Trade Nation Rebrands TD365 in Global Integration Move

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country’s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

The Reserve Bank of India (RBI) has introduced the Offline Digital Rupee (e₹), a groundbreaking initiative that facilitates secure real-time digital payments without mobile or Internet connectivity. It is a move aimed at deepening the country‘s digital financial ecosystem. Launched at the Global Fintech Fest 2025, the move adds a significant feather to India’s continual journey toward a cashless and financially inclusive economy.

Contrary to UPI and other online payment systems requiring Internet connectivity and linked bank accounts, the new initiative facilitates direct transfers within wallets, a financially defining moment for rural and remote locations with limited banking infrastructure or network access. With no reliance on online networks for payments, millions of unbanked and underbanked citizens can enjoy secure digital transactions.

The new initiative, i.e., e₹, incorporates two transformative technologies for seamless offline digital payments - Near Field Communication (NFC) and Telecom-Assisted Payments. While NFC allows instant fund transfers within NFC-enabled devices using a simple tap, telecom-assisted payments facilitate transactions even under the least network availability. All these ensure simple, seamless, and universal digital transactions.

Users can seamlessly access e₹ through the digital wallets of 15 participating banks. The bank list includes the State Bank of India (SBI), ICICI Bank, and HDFC Bank. Here are the salient features of this initiative.

Users can access wallets through official banking apps.

The new initiative comes with a new dimension - Programmable Money - by which funds can be geofenced for use within certain areas, remain time-bound for usage within a set period, or be limited to specific needs. These features make the e₹ especially beneficial for government welfare schemes, benefit reimbursements, and corporate payrolls. This ensures that funds are utilized as intended, boosting accountability and transparency.

RBI Governor Sanjay Malhotra hailed e₹ as a transformative step in India‘s digital evolution. He stated that the Offline Digital Rupee enhances India’s digital public infrastructure by providing a secure, reliable, and inclusive payment solution to citizens across the country. The initiative helps India enter into a select group of countries having witnessed a successful Central Bank Digital Currency (CBDC) with offline functionality.

According to experts, this RBI initiative will aid in financial inclusion, especially among rural and low-income populations with network or banking barriers. Other likely benefits include reduced reliance on cash, improved payment experience, and smart government transfers and corporate settlements.

Summing Up

The launch of the Offline Digital Rupee (e₹) marks a significant milestone in Indias digital finance revolution. By enabling seamless payments without Internet or mobile connectivity, the RBI has addressed one of the most critical barriers to financial inclusion. With advanced technologies like NFC and telecom-assisted payments, and features such as programmable money, the e₹ stands as a forward-looking solution that bridges the digital divide. As the initiative expands through leading banks and gains public adoption, it is poised to redefine the way India transacts—empowering every citizen to be part of a truly cashless and connected economy.

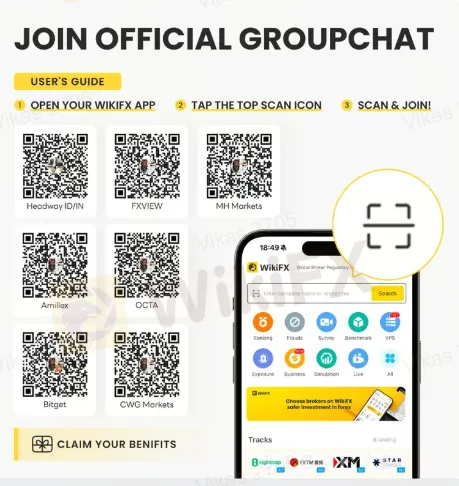

For more insights on forex brokers, trader ratings, and key market updates, join our official chat groups — your gateway to a remarkable forex trading journey - through any of the below QR codes or ID:EODL15W5IH.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

INFINOX secures UAE CMA Category 5 license, expanding its regulated presence in the Middle East with a focus on transparency and strategic growth.

Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.

New to forex? Learn key regulation basics—check FCA, ASIC, CFTC rules, verify licenses easily with the WikiFX App, spot scam signs, and use our checklist to pick safe brokers. Protect your money and trade confidently!