Abstract:Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from whats available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

Check Out the Top Maven Trading Complaints

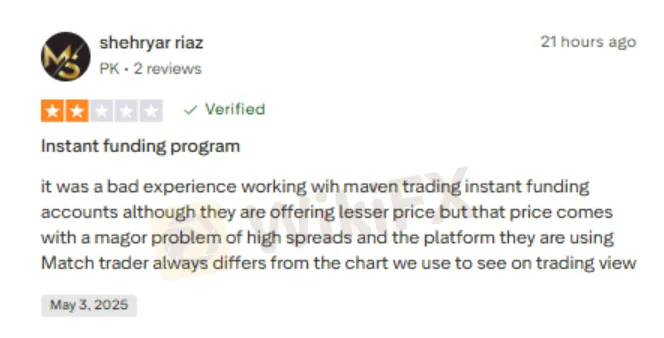

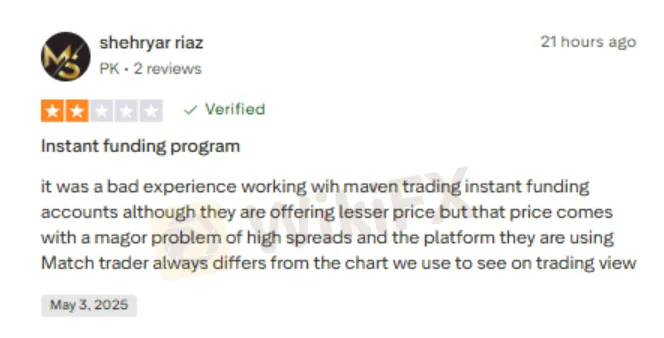

Highlighting Funding Program Issues

Its like a double whammy for traders when looking for a funded account at Maven Trading. A trader reported that the instant funding program comes at a lower price. Yet, there are higher spreads involved in the transaction. Additionally, the Maven Trading App platform shows data different from the globally recognized platform, i.e., TradingView.

