Abstract:Do FXPesa support officials fail to pick up your calls when you raise fund withdrawal requests with the broker? But are these officials always open to you regarding fund deposits? Do you frequently spot slippage and stop-loss order execution errors on the FXPesa login? These issues are increasingly becoming common with this forex broker. Consequently, many traders have expressed their dissatisfaction with the broker online. In this FXPesa Review article, we have shared some of these complaints. Take a look!

Do FXPesa support officials fail to pick up your calls when you raise fund withdrawal requests with the broker? But are these officials always open to you regarding fund deposits? Do you frequently spot slippage and stop-loss order execution errors on the FXPesa login? These issues are increasingly becoming common with the Kenya-based forex broker. Consequently, many traders have expressed their dissatisfaction with the broker online. In this FXPesa Review article, we have shared some of these complaints. Take a look!

Top Complaints Against FXPesa

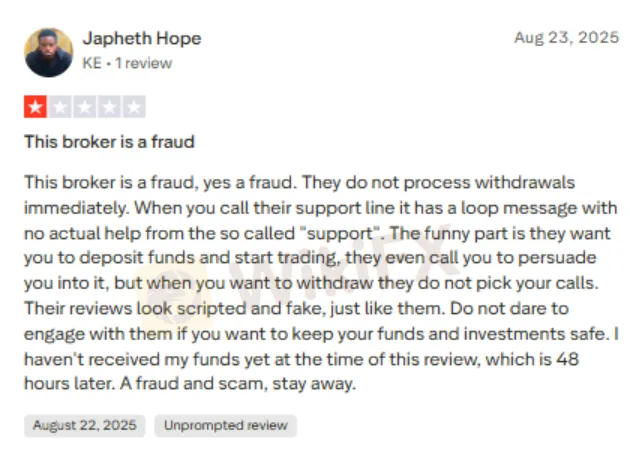

The Dubious Approach to FXPesa Withdrawals and Deposits

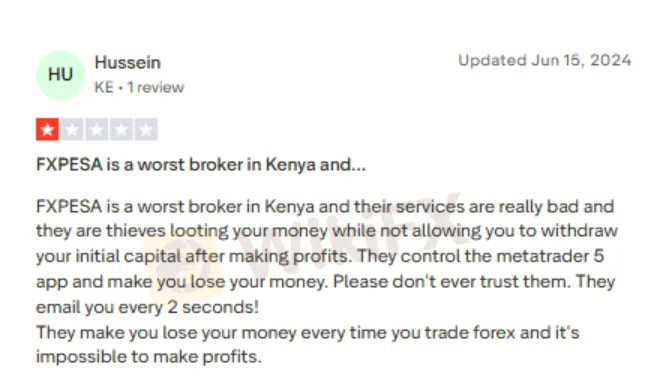

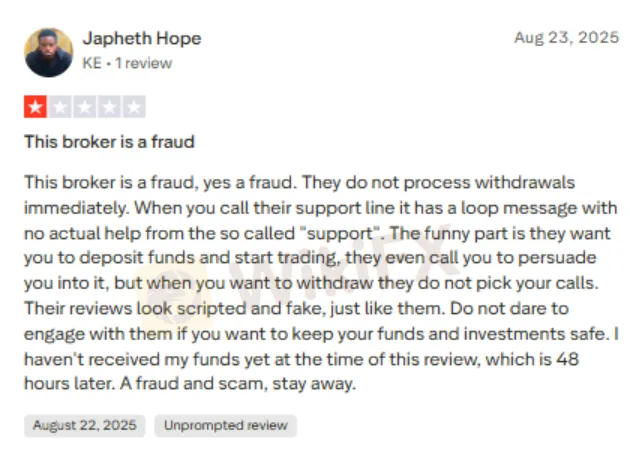

FXPesa is alleged to have been persuading traders to deposit and trade through the broker. Its officials seem responsive to your deposit and trading calls. The moment the FXPesa withdrawal request is raised, these officials will stop receiving your calls. This is what this trader stated while sharing the FXPesa review.

