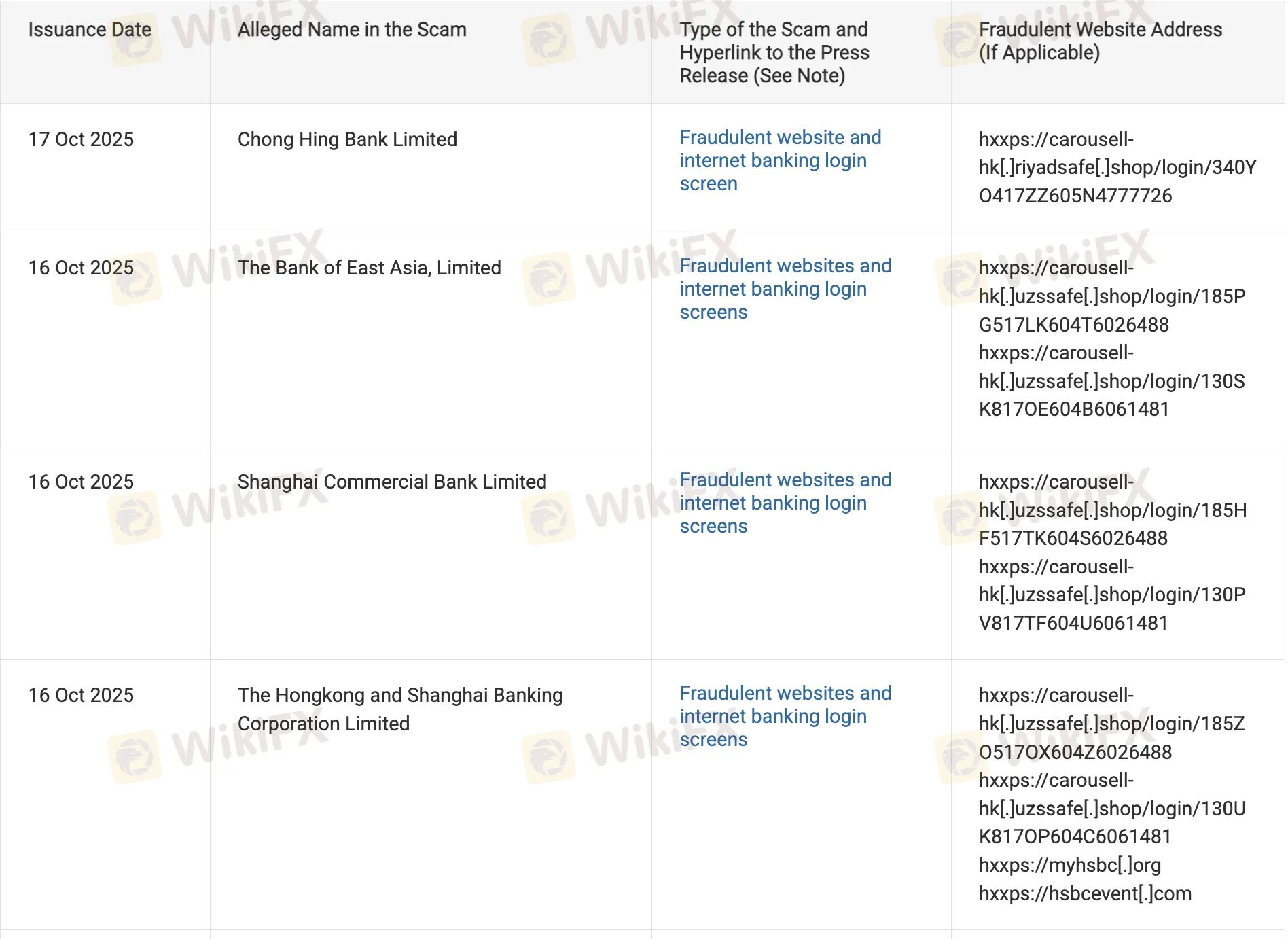

To illustrate the scope, the HKMA's updated list from October 16 and 17 highlights specific instances tied to each bank, focusing on counterfeit interfaces designed for data theft.

The HKMA notes that these incidents reflect a broader pattern in financial cybercrime, where scammers leverage advanced tools to create convincing replicas of banking systems. This wave builds on earlier warnings, such as the September alert about bogus AI investment apps falsely claiming regulatory approval. Factors contributing to the increase include Hong Kong's widespread adoption of mobile banking, which has inadvertently expanded the attack surface for cybercriminals. Experts suggest that international networks may be coordinating these efforts, using low-barrier technology to target regions with high digital transaction volumes.

The authority advises immediate caution: Legitimate banks do not send hyperlinks for transactions or request OTPs via phone, email, or SMS. If exposed, users should contact their bank to lock accounts and monitor for unauthorized activity. Reporting to the Hong Kong Police Force's Commercial Crime Bureau is also crucial for aiding investigations and preventing further spread.

To prevent such incidents, the HKMA recommends enabling two-factor authentication, verifying website URLs before inputting data, and regularly checking the official warning list for updates. Institutions like PAObank and WeBank are piloting AI-based fraud detection under the HKMA's sandbox initiative, which could soon offer enhanced safeguards.

This alert highlights the evolving challenges in maintaining trust within Hong Kong's robust financial ecosystem. As digital services grow, so does the need for collaborative efforts between regulators, banks, and consumers to stay ahead of threats.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.