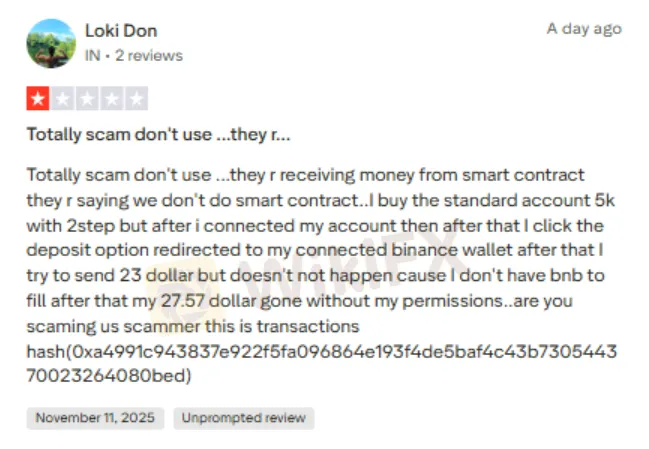

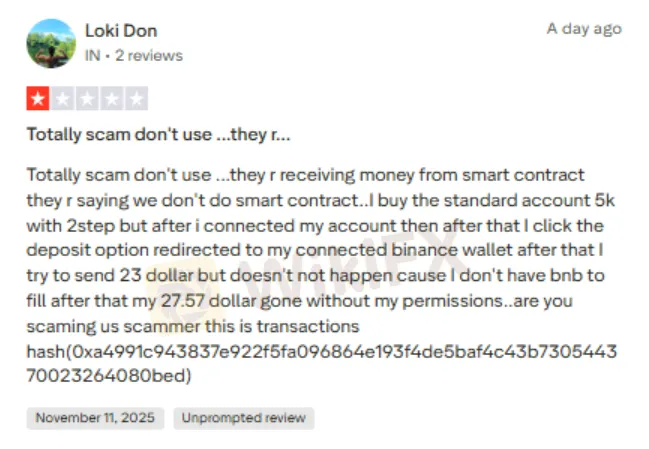

Traders Raise Fund Scam Allegations Against Maven Trading

A trader recently reported that Maven Trading receives money through smart contracts but denies doing so. The trader subscribed to the standard account with two steps, connected his account, and clicked on the deposit option. It redirected the trader to the Binance wallet. Subsequently, the trader attempted to send $23. However, the transaction did not go through because the trader did not have BNB to fill. Strangely, the traders account saw an unfair debit of 27.57 without his permission. Frustrated by this, the trader shared this Maven Trading review.

