简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

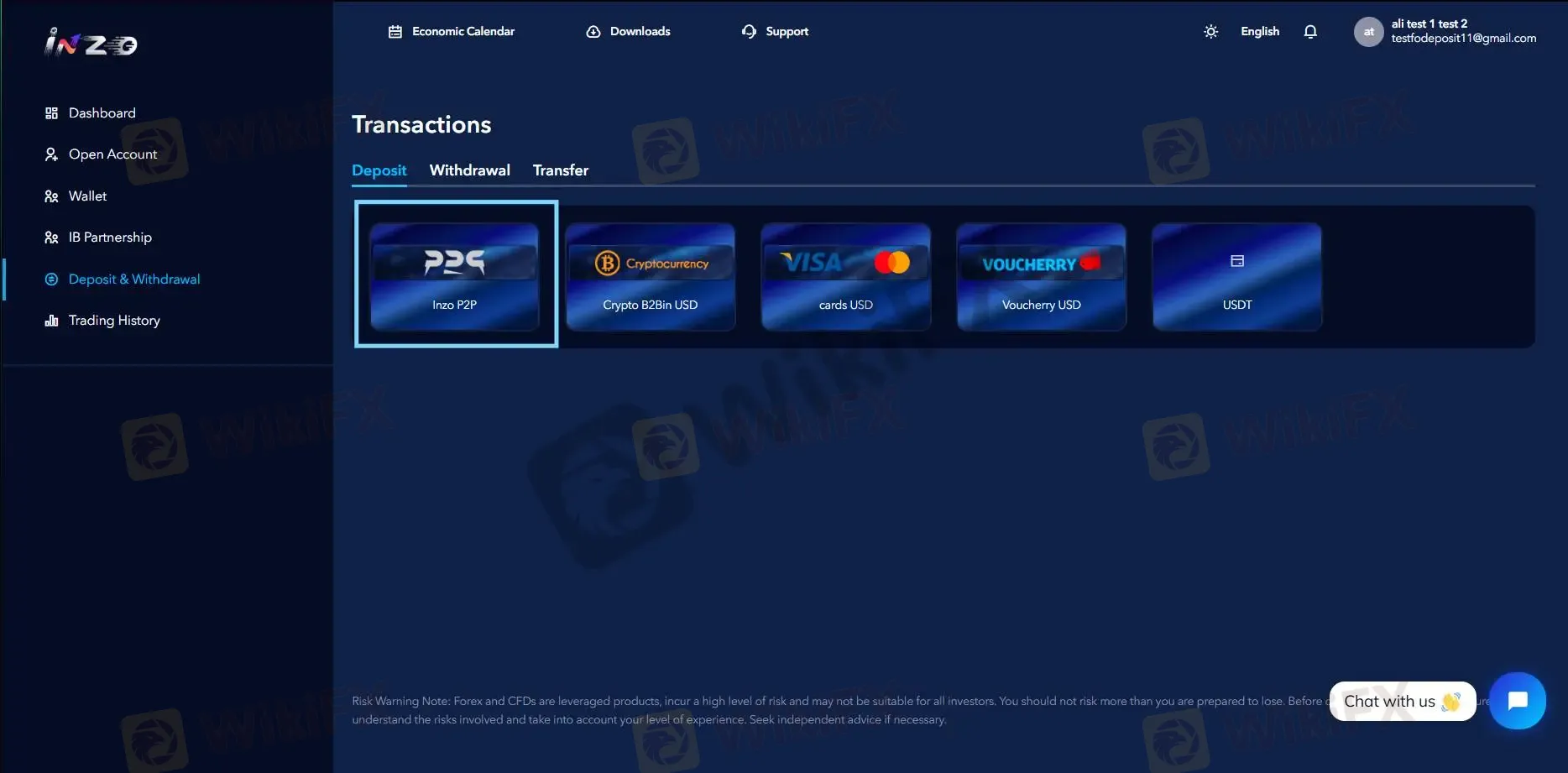

A Professional Look at INZO's P2P Service: A Financial Solution Redefining the Deposit & Withdrawal

Abstract:With the expansion of trading services in the Middle East, new solutions have emerged aimed at reducing the usual complexities associated with deposits and withdrawals. Among these solutions that have

With the expansion of trading services in the Middle East, new solutions have emerged aimed at reducing the usual complexities associated with deposits and withdrawals. Among these solutions that have caught the attention of many traders recently is the P2P platform offered by INZO, which has generated considerable impressions regarding its ease of use and flexibility compared to traditional methods.

Despite the novelty of this type of service among some brokers, the practical experience of INZO users indicates that the platform is designed to serve as a practical and swift alternative to conventional financial channels.