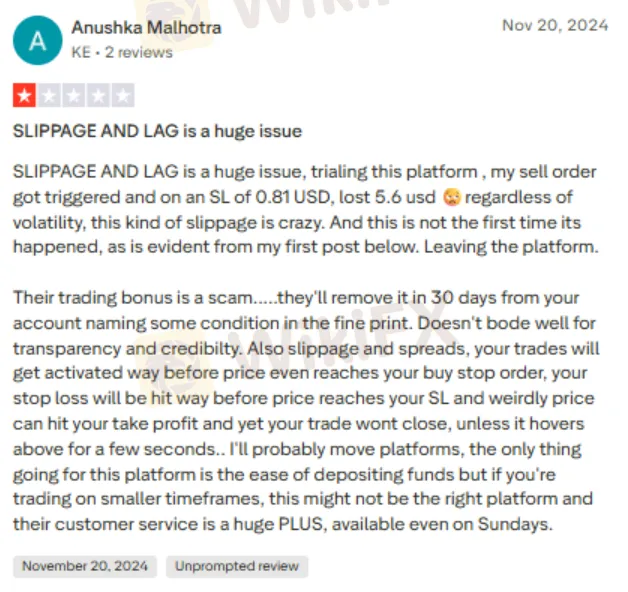

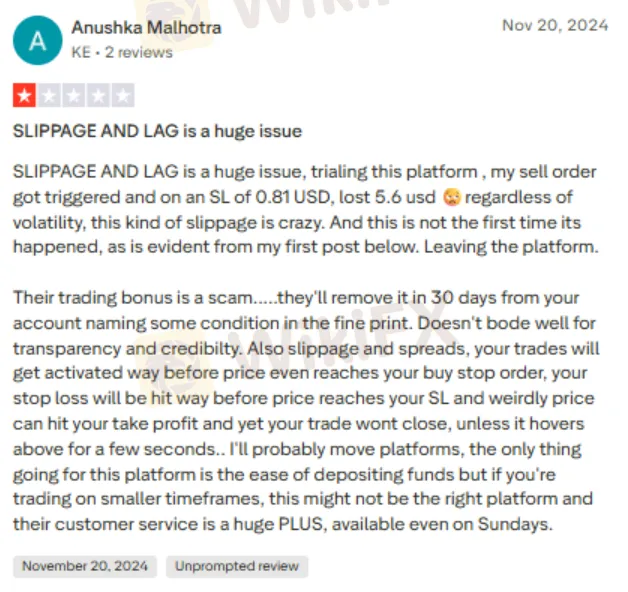

Slippage and Trade Order Execution Error

Traders also accuse the broker of causing losses with high slippage and trade execution errors. While sharing the FXPesa review, the trader alleged that the broker initiated the stop-loss way before the price fell to the preset limit. Due to this, the trader admitted having borne a loss worth 5.6 USD. Here is the full review.

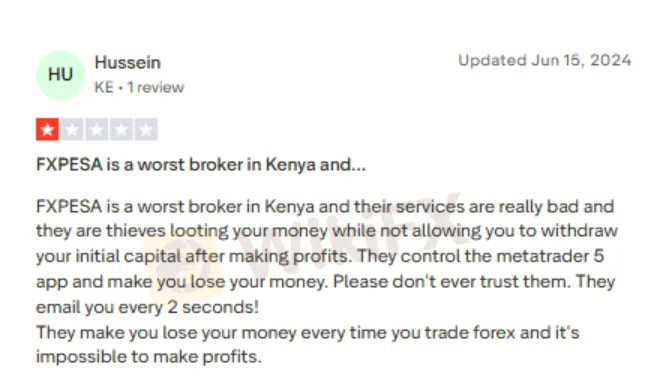

No FXPesa Withdrawal Possible After Initial Profits

Traders also claim that FXPesa denies fund withdrawals after they earn initial profits, further establishing that the broker is not reliable for forex trading. They even allege that the broker does everything possible to make sure you lose capital. This even includes manipulating the MT5 platform. Here is a trader who shared his frustration over the lack of access to fund withdrawals.

FXPesa Review by WikiFX: Score & Regulation

The complaints marked against FXPesa point to a severe glitch in its operations, affecting traders of all types with varied experience levels. The root cause of the scam allegations is the lack of a license for the broker. Trading with unregulated entities, such as FXPesa, can always lead to capital losses for the trader. As a result, the WikiFX team gave the broker a score of 1.57 out of 10.

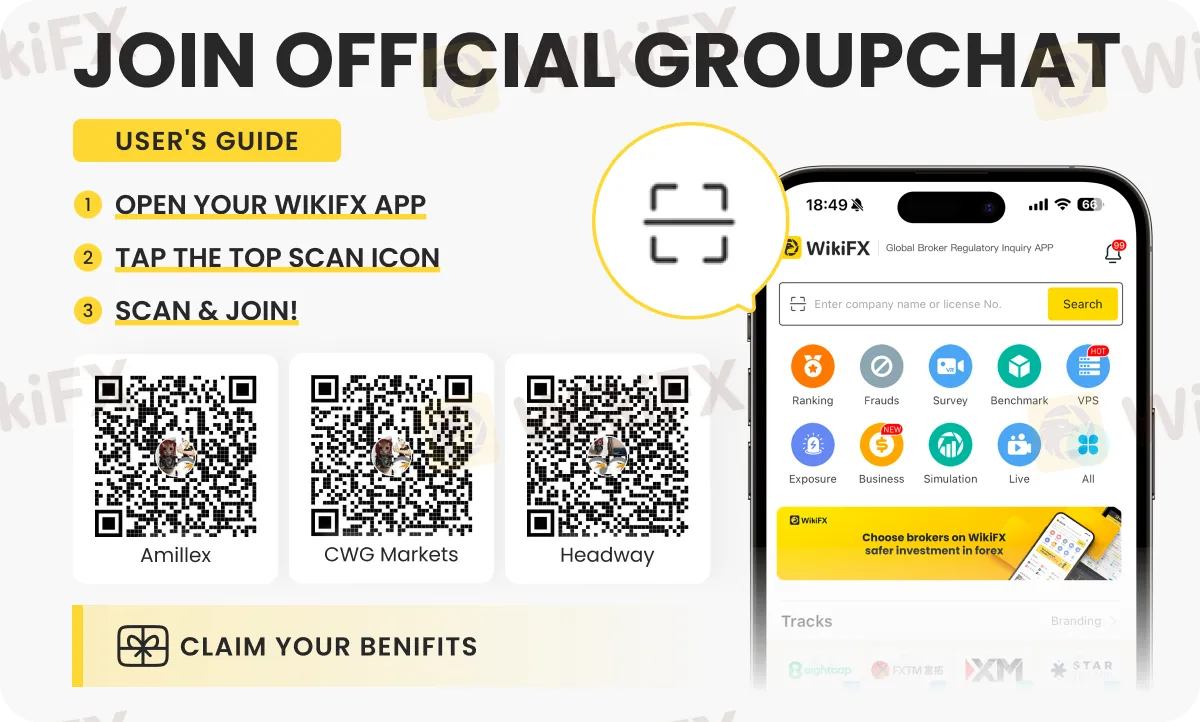

To be updated about the latest forex news, keep following us on any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join the group/s by following the instructions shown below.