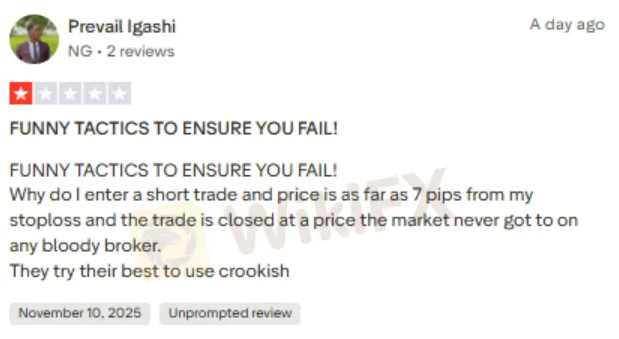

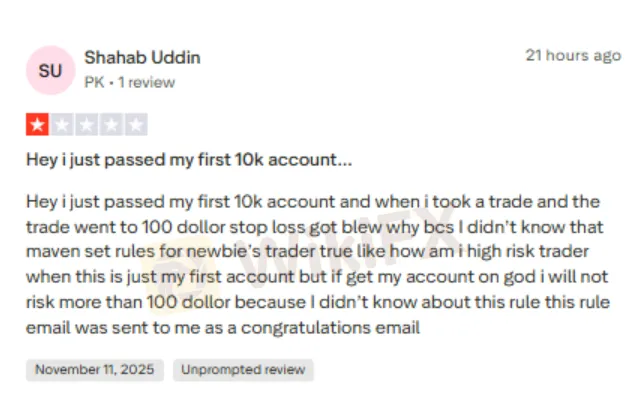

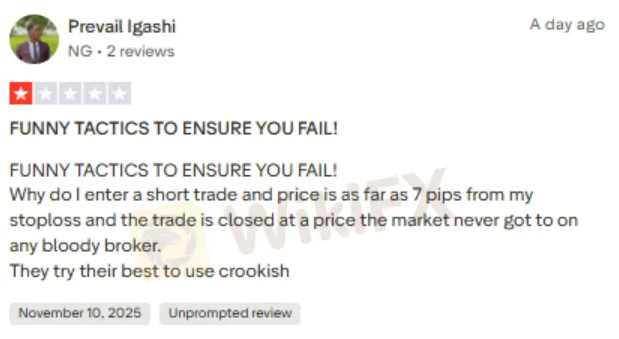

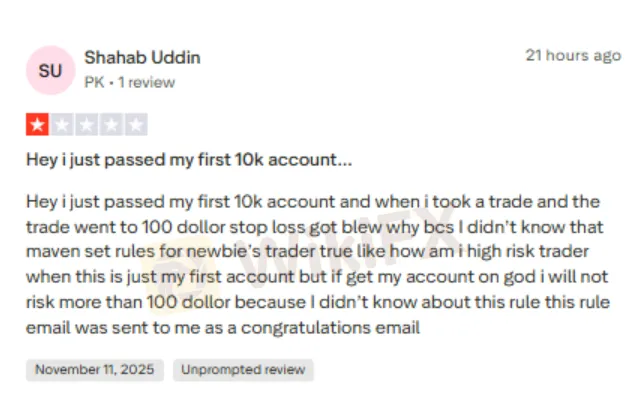

Traders Report Illegitimate Stop-loss Order Execution by Maven Trading

Traders also report increasing incidents of foul play by the broker when executing stop-loss, a trading order, when applied effectively, can help curb losses for the trader. However, as per traders accusations, Maven Trading closes the order even if the price is far away from reaching the stop-loss point. This prevents traders from leveraging the forex market potential. Some traders even point out that, as soon as passing the challenge and getting funded, the broker blows away the account if it reaches the stop-loss point. They get surprised by this. As they delve deeper, they find that new Maven Trading rules label them in the high-risk segment. Traders question how they can be classified as high-risk, given that it is their first shot at trading. To know more, check two explosive Maven Trading reviews.

Maven Trading Review by WikiFX: Score & Regulatory Status

Maven Trading review by WikiFX is not good either, much in line with the above complaint screenshots. The team investigated the broker by screening numerous complaints and its regulatory status. While it is found to be regulated, it is marked as ‘Exceeded’, which raises alarms and may lead to penalties by the regulator. Looking at the overall scenario, the team could only give a score of 1.56 out of 10 to Maven Trading.

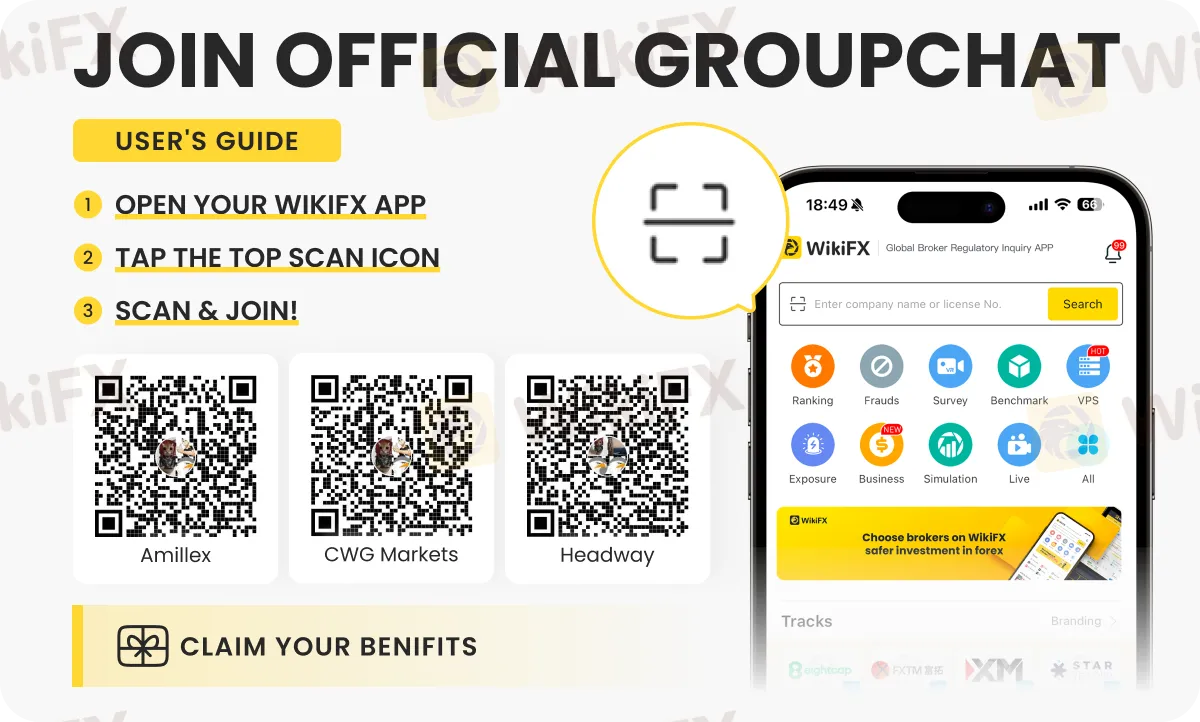

To know whats keeping the forex market alive and kicking, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.