P2P Platform: A Simple Idea with Clear Application

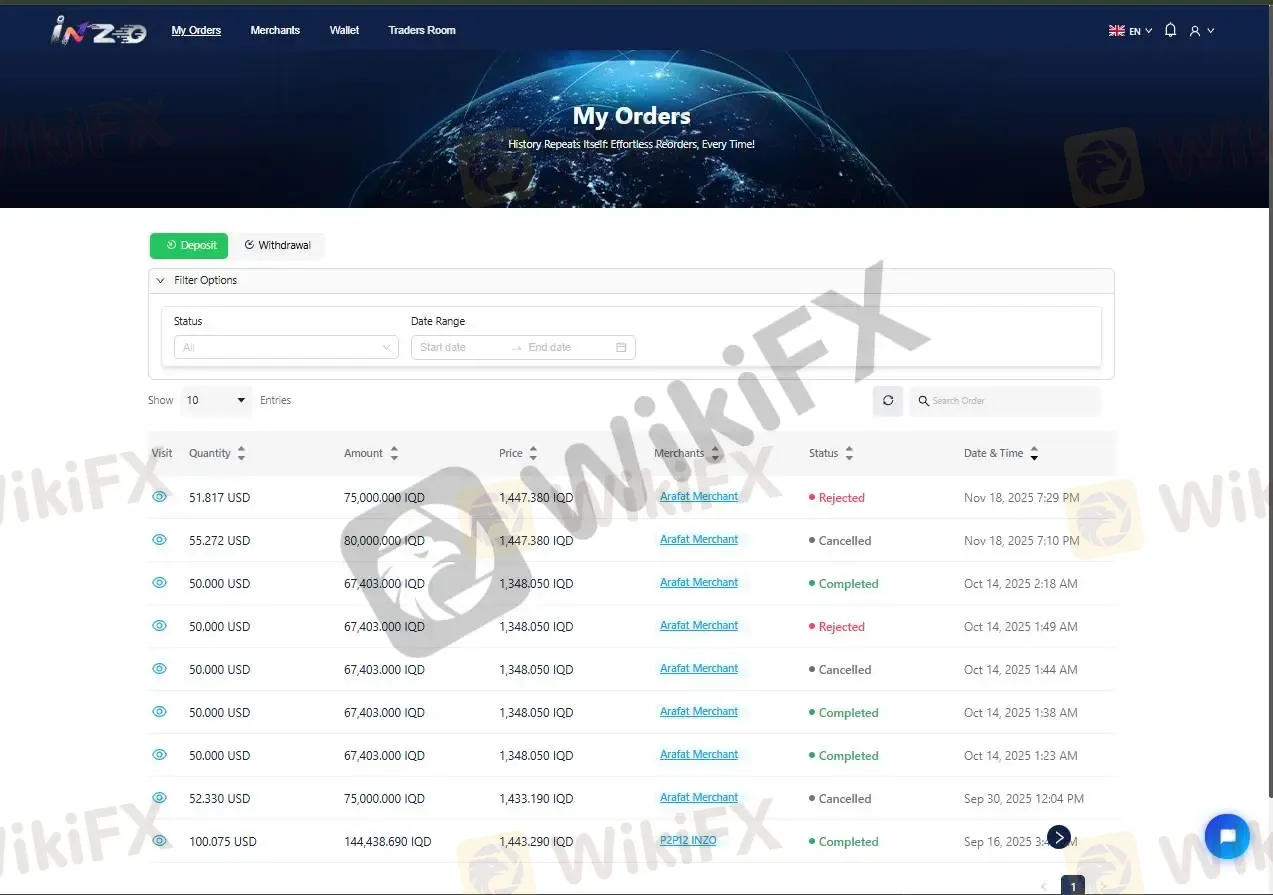

The platform operates on a straightforward principle: connecting clients with authorized merchants within a monitored environment to facilitate deposit and withdrawal operations almost instantly.

This mechanism eliminates a significant portion of the time mediation that accompanied bank transfers or traditional transactions, allowing clients to interact directly with local service providers in a faster and less complicated manner.

What Makes This Service Stand Out?

1. Time Efficiency: The service streamlines transaction times, avoiding delays often encountered with banks.

2. Local Currency Payments: Users benefit from payment options in their local currency, reducing the hassle of international transfers.

3. Safe Environment: The platform maintains security through clear verification steps, ensuring client safety throughout the transactions.

User-Friendliness: A Point Noted by New Traders

According to shared experiences, the interface of the P2P platform appears tailored for first-time users. The steps involved are clearly laid out, and the offers from merchants are organized in a way that simplifies the process for clients to choose the most suitable offer based on:

- Price

- Speed of execution

- Type of transaction (deposit or withdrawal)

Additionally, the presence of educational materials within the system aids beginners in comprehending the process without requiring technical expertise.

Security: An Essential Factor

The platform implements a solid level of verification and monitoring, notably:

- User identity verification to ensure transaction safety.

- Merchant ratings to promote trustworthiness.

- Continuous system monitoring of transactions to prevent misuse.

This is crucial in an environment that relies on direct exchanges between individuals, especially concerning sensitive financial operations.

Local Currency Transactions: A Genuine Advantage for Middle Eastern Markets

The ability to deposit in the local currency is one of the key reasons that have made the P2P platform a focal point of interest. Instead of relying on international transfers or complicated payment gateways, clients can:

- Deposit directly in their local currency.

- Withdraw in the same currency.

- Avoid additional conversion fees.

This aspect significantly reduces transfer costs, making trading simpler for the average user.

More Flexible Trading Experience

With this service, deposit operations can be completed within minutes, and withdrawals can be processed just as swiftly, granting traders greater freedom in managing their capital—especially during daily trading or when news events occur.

The service provides not just a payment channel, but a comprehensive experience that combines:

- Speed

- Security

- Accessibility

- Local coverage across Arab countries

Conclusion: Why Is Interest in This Service Increasing?

Considering the nature of the Arab trading market, which heavily emphasizes speed and ease of transfer, INZO's P2P platform emerges as a practical solution that addresses common challenges such as:

- Delays in bank transfers

- Complications with international cards

- Limited electronic payment gateways in some countries

While the service will always require continuous improvement, the current experience—as evidenced by circulating information—demonstrates that it represents a significant step towards creating a more flexible trading environment that is closer to the local trader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator