简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Multi-Channel Deposit & Withdrawal: How INZO Became a Benchmark for Fluid Fund Movement in Trading P

Abstract:Introduction:In an era where speed and flexibility are fundamental elements in selecting a trading broker, deposit and withdrawal services have become a key metric for evaluating firms. Over recent ye

Introduction:

In an era where speed and flexibility are fundamental elements in selecting a trading broker, deposit and withdrawal services have become a key metric for evaluating firms. Over recent years, the experience of financial dealings with INZO has gained significant attention among users, particularly concerning the diversity of payment methods and the speed of execution compared to the general market average.

This growing reputation is not due to a single factor but is the result of a financial ecosystem designed to minimize friction and empower clients to manage their capital with greater ease during both deposits and withdrawals.

Diversity of Payment Channels: From Digital Currencies to Traditional Systems

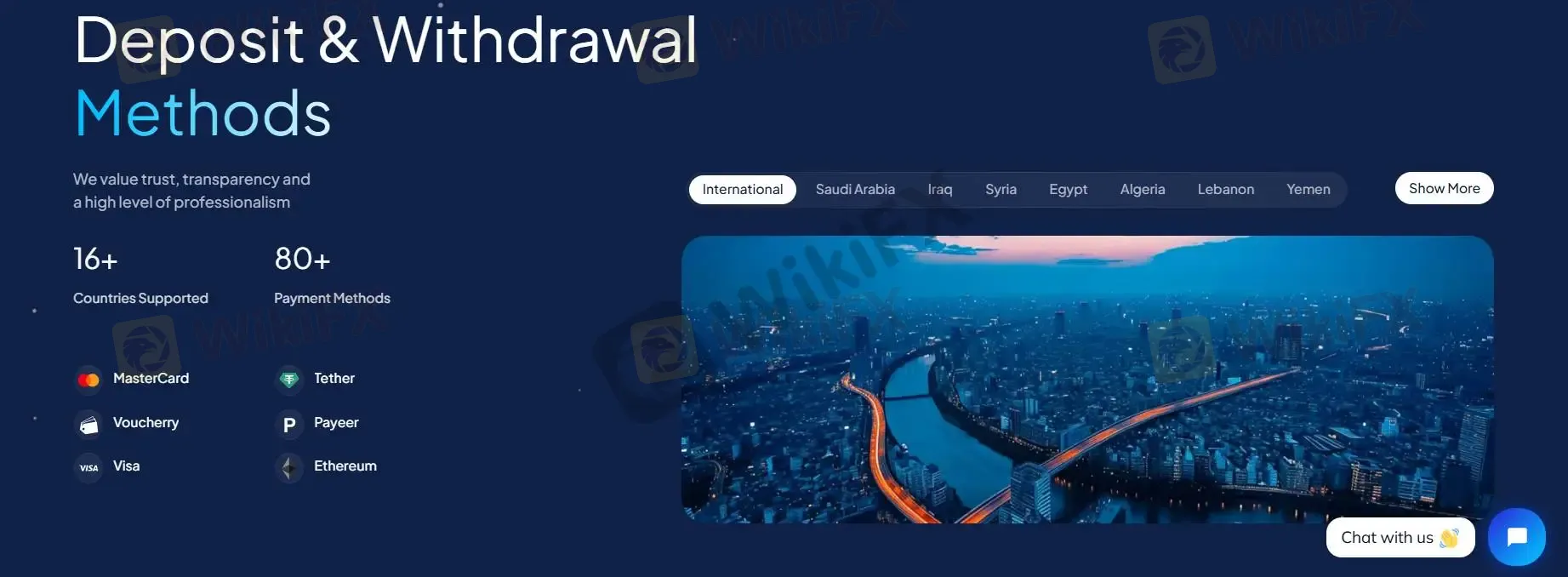

One of the most evident aspects of the user experience is the availability of numerous payment options, which reduces client reliance on a single path that might face technical or procedural issues. Instead of merely offering traditional methods, INZO has adopted a multi-channel system that includes:

Withdrawal Methods:

Digital Currencies (USDT TRC20 / ERC20)

Local Bank Transfers (in select countries)

International Debit/Credit Cards

Fast Payment Systems (P2P services)

Customized solutions utilizing local payment providers based on the client's region.

Deposit Methods:

Digital Currency Deposits

Bank Cards (Visa / MasterCard)

Regionally approved E-Wallets

Direct Bank Transfers

Instant payment solutions leveraging local providers

This variety creates a highly flexible environment, allowing the client to choose the most suitable method without significant operational constraints. This approach successfully helps traders bypass the traditional inconvenience associated with limited payment options.

Execution Speed – A Factor Directly Impacting Trader Confidence

A notable finding in trader feedback is the frequent mention of rapid processing times for both deposits and withdrawals.

The ability to quickly withdraw profits without complications is a decisive point for every trader, especially those employing daily trading or scalping strategies who require frequent realization of gains.

Timely Execution: In the case of digital currencies and instant payment services, transaction completion is generally reported to be on the same day, which fully supports time-sensitive trading strategies.

Traditional Methods: Traditional methods, while subject to banking network delays, typically remain within an acceptable market timeframe, depending on the clients country and specific bank.

Repetitive Transactions: Withdrawal and Deposit Without Restrictive Limits

One aspect that has drawn attention in user evaluations is the capacity for executing multiple deposit and withdrawal transactions on the same day without strict limitations.

Instead of defining a specific cap on the number of transactions, the system appears to allow the execution of numerous requests, provided the required balance is available and the payment method supports repetition.

This flexibility is particularly beneficial for traders who:

Manage capital on a near-real-time basis.

Withdraw profits immediately after a successful trading sequence.

Deposit smaller amounts frequently throughout the day.

This approach introduces an added layer of financial control for the client, a level of service not commonly offered by all brokerage firms.

Technical Stability: The Invisible Yet Influential Factor

Technical stability is an underlying strength that often goes unmentioned but is observed in practice: INZOs payment channels consistently operate without prolonged outages.

In a market frequently plagued by bank freezes and pending transfers, the continuous availability of effective payment channels suggests a robust backend infrastructure supported by multiple providers, rather than reliance on a single path.

This stability, though seemingly simple, plays a crucial role in creating a consistently smooth, interruption-free payment experience, even during peak transaction periods or following significant economic news releases.

Conclusion: Why This Matters to the Trader

When all these elements are combined—channel diversity, execution speed, repetition capability, and technical stability—a clear picture emerges: INZO has successfully built a payment ecosystem that is both fast and flexible compared to many regional and international brokers.

While the experience may vary slightly depending on the clients location and local banking regulations, the consistent and recurring general sentiment indicates that the company offers advanced payment solutions that rival most of its regional and global peers.

As the shift toward digital systems continues to accelerate, INZOs multi-channel approach to deposits and withdrawals is poised to remain a key factor attracting traders who prioritize the unhindered movement of their funds above all else.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator