Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

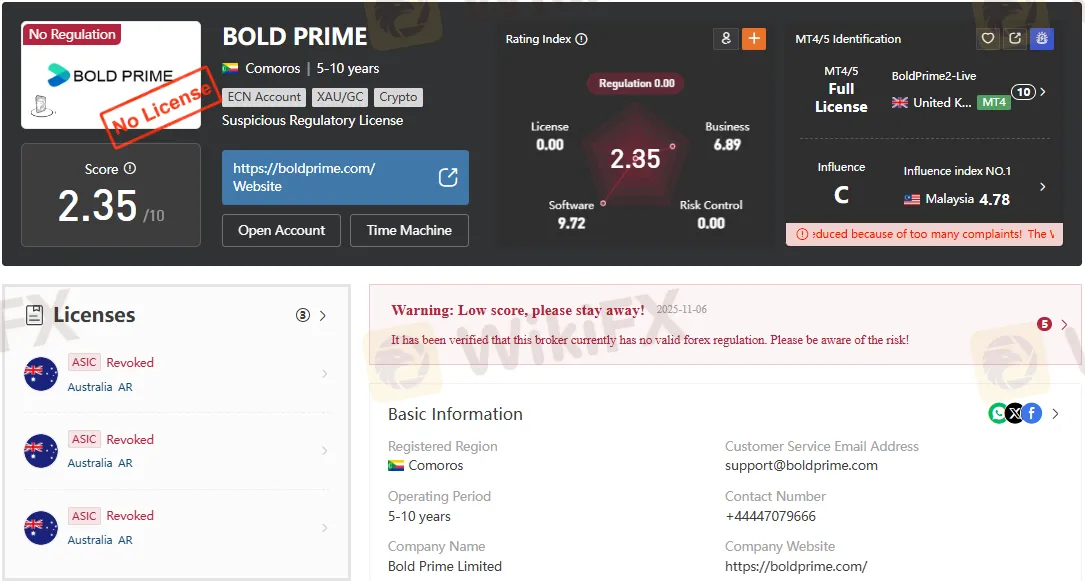

Abstract:Bold Prime Regulation Review: ASIC license revoked. Learn the risks of trading with unregulated brokers and why oversight matters.

Bold Prime, once tied to Australia‘s Securities and Investments Commission (ASIC), has seen its regulatory standing collapse. Regulation is the invisible shield protecting traders in the volatile world of forex and CFDs. Without it, investors are exposed to unnecessary risks. This review explores the broker’s licensing journey, its current status, and what traders should know before engaging with it.

Bold Prime Pty Ltd entered the market with ambitions of becoming a global broker. To establish credibility, it operated as an Appointed Representative (AR) under STAR FUNDS MANAGEMENT PTY LTD.

This structure allowed Bold Prime to market itself as regulated in Australia, but the distinction matters. An Appointed Representative does not hold a direct license—it operates under another firms authorization. For traders, this means oversight is indirect and weaker compared to brokers with full ASIC licenses.

For years, Bold Prime leaned on this framework:

These details reveal a broker whose regulatory foundation was borrowed rather than earned.

The Australian Securities and Investments Commission (ASIC) is one of the most respected regulators globally. Brokers under ASIC oversight must meet strict standards, including:

These safeguards are designed to protect traders from fraud, insolvency, and malpractice.

Bold Prime‘s reliance on an Appointed Representative license meant it was never directly accountable to ASIC. Instead, STAR FUNDS MANAGEMENT carried the responsibility. This indirect relationship left Bold Prime’s compliance weaker than brokers holding full ASIC licenses.

On August 17, 2023, Bold Primes appointed representative license was officially revoked.

Key Details:

Revocation means Bold Prime no longer has the legal right to claim ASIC oversight. For traders, this translates into a loss of protection—no audits, no dispute resolution, no safety net.

The consequences of losing ASIC oversight are far‑reaching:

Independent review platforms echo this sentiment, warning traders against using brokers that are not regulated by top‑tier authorities.

| License Status | Revoked | Active |

| Investor Protection | None | Strong |

| Oversight | Absent | Continuous |

| Credibility | Questioned | Established |

This comparison highlights the gulf between Bold Primes current standing and brokers maintaining active ASIC licenses.

Regulation is more than a legal requirement—it is the backbone of trust in financial markets. Traders rely on regulators to enforce standards that prevent fraud, mismanagement, and abuse.

When a license is revoked, confidence evaporates. Traders are left to rely on the broker‘s word rather than the regulator’s oversight. Thats a gamble few investors can afford.

Bold Primes license revocation in August 2023 highlights the risks traders face with unregulated brokers. Losing ASIC oversight means no investor protection or dispute resolution.

Traders must always check a brokers current regulatory status before investing. Active licenses from top regulators like ASIC, FCA, or CySEC ensure transparency and security.

Bold Primes revoked license is a clear warning. For safety and trust, choose brokers with valid, reputable regulatory credentials